Posted on

December 7, 2023

by

Marie Taverna

SURREY, BC – The Fraser Valley real estate market continues to cool heading into the holiday season as buyers and sellers maintain the holding pattern seen over the latter half of this year.

The Fraser Valley Real Estate Board recorded 891 transactions on its Multiple Listing Service® (MLS®) in November, a drop of 8 per cent from the previous month, representing the 9th slowest November in a decade.

At 2,030 new listings also fell again, decreasing by 20 per cent from October and by 43 per cent since peaking in May at 3,533.

“As we head into the holiday season, buyers and sellers are busy with other priorities and will most likely continue to wait on the sidelines,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We anticipate this holding pattern, defined by slow sales and declining new listings, will continue through the winter months until we see some downward movement in interest rates.”

Active listings in November were 6,254, down by 5 per cent over last month and up by 17 per cent over November 2022. The sales-to-active listings ratio was 14 per cent, creating balanced conditions in the overall market. Detached houses are in balanced market territory at 12 per cent, while both townhomes and apartments remain in seller’s market territory. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“With seasonality and high interest rates continuing to dampen sales activity, we expect to see sales slow further into early 2024,” said FVREB CEO Baldev Gill. “However, even a slow market can present opportunities, and buyers would be well-advised to work with a knowledgeable, professional REALTOR® who can provide expert advice and guidance.”

On average, properties spent approximately one month on the market, with single family detached homes spending 36 days on the market, and townhomes and apartments moving more quickly at 29 days.

Overall Benchmark prices continued to slide for the fourth month in a row, losing 1.1 per cent compared to October.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,489,100, the Benchmark price for an FVREB single-family detached home decreased 0.94 per cent compared to October 2023 and increased 6.22 per cent compared to November 2022.

- Townhomes: At $837,200, the Benchmark price for an FVREB townhome decreased 0.95 per cent compared to October 2023 and increased 5.08 per cent compared to November 2022.

- Apartments: At $545,300, the Benchmark price for an FVREB apartment/condo decreased 0.02 per cent compared to October 2023 and increased 5.60 per cent compared to November 2022.

To read the full statistics package, click here.

Posted on

October 11, 2023

by

Marie Taverna

NEW LISTING 69-9208 208 Street Langley BC $1,029,000.00

Welcome to Churchill Park Gated Complex.

This lovely duplex town home has had many updates through the years.

Elegant living & dining room with valued ceilings + hardwood flooring. Living room with gas fireplace.

Family room with vaulted ceiling + gas fireplace & sliders to patio.

Kitchen with wood cabinets, lots of easy glide drawers + pantry + centre island + granite counter tops.

Main floor primary bedroom with walk-in closet. 5-piece ensuite + storage under stairs. Laundry room on main.

Two bedrooms up & one with cheater door to main bath.

Newer windows & windows coverings. Lots of windows to let in the natural light. Double garage.

Great club house with seasonal pool & hot tub. Exercise room, large party area with fireplace, pool table, library and kitchen.

Lots of activities for the residents.

http://www.listings.360hometours.ca/15861

Posted on

September 7, 2023

by

Marie Taverna

BC Housing Market Resilient Despite High Rates

BCREA 2023 Third Quarter Housing Forecast

|

|

Vancouver, BC The British Columbia Real Estate Association (BCREA) released its 2023 Third Quarter Housing Forecast Update today.

Multiple Listing Service® (MLS®) residential sales in BC are forecast to decline 2.8 per cent to 78,640 units this year. In 2024, MLS® residential sales are forecast to post a modest rebound, rising 6.1 per cent to 83,425 units. |

|

“The BC housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates,” said BCREA Chief Economist Brendon Ogmundson. “However, we expect sales to cool as the result of renewed Bank of Canada tightening and a delay in expectations regarding the timing of future Bank of Canada rate cuts from early next year to perhaps the end of 2024 or even mid-2025.”

Because inventory remains very low, prices rose through much of 2023 despite below-average sales. The average price in BC has varied widely throughout this year, beginning the year below $900K before reaching just over $1 million in May as sales in more expensive markets surged amid dwindling supply. If the average price trends near its current level of $970K over the year's second half, it would mean an annual average price of $976K in 2023, or a 2 per cent decline compared to 2022. As home sales return to normal levels next year, we anticipate prices will rise 2.4 per cent to an annual average of just over $1 million, though there is risk to the upside on price growth given the state of housing supply. |

|

|

-30-

For the complete news release, including detailed statistics, click here.

|

|

| Housing Forecast Update is published twice a year by the British Columbia Real Estate Association. Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: "Copyright British Columbia Real Estate Association. Reprinted with permission." BCREA makes no guarantees as to the accuracy or completeness of this information. |

|

Posted on

September 7, 2023

by

Marie Taverna

Bank of Canada Interest Rate Announcement -

September 6, 2023

|

|

The Bank of Canada maintained its overnight rate at 5 per cent this morning. In the statement accompanying the decision, the Bank noted that the Canadian economy has entered a period of weaker growth, with slowing household spending and housing activity. On inflation, the Bank cited that recent data indicates inflationary pressures are broad-based and rising gas prices may cause a near term increase in CPI inflation. Meanwhile, core measures of inflation continue to trend near 3.5 per cent with little recent downward momentum.

Higher borrowing costs seemed to finally being felt as the Canadian economy contracted at an annualized rate of 0.2 per cent in the second quarter and the preliminary estimate for July showed zero growth. However, with the inflation rising to 3.3 per cent as of the latest data in July, the effects of prior rate hikes still have work to do to bring inflation back down towards the Bank's target of 2 per cent. While the Bank of Canada decided to maintain its overnight rate at 5 per cent, persistent inflationary pressures are a concern and could still lead to future rate increases.

Link: https://mailchi.mp/bcrea/bank-of-canada-interest-rate-announcement-sl68zxi0f8 |

|

| Economics Now is produced by the British Columbia Real Estate Association. Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: "Copyright British Columbia Real Estate Association. Reprinted with permission." BCREA makes no guarantees as to the accuracy or completeness of this information. |

|

Posted on

September 7, 2023

by

Marie Taverna

September 7, 2023

Stats Centre Reports - August 2023

The latest Stats Centre Report for Metro Vancouver is now available. Click here to view it.

The latest Stats Centre reports for the Tri-Cities are ready.

Click here to view the latest Stats Centre Report for Coquitlam.

Click here to view the latest Stats Centre Report for Port Coquitlam.

Click here to view the latest Stats Centre Report for Port Moody.

You're receiving this report because our records show that your office is located in the Tri-Cities

Posted on

September 7, 2023

by

Marie Taverna

Canadians buying homes with family, friends to combat housing affordability woes: Royal LePage survey

76% of Canadian co-owners cite a lack of housing affordability as a major motivator for choosing to co-purchase a property

Highlights:

TORONTO, August 31, 2023 – According to a recent Royal LePage survey[1] conducted by Leger, six per cent of Canadian homeowners[2] co-own their property with another party, not including their spouse or significant other. Of this group, 89 per cent co-own with family members and seven per cent with friends. Another eight per cent co-own with someone who is not a friend or family member. TORONTO, August 31, 2023 – According to a recent Royal LePage survey[1] conducted by Leger, six per cent of Canadian homeowners[2] co-own their property with another party, not including their spouse or significant other. Of this group, 89 per cent co-own with family members and seven per cent with friends. Another eight per cent co-own with someone who is not a friend or family member.

Concerning their co-owning situation, 44 per cent of co-owners[3] say that they and all fellow co-owners live in the home together. A smaller percentage (28%) say that they co-own a home with another person(s), but they do not cohabitate. Six per cent of respondents say that they co-own a home with another person(s) and neither party uses the home as a primary residence, rather as an investment or recreational property.

The COVID-19 pandemic forced some Canadians to reconsider their living situation, with many choosing to share living space with friends or family in a time of isolation. Now, in an era where social distancing restrictions have ceased, a number of Canadians continue to choose cohabitation to address their housing needs. According to a recent Royal LePage survey[4] of real estate professionals across the country, 23 per cent say that they have seen somewhat of an increase in the number of homebuyers purchasing a property with another person(s), other than their spouse or significant other, compared to pre-pandemic times. Eight per cent say they have seen a noticeable increase over the same time period.

“Different generations of families living under one roof is not a new phenomenon, but has been growing in popularity in recent years,” said Karen Yolevski, COO, Royal LePage Real Estate Services Ltd. “Census data[5] shows that multigenerational households are now the fastest growing household type in Canada. Households group together for many reasons, including communal care for elderly parents, help raising children, cultural preferences or simply to be together. However, the decision to live together, including co-owning a home, is a decision increasingly made for financial reasons. In an environment where home prices and interest rates have risen quickly and sharply, and where the threshold to qualify for a mortgage has become much more challenging, Canadians are pooling their resources and buying homes together. In cases where homebuyers cannot afford to purchase on their own, they are combining their buying power with their parents, children, siblings or even friends.”

Of all co-owners surveyed, 65 per cent say that they co-own a single-family detached home, 19 per cent say they share an attached home, such as a townhouse or semi detached property, and 13 per cent say they share a condominium/apartment.

Lack of housing affordability stimulates co-ownership trend

In light of the rising cost of living in recent years, alongside higher interest rates and housing prices, a large number of co-owners say that their decision to share a home was prompted by a lack of affordability.

According to the survey, 76 per cent of co-owners say that affordability was a major motivating factor in their decision to co-purchase their property. Not surprisingly, that number rises to 83 per cent for co-owners between the ages of 25 and 34. Thirty-two per cent of respondents who were influenced by a lack of affordability say that they co-purchased their property after the Bank of Canada began raising interest rates in March of 2022.

Twenty-five per cent of Royal LePage real estate professionals reported somewhat of an increase in the number of homebuyers purchasing a property with another person(s), other than their spouse or significant other, since interest rates began to rise. Eight per cent say they have seen a noticeable increase over the same time period.

“In a market beset by reduced home supply, escalating prices, tightened mortgage qualification requirements, and the highest borrowing rates in more than two decades, many buyers are having difficulties securing the property that they want. Some Canadians are using co-ownership as a way of boosting their borrowing capacity or lowering their monthly mortgage costs, helping them achieve their goal of home ownership,” said Yolevski. “By dividing the cost of a home between more people, Canadians can not only get their foot on the property ladder more easily, but also expand their home search to more desirable locations or larger properties that may not have been accessible with their budget alone.”

Of those who co-own a home with another person(s) and live in the home together, nearly half (49%) say that they purchased the home with another party because they would not have been able to afford a home on their own. Thirty-eight per cent say that by co-owning, they were able to afford a larger property and/or a property in a more desirable neighbourhood. Thirty per cent say that they purchased a co-owned home because they required family support with childcare or taking care of elderly relatives.

“Opting to co-own with friends or family is not as simple as signing a piece of paper next to someone else’s name – co-owning a home often comes with meaningful lifestyle changes, and requires in-depth conversations over financial, legal and personal obligations,” said Yolevski. “Regardless of whether you live in the home with your fellow co-owners or not, the responsibilities of owning a home with other people are shared, but so are the benefits.”

2023 Canadian Co-owners Survey Chart:

rlp.ca/table_2023-Canadian-co-owners-survey

Posted on

September 7, 2023

by

Marie Taverna

Seasonal slowdown brings price stability to Metro Vancouver

As summer winds to a close, higher borrowing costs have begun to permeate the Metro Vancouver housing market in predictable ways, with price gains cooling and sales slowing along the typical seasonal pattern.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,296 in August 2023, a 21.4 per cent increase from the 1,892 sales recorded in August 2022. This was 13.8 per cent below the 10-year seasonal average (2,663).

“It’s been an interesting spring and summer market, to say the least” Andrew Lis, REBGV’s director of economics and data analytics said. “Borrowing costs are fluctuating around the highest levels we’ve seen in over ten years, yet Metro Vancouver’s housing market bucked many pundits’ predictions of a major slowdown, instead posting relatively strong sales numbers and year-to-date price gains north of eight per cent, regardless of home type.”

There were 3,943 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in August 2023. This represents an 18.1 per cent increase compared to the 3,340 homes listed in August 2022. This was 5.3 per cent below the 10-year seasonal average (4,164).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 10,082, a 0.2 per cent decrease compared to August 2022 (10,099). This was 13.4 per cent below the 10-year seasonal average (11,647).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for August 2023 is 23.9 per cent. By property type, the ratio is 14.2 per cent for detached homes, 30.3 per cent for townhomes, and 31.9 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“It’s a bit of a tortoise and hare story this year, with sales starting the year slowly while prices increased due to low inventory levels,” Lis said. “As fall approaches, sales have caught up with the price gains, but both metrics are now slowing to a pace that is more in-line with historical seasonal patterns, and with what one might expect given that borrowing costs are where they are.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,208,400. This represents a 2.5 per cent increase over August 2022 and a 0.2 per cent decrease compared to July 2023.

Sales of detached homes in August 2023 reached 591, a 13.2 per cent increase from the 522 detached sales recorded in August 2022. The benchmark price for a detached home is $2,018,500. This represents a 3.3 per cent increase from August 2022 and a 0.3 per cent increase compared to July 2023.

Sales of apartment homes reached 1,270 in August 2023, a 27.4 per cent increase compared to the 997 sales in August 2022. The benchmark price of an apartment home is $770,000. This represents a 4.4 per cent increase from August 2022 and a 0.2 per cent decrease compared to July 2023.

Attached home sales in August 2023 totalled 422, an 18.9 per cent increase compared to the 355 sales in August 2022. The benchmark price of an attached home is $1,103,900. This represents a 3.9 per cent increase from August 2022 and a 0.1 per cent decrease compared to July 2023.

Download the August 2023 stats package.

Posted on

June 8, 2023

by

Marie Taverna

Listed for $1,538,000

Welcome to 2110 Anita Drive in the popular MaryHill family friendly neighbourhood.

This home has been updated through the years.

Stunning kitchen with white painted wood cabinets/quartz counters/SS appliances & black accents.

Large laundry/pantry off dining area/family room.

3-year-old roof & gutters. Lovely real hardwood flooring.3 bdrms up+2 baths.

Lots of windows.

Beautiful soundproofed 1 bdrm suite down with updated kitchen & 3-piece bath.

Separate entrance with a patio area.

Rec room with a 3-piece bath, great gym/teen/student hangout/home office,etc.

Fabulous kid & dog friendly fully fenced backyard.New gazebo on the raised patio.

2 sheds+workshop for extra storage.Imagine entertaining in this lovely backyard oasis.

First showing at sneak peak June 8th 6-8pm.

Open houses Sat June 10 & Sunday June from 2-4

http://www.listings.360hometours.ca/15845

Posted on

June 2, 2023

by

Marie Taverna

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium. Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.

From the moment you walk in you will be impressed with this quality-built home by Quadra.

Spacious living & dining room area.

Gourmet kitchen with solid wood cabinets,large pantry, granite counter tops,SS appliances&gas stove.

With 3 bedrooms & 1 den. Primary suite with 4-piece bath & wall in closet.

2nd bedroom can be other primary bedroom with connecting 5-piece bath.

Lots of storage.In suite laundry.

Air-conditioning. 2 parking spots & one is wider. Lrg storage locker with roller door.

Stroll to shopping, transit&recreation.

Perfect location & size for downsizers that are moving from a home or anyone that wants just a little more space in a condo.

Year-round use of the glass solarium+BBQ hookup, perfect for entertaining...

Posted on

June 2, 2023

by

Marie Taverna

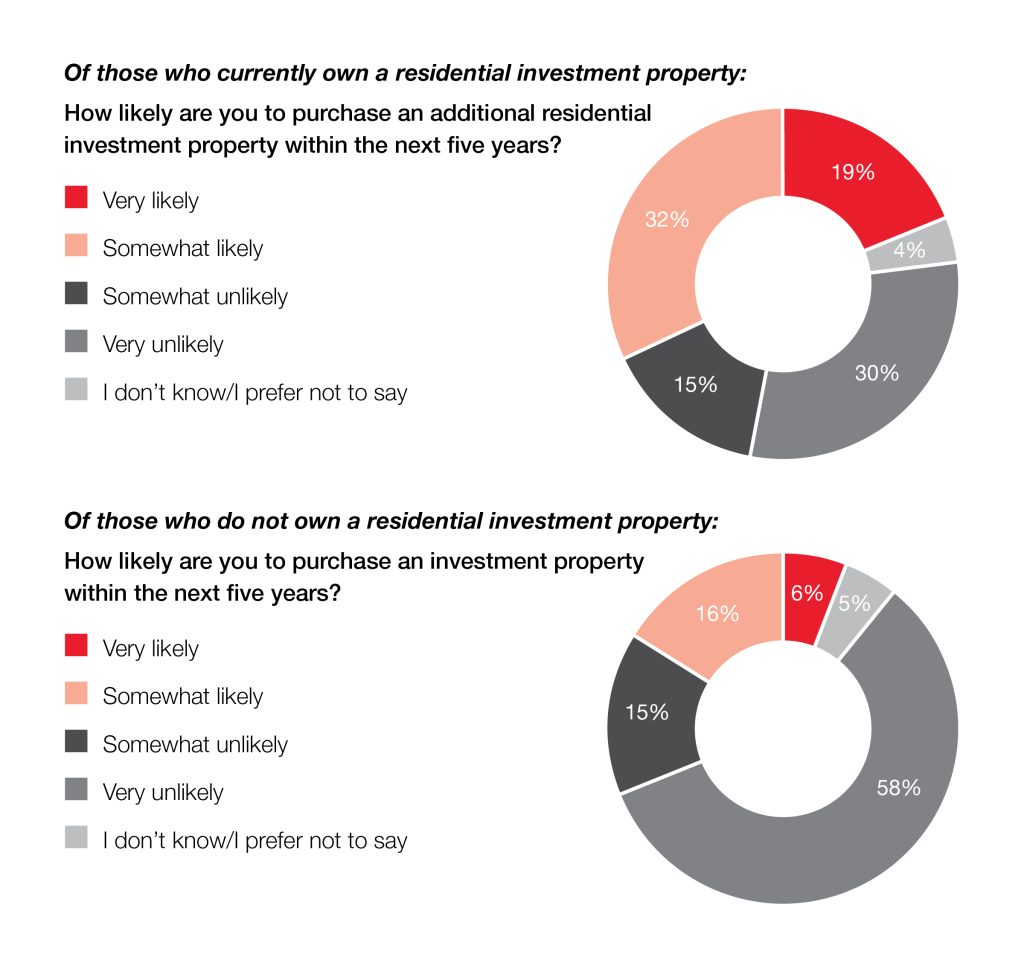

Despite higher lending rates and lower levels of inventory, the desire to own a home in Canada remains strong, especially among those who see ownership as a way to support their financial future. Canadians continue to look to the housing market as a means of building generational wealth and an additional source of income, and many are planning to try their hand in real estate investing within the coming years.

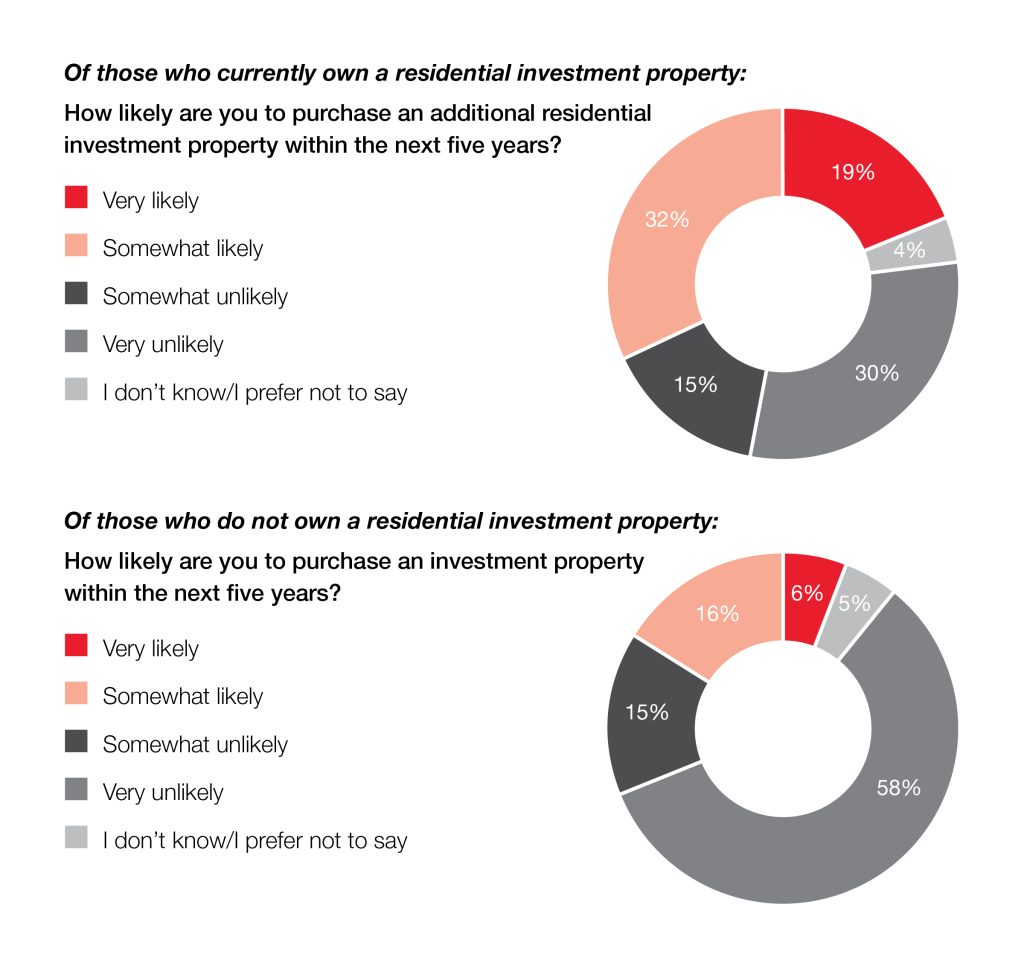

According to a recent Royal LePage survey conducted by Leger,1 23% of Canadians who do not own a residential investment property say that they are likely to purchase one in the next five years, and more than half (51%) of current investors say that they are likely to purchase an additional residential investment property within the same time period. Overall, 26% of all Canadians, current investors or otherwise, plan to buy an investment property before 2028.

“We know that the value of home ownership is strong among Canadians – it is clear that possessing real estate remains a desirable means for building wealth over time. Many choose to invest in real estate not only as a way of generating income and reaping the benefits of value appreciation, but to provide an opening into the market for future generations of their family, ” said Phil Soper, president and CEO, Royal LePage. “Despite the hurdles of low home supply and increased lending rates, young people are more inclined than ever to make real estate investing a part of their financial planning for the future. In fact, survey results tell us that many of them are actually prioritizing an investment property over owning their primary residence.”

15% of Canadian residential investors do not own their primary residence (12% rent and 3% live for free with family or friends); the majority of whom are aged 18-34.

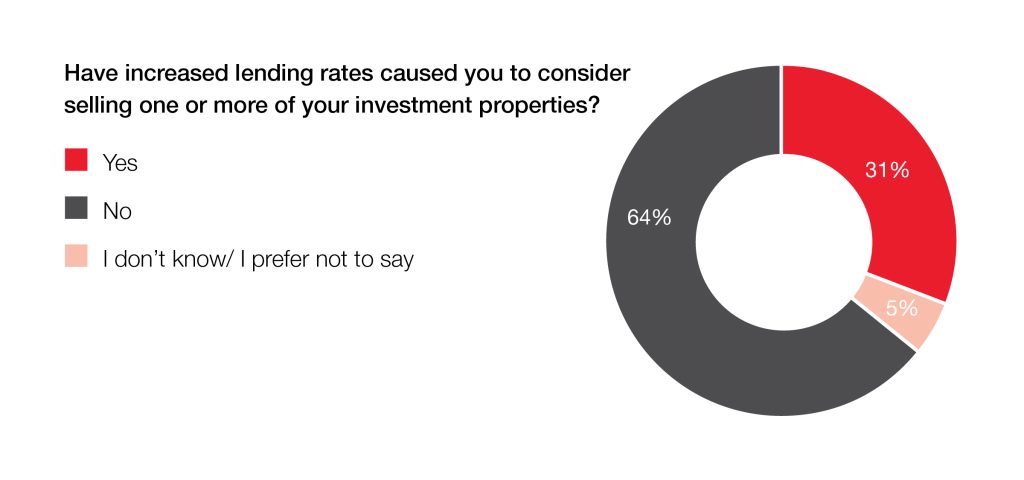

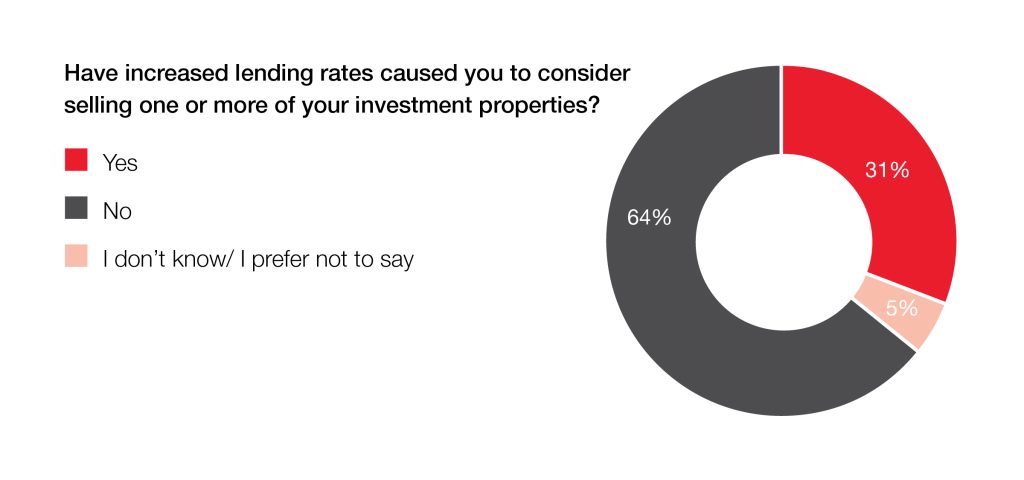

The increased cost of borrowing has had a significant impact on variable-rate mortgage holders in Canada over the past year, and those with investment properties have also been feeling the effects. Increased lending rates have caused nearly one third of investors (31%) to consider selling one or more of their properties. Investors aged 18 to 34 are the most likely to weigh the decision of selling at least one of their investment properties (54%).

“Much higher mortgage rates and the increased cost of home maintenance and utilities have prompted some over-leveraged investors to consider selling,” said Soper. “That said, there was speculation that the investor segment would experience a serious downturn during the pandemic, as pre-construction projects were postponed and condos in downtown neighbourhoods emptied out, driving landlords to cut rental rates to keep tenants. Given widespread housing shortages across Canada, residents quickly returned to urban centres as the health scare was contained. Rents not only rebounded, they rose sharply and it became obvious that the sector’s downturn was temporary.”

Here are a few highlights from the Royal LePage 2023 Real Estate Investors Report:

- 11% of Canadians – approximately 4.4 million people – currently own an investment property

- Nearly one third of investors in Canada (31%) have considered selling one or more of their investment properties due to higher lending rates

- 20% of investors in the Greater Montreal Area say they are likely to sell one or more of their investment properties within the next two years; this percentage rises to 24% and 28% in the greater regions of Toronto and Vancouver

Continue reading for regional insights into the investor markets in the Greater Toronto Area, Greater Montreal Area and Greater Vancouver.

Posted on

June 2, 2023

by

Marie Taverna

Spring has officially sprung, and with the arrival of warmer weather, now is an opportune time to give your home a post-winter deep clean. A thorough spring cleaning goes beyond everyday surfaces and tackles the nooks and crannies of your living space. It’s a great time to start fresh by purging old and underused items in your garage, closets and cabinets. It’s also the perfect opportunity to perform a maintenance checkup on major household appliances, like your washing machine, stove and fridge.

Conducting a yearly maintenance checkup is not only beneficial in extending the lifespan of your appliances, but also ensures that they will be running optimally when you need them the most. Is there anything worse than your dryer breaking down before an important job interview, or the oven giving out just as your guests are set to arrive for a dinner party, or your air conditioner malfunctioning in the dead of summer?

Here’s a maintenance checklist to help ensure your large home appliances are in top shape this spring:

Fridge maintenance

- Coils: To clean your coils, locate where they are on your fridge – whether they’re at the bottom or at the back of the appliance – and remove the access panel. Gently remove any debris and dirt with a vacuum or brush before replacing the panel. Cleaning your fridge coils annually can actually help to reduce your electricity bill, as dirtier coils require more time and energy to chill food.

- Water filter: If your fridge has a water filter, clean or replace this every five to six months to avoid impurities and contaminants in the water.

- Door seals: If the door seals are leaking or don’t seem tight enough, replacing these will ensure your refrigerator is running in an energy efficient manner.

Oven and stove maintenance

- Stovetop: While it’s important to give your stovetop a regular clean, a deeper scrub down is vital for preventing overheating and potential fire hazards from baked-on food particles. For electric stovetops, wipe down the cooking surface with warm, soapy water before applying a layer of glass cooktop cleaner or baking soda paste and leaving to dry. Once fully hardened, remove the paste with a scrubber or non-abrasive tool to remove baked-on food and stains. If you have a coil stove top, carefully remove each coil by hand and wash down without fully submerging in water before reassembling. For gas cooktops, be sure to remove the grates and burner caps, and wash with hot water and soap. Carefully wipe down the surface of the stove without getting the igniters or electrical components wet.

- Range hood: Oven range hood filters must be cleaned or replaced to ensure proper functioning of the appliance. You can clean your filter by letting it soak in hot water and degreasing dish soap before scrubbing off the remaining debris. Allow the filters to dry completely before reinserting.

- Oven door seals: Similar to refrigerator door seals, these are required to ensure ovens can heat efficiently, and should be regularly cleaned with warm water and soap, and replaced if/when necessary.

- Oven drip pans and racks: Ensure oven drip pans and racks are routinely cleaned to avoid potential fire hazards. Soak greasy items in hot water with degreasing dish soap or cleaning vinegar to remove splatters, stains and food particles.

Dishwasher maintenance

- Rust removal: Remove any visible rust from your dishwasher by running an empty cycle with a calcium, lime and rust remover solution. A water and baking soda paste or a combination of water and vinegar can also be effective against rust.

- Spray/pump area: Clean around this area in the base of your dishwasher to promote seamless drainage.

- Filter: Hard water and leftover food can build up in your dishwasher. Cleaning the filter will extend the life of your appliance and ensure this build-up is not continually being released onto your dishes during the cleaning cycle. To clean, simply pull the cylindrical filter from the base of your dishwasher and gently wash it with a brush under warm running water.

Washing machine maintenance

- Hose lines: Prevent flooding in your home by ensuring no cracks or breakage are present in your washer’s hose lines. Perform a thorough check once per year, and replace them every five years.

- Washer drum: Prevent build up in the drum of your washing machine by regularly running a cleaning cycle with a dedicated cleaner or water and bleach every few months. Using a damp rag, thoroughly wipe the rubber liner and inside of the door.

Dryer maintenance

- Dryer vent: In addition to clearing out your dryer’s lint trap after each load, the dryer vent should be cleaned at least once per year to clear out lint build up and to prevent fire hazards. Disconnect the dryer before pulling it away from the wall and removing the dryer duct. Use your vacuum cleaner inside and around the vent to catch leftover lint. Remember to clean the exterior vent too by removing the cover and removing any debris.

- Dryer drum: Using a damp rag, clean the inside of your dryer drum, the rubber liner and the door. If necessary, soak and wash the lint trap, but ensure it is completely dry before replacing it.

Air Conditioner maintenance (outdoor unit)

- Condenser unit: Spring is the best time to run maintenance on your HVAC A/C unit. The weather is warm enough to run a cooling test cycle, yet not cool enough to withstand a few days with no air conditioning if your unit requires major repairs. Begin by turning off the power and removing the winter cover from your outdoor unit. Remove the cage and pull out any leaves and debris that may have accumulated on the bottom.

- Fins and fan: Using a paint brush or other long bristled brush, carefully brush away any trapped dirt and debris that may be caught in the air conditioning unit’s fins and condenser fan. If necessary, vacuum the fins to pick up fine dust. It is safe to use a garden hose to wash the inside and outside of your unit, but avoid using a pressure washer as this can damage the fins. Reassemble the unit before turning the power back on.

- Filters and vents: Replace filters and clean out vents on a regular basis (every one to two months) to ensure clean air is circulating through your home.

Be sure to run through this appliance maintenance checklist every spring to keep your appliances operating safely and optimally, and save you money in the long run.

Posted on

June 2, 2023

by

Marie Taverna

The spring market is off to a healthy start. Buyer activity picked up earlier than was anticipated in the first quarter of 2023, pushing home prices up over the final quarter of last year. As a result, home prices in Canada are expected to continue climbing, albeit at a much slower rate than the last two years.

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 4.5% in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast was revised upward to reflect an earlier-than-expected boost in activity in Canada’s major housing markets.

Following activity levels in the first quarter of 2023 that surpassed the Company’s expectations – a vigorous return of buyer demand coupled with ultra-low housing supply conditions – Royal LePage has adjusted its quarterly forecast for the remainder of the year. On a quarter-over-quarter basis, the national aggregate home price is expected to continue rising modestly but steadily over the next nine months.

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” said Phil Soper, president and CEO of Royal LePage. “While we do not expect huge price gains this year, some sense of normalcy is returning to the market.”

According to the Royal LePage House Price Survey released today, the aggregate price of a home in Canada decreased 9.2% year-over-year to $778,300 in the first quarter of 2023. On a quarter-over-quarter basis, however, the aggregate price of a home in Canada rose 2.8%, as buyers began to come off the sidelines following the Bank of Canada’s decision last month to pause interest rate hikes for the first time in a year.

“There has been nothing ‘typical’ about Canada’s housing market since the start of the COVID-19 pandemic. Lockdowns brought the housing market to a grinding halt in early 2020 before the work-from-home revolution catapulted it into a two-year, all-season frenzy of record sales volumes and aggressive price growth,” said Soper. “As markets do, this market overshot, and the inevitable correction was triggered when the Bank of Canada began to rapidly raise interest rates. The downturn came swiftly, and the real estate industry remained depressed for twelve months, a longer correction than the aftermath of the financial crisis thirteen years ago. We have turned the corner and the housing economy is growing again; none too soon for many buyers, who have been waiting patiently for prices to bottom out.”

Read Royal LePage’s first quarter release for national and regional insights.

First quarter press release highlights:

- Single-digit price gains in first quarter driven by early return of sidelined buyer demand and continued shortage of inventory

- Greater regions of Toronto, Montreal and Vancouver post quarterly aggregate price gains of 4.8%, 1.3% and 1.3%, respectively in the first quarter

- Royal LePage urges OSFI to heed the economic dangers that would accompany new, aggressive mortgage restrictions

Posted on

May 1, 2023

by

Marie Taverna

What a year!

This spring season, I'm feeling so much pride in our collective accomplishments for 2022, and excitement for what’s ahead at the Royal LePage Shelter Foundation in 2023. Thanks to the generosity of donors like you, we were delighted to announce $3.25 million raised last year. Well into our milestone 25th year, we have now raised more than $41 million!

Looking ahead, we will soon be unveiling two new fundraising programs (stay tuned!) and we are eagerly anticipating our Ecuador Challenge for Shelter, which will see 120 adventurous Royal LePage professionals trek for 5 days towards one of the highest active volcanoes in the world. My heartfelt thanks go out to all those who have already helped our trekkers raise more than $340,000 for women's shelters across the country.

Then, there’s the context for why we do what we do, and that’s never been more important. We were sadly reminded of this as recently as March 31, 2023. On that day, the Mass Casualty Commission’s Final Report was released, arising from the devastating mass murders of April 2020 in Portapique, NS. The Commission declared gender-based violence to be an epidemic. In the words of Lise Martin, executive director of Women’s Shelters Canada (supported since inception by the Royal LePage Shelter Foundation), “The idea that domestic violence is a private matter is flawed and dangerous. We know that most mass casualty events are preceded by gender-based violence, and if we deal effectively with that issue, we can prevent violence both within and outside the home.”

Past, present and future, thank you for taking pride in the Royal LePage Shelter Foundation and making it the charity of choice for Royal LePage agents and their community of supporters who believe that home should be a safe place for everyone.

With gratitude,

Lisa Gibbs

Executive Director

Posted on

March 24, 2023

by

Marie Taverna

When it comes to selling your home, making a positive first impression on a potential buyer is a crucial part of the process.

Many sellers opt to stage their home – either through professional services or their own efforts – to make their space look more appealing to buyers, both in-person and online. Staging is a popular real estate marketing strategy that is effective at attracting purchaser interest, garnering offers at higher prices and selling homes quicker.

If you’re preparing to list your property on the market soon, here are the dos and don’ts of staging your home for sale.

DO – Depersonalize your space

Buyers want to visualize themselves living in their potential new home, a fantasy that can be hard to conceptualize in a space that is decked out with the seller’s belongings.

To help buyers build an attachment to a property, it’s important to depersonalize. This means removing any family photos, collectables, diplomas and other personal items. Consider depersonalizing your walls and furniture too. Busy accent walls, bold wallpaper and quirky fixtures speak to the specific tastes of the owner. Softening your home with neutral colours and fabrics can help make a potential buyer feel more at home.

However, it’s important not to strip your space completely of personality. When staging, stick with basic accent pieces, such as a vase of flowers or simple throw pillows, to liven up the room.

DON’T – Overlook unfavourable smells

When buyers enter your home, they aren’t just judging your property with their eyes. All senses are engaged, including smell.

Unappealing odours due to mould, pets and garbage can quickly turn off a potential purchaser, so be sure to tackle them before you welcome any showings. Take out the trash and scoop the litter box regularly. If the smell of mildew is present, give your showers and tubs a thorough clean, and schedule a visit from a contractor to rule out any mould-spawning water leaks.

Don’t fill the room with artificial air fresheners either – add subtle natural scents such as fresh linen, baked goods or potted herbs to entice the senses.

DO – Improve the lighting

Dark interiors can make spaces feel cramped and uninviting, so introduce an abundance of light into your home.

When staging for photographs or showings, open all of the blinds and drapes, and remove obstructions away from windows to let in as much natural light as possible. You can also boost the amount of lighting in the home with a layered approach. In addition to ceiling lights, use a mix of floor lamps, wall sconces, undermount lighting and table lamps to brighten your space for potential purchasers.

DON’T – Forget about curb appeal

Buyers can easily make a snap judgement about your property from the minute they arrive on the street, so get things off to a good start from the get-go by staging your home’s exterior too.

Begin with a simple clean up, like mowing the grass, power washing the siding and walkways, and freeing the lawn and eavestroughs of any fallen leaves or branches. Be sure to repair any broken porch lights or wonky house numbers. Complete your property’s refreshed façade with a clean doormat and some inviting potted plants or hanging baskets on the front porch. And, don’t underestimate the power of a fresh coat of paint on the front door!

DO – Rearrange your furniture

It is possible to have too much furniture – overstuffed rooms can give the illusion that there is a lack of spaciousness. When staging your home for sale, don’t be afraid to put some items in storage or swap furniture out to achieve an appealing layout that buyer’s can easily walk through. If space permits, pull furniture away from the walls to allow for more movement and reduce any dead space in the centre of the room.

Posted on

March 24, 2023

by

Marie Taverna

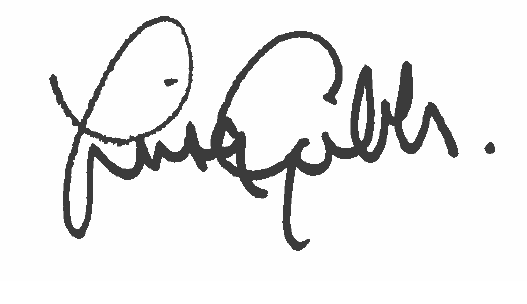

More than a quarter of Canadians who put their home purchase plans on hold over the last year say they will resume their search this spring

Climbing interest rates have given many Canadian homebuyers reason to pause their purchase plans over the last year. Nearly one quarter of Canadians (24%) were in the market for a new home this past year, and 63% of them say they postponed their plans due to rising rates, according to a recent Royal LePage survey, conducted by Maru/Blue.1 Now, with the Bank of Canada placing a hold on the overnight lending rate for the first time since March of 2022, many homebuyers intend to resume their purchasing plans once again. Of those who say they postponed their plans, 62% now intend to return to the market.

The survey found that more than a quarter (26%) of Canadians who put their home purchase plans on hold over the last year due to rising interest rates will resume their search this spring, following the Bank of Canada’s announcement last week to hold the overnight lending rate at 4.5%. Meanwhile, more than one third (36%) say they plan to move forward with their buying intentions, but will wait for the central bank to maintain the current rate for several consecutive months. Some 25% of those who postponed their home buying goals stated that they do not intend to resume their plans in the near future.

“Eight times a year, the Bank of Canada announces changes to its key interest rate, and for eight consecutive meetings, they aggressively raised rates in an effort to tame runaway inflation. On March 8th, 2023 they did nothing and doing nothing was a very big deal,” said Phil Soper, president and CEO, Royal LePage. “Based on our just-completed national survey, this was the signal that many Canadians were waiting for – an indication that it was safe to wade back into the housing market to search for the family home they so desperately want or need.”

Of the Canadians who stated that their home buying plans were postponed on account of the increased cost of borrowing, 65% report that higher interest rates have greatly reduced the value of home they can afford. Meanwhile, 28% of respondents say rates have somewhat reduced this value. Of those who chose to postpone their home purchase plans, two-thirds (67%) are between the ages of 18 and 34.

For those Canadians who intend to jump back into the housing market, many are gravitating towards a fixed rate mortgage, which can shelter homeowners from fluctuating interest rates. More than half (53%) say they would choose a four- or five-year fixed rate mortgage, and 17% say they would choose a short-term fixed-rate mortgage (1-3 years). Some 16% of respondents say they would opt for a variable rate mortgage.

“The Bank of Canada has indicated that it believes the rate hikes completed over the past twelve months are working their way through the economy, and that inflation should fall to three per cent by mid-year,” continued Soper. “While stating that they believe this period of rising rates is behind us, the bank qualified the statement, stating that if needed, it will increase rates again in the future. That said, it is unlikely we will see another period of back-to-back rate hikes in the near future.

“In recent weeks, well-priced properties in some popular neighbourhoods with low inventory have already seen multiple offers,” added Soper. “We anticipate that signs of stable economic conditions will lead to a more normalized spring market.”

Despite more pronounced economic challenges south of the border, Canada’s economy has remained stable throughout this period of correction. In the wake of the collapse of two U.S. banks, industry regulators are taking a cautiously optimistic approach, noting that while no bank is immune, Canadian financial institutions – even smaller ones – are more resilient to increased interest rates due to the strict federal regulations imposed upon them, as evidenced during the 2008 financial crisis when the Canadian housing market and its banking sector performed better than the U.S.

Posted on

December 31, 2022

by

Marie Taverna

Government releases regulations around Jan 1 foreign buyer ban

The government released the regulations supporting the federal foreign buyer ban today, defining what the ban will look like.

These regulations outline:

- The definition of a residential property, foreign buyer, and purchase;

- Exceptions for temporary residents that meet specific obligations that include students or workers, refugees, and accredited members of foreign missions in Canada; and

- Penalties for non-compliance applicable to Non-Canadians, as well as any person or entity knowingly assisting a Non-Canadian in violating the prohibition

There’s still little information on how this law and its regulations will be interpreted and enforced.

Reducing risk for REALTORS®

The regulations don’t require any further record keeping for Realtors, however the Canadian Real Estate Association (CREA) recommends members perform due diligence to ensure they’re not facilitating a sale to a foreign buyer.

CREA developed the Certification and Consent of Purchaser as a way Realtors can help mitigate their risk – though members should be aware that this document may not be foolproof as there’s still little information on how the regulations will be enforced.

The certificate should be completed before assisting or advising a potential buyer and should be used in combination with other due diligence practices.

Reducing risk for REALTORS®

- The Prohibition on the Purchase of Residential Property by Non-Canadians Act prevents non-Canadians from buying residential property in Canada for two years starting on January 1, 2023.

- Non-Canadians are defined as individuals who aren’t:

- Canadian citizens

- permanent residents of Canada

- persons registered under the Indian Act.

- corporations based in Canada that are privately held, not listed on a stock exchange in Canada, and controlled by someone who is a non-Canadian.

- The act defines residential property as buildings with three homes or less, as well as parts of buildings like a semi-detached house or a condominium unit. The law doesn’t prohibit the purchase of larger buildings with multiple units.

- The act has a $10,000 fine for any non-Canadian or anyone who knowingly assists a non-Canadian and is convicted of violating the act. If a court finds that a non-Canadian has done this, they may order the sale of the house.

More information

Posted on

December 31, 2022

by

Marie Taverna

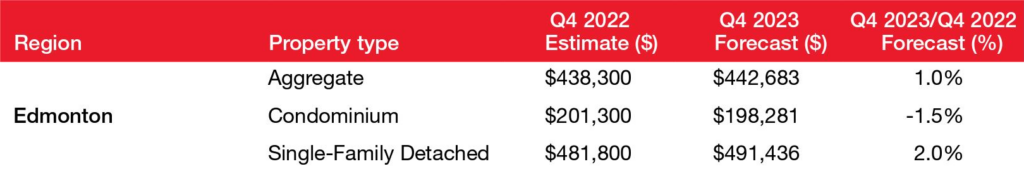

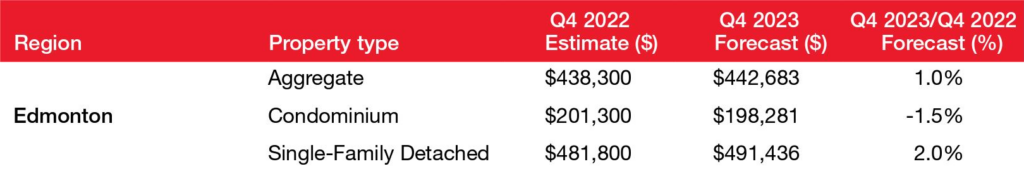

Contrary to Canada’s large urban centres, major cities in Alberta and Atlantic Canada are expected to see home price growth in 2023.

In its annual Market Survey Forecast, Royal LePage predicts that the aggregate price of a home in Canada will decrease 1.0% year-over-year to $765,171 in the fourth quarter of 2023, with five of the major regions surveyed expected to see aggregate price declines. The four regions where prices are forecast to increase – Calgary, Edmonton, Ottawa and Halifax – are among the more affordable cities in Canada, and have proven to be top destinations for Canadians seeking more affordable housing options.

Enabled by remote working opportunities during the COVID-19 pandemic and beyond, the number of buyers relocating out of the major urban centres has accelerated over the last two years. Now faced with higher borrowing costs and living expenses, it is expected that buyer hopefuls from Ontario and British Columbia will continue to seek out affordable housing options in cities like Calgary, Edmonton and Halifax. Price growth in Calgary, Ottawa and Halifax in the fourth quarter of 2023 is expected to be led by the more affordable condominium segment. Ottawa, with its healthy employment market, relatively affordable housing and continued positive net migration, is also expected to see positive price appreciation next year.

Calgary

“Unlike Canada’s major urban centres, which saw steep increases during the pandemic boom followed by rapid declines over the last six months, the Calgary market has experienced less drastic swings,” said Corinne Lyall, broker and owner, Royal LePage Benchmark. “I expect we will continue to see moderate price growth in the entry-level market, particularly in the condominium segment.”

Edmonton

“Many buyers from outside of Alberta and elsewhere in the province continue to enter the city’s housing market. Since the beginning of February, demand has been strong from Ontario and British Columbia buyers looking to relocate to Edmonton, due to its relative affordability and healthy job market,” said Tom Shearer, broker and owner, Royal LePage Noralta Real Estate.

Halifax

“While real estate activity in 2023 is unlikely to reach the exuberant levels recorded in the first half of this year, Halifax’s population continues to grow and attract buyers from across Canada and abroad. I anticipate that we will see a return to more normal seasonal trends next year,” said Matt Honsberger, broker and owner, Royal LePage Atlantic.

Ottawa

“Condominiums will likely see greater price appreciation than other property types, as higher borrowing costs will continue to limit buyers’ purchasing power and push them to the lower end of the market,” said John Rogan, broker of record, Royal LePage Performance Realty. “Local housing activity has been largely motivated by buyers and sellers who are forced to move, including those relocating for work.”

For additional information on all nine of Canada’s major markets, read more here.

Posted on

November 18, 2022

by

Marie Taverna

Backgrounder

In Budget 2022, the government proposed the introduction of the Tax-Free First Home Savings Account (FHSA). This new registered plan would give prospective first-time home buyers the ability to save $40,000 on a tax-free basis. Like a Registered Retirement Savings Plan (RRSP), contributions would be tax-deductible, and withdrawals to purchase a first home—including from investment income—would be non-taxable, like a Tax-Free Savings Account (TFSA).

Budget 2022 announced the key design features of the FHSA, including an $8,000 annual contribution limit in addition to a $40,000 lifetime contribution limit. Today, the Department of Finance is releasing for public comment draft legislative proposals that provide additional details on the design of the FHSA. This backgrounder offers a summary of these details.

The government expects that Canadians will be able to open and contribute to an FHSA at some point in 2023. No matter when this happens in 2023, Canadians would be allowed to contribute the full $8,000 annual limit in that year.

Opening and Closing Accounts

To open an FHSA, an individual must be a resident of Canada and at least 18 years of age. In addition, an individual must be a first-time home buyer, meaning that they have not owned a home in which they lived at any time during the part of the calendar year before the account is opened or at any time in the preceding four calendar years. For this purpose, ownership is defined broadly and includes beneficial ownership, but excludes a right to acquire less than 10% of a qualifying home.

An FHSA of an individual would cease to be an FHSA, and the individual would not be permitted to open an FHSA, after December 31 the year in which the earliest of these events occurs:

- The fifteenth anniversary of the individual first opening an FHSA; or

- The individual turns 71 years old.

Any savings not used to purchase a qualifying home could be transferred on a tax-free basis into an RRSP or Registered Retirement Income Fund (RRIF) or would otherwise have to be withdrawn on a taxable basis. Individuals that make a qualifying withdrawal could transfer any unwithdrawn savings on a tax-free basis to an RRSP or RRIF until December 31 of the year following the year of their first qualifying withdrawal.

Qualified Investments

An FHSA would be permitted to hold the same qualified investments that are currently allowed to be held in a TFSA. In particular, taxpayers would be able to hold a broad range of investments, including mutual funds, publicly traded securities, government and corporate bonds, and guaranteed investment certificates.

The prohibited investment rules and non-qualified investment rules applicable to other registered plans would apply, including the potential tax consequences described below. These rules are intended to disallow investments in entities with which the account holder does not deal at arm's length, as well as investments in certain assets such as land, shares of private corporations and general partnership units.

Contributions

The lifetime limit on contributions would be $40,000, with an annual contribution limit of $8,000. In other words, individuals would be subject to the lesser of their annual limit and remaining lifetime limit. The full annual limit would be available starting in 2023.

The annual contribution limit would apply to contributions made within a particular calendar year. Individuals would be able to claim an income tax deduction for contributions made in a particular taxation year. Unlike RRSPs, contributions made within the first 60 days of a given calendar year could not be attributed to the previous tax year.

An individual would be allowed to carry forward unused portions of their annual contribution limit up to a maximum of $8,000. This means that an individual contributing less than $8,000 in a given year could contribute the unused amount (i.e., $8,000 less their contribution in that year) in a subsequent year on top of their annual contribution limit of $8,000 (subject to their lifetime contribution limit). For example, an individual contributing $5,000 to an FHSA in 2023 would be allowed to contribute $11,000 in 2024 (i.e., $8,000 plus the remaining $3,000 from 2023). Carry-forward amounts would only start accumulating after an individual opens an FHSA for the first time.

An individual would be permitted to hold more than one FHSA, but the total amount that an individual contributes to all of their FHSAs could not exceed their annual and lifetime contribution limits. Taxpayers would generally be responsible for ensuring they do not exceed their limit in a given year. The Canada Revenue Agency (CRA) would provide basic FHSA information to support taxpayers in determining how much they can contribute in a given year.

Contributions made to an FHSA following a qualifying withdrawal being made (i.e., when buying a first home) would not be deductible from net income.

Undeducted Contributions

An individual would not be required to claim a deduction for the tax year in which a contribution is made. Like RRSP deductions, such amounts could be carried forward indefinitely and deducted in a later tax year.

Qualifying Withdrawals

In order for an FHSA withdrawal to be a qualifying (i.e., non-taxable) withdrawal, certain conditions must be met.

First, a taxpayer must be a first-time home buyer at the time a withdrawal is made. Specifically, the taxpayer could not have owned a home in which they lived at any time during the part of the calendar year before the withdrawal is made or at any time in the preceding four calendar years. There is an exception to allow individuals to make qualifying withdrawals within 30 days of moving into their home.

The taxpayer must also have a written agreement to buy or build a qualifying home before October 1 of the year following the year of withdrawal and intend to occupy the qualifying home as their principal place of residence within one year after buying or building it.

A qualifying home would be a housing unit located in Canada. A share in a co-operative housing corporation that entitles the taxpayer to possess, and have an equity interest in a housing unit located in Canada, would also qualify. However, a share that only provides a right to tenancy in the housing unit would not qualify.

Provided the taxpayer meets the qualifying withdrawal conditions, the entire amount of available FHSA funds may be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals.

Non-qualifying Withdrawals

Withdrawals that are not qualifying withdrawals would be included in the income of the individual making the withdrawal. Financial institutions would be required to collect and remit withholding tax on non-qualifying withdrawals, consistent with the treatment applicable to taxable RRSP withdrawals.

Non-qualifying withdrawals would not re-instate either the annual contribution limit or the lifetime contribution limit.

Transfers

An individual could transfer funds from an FHSA to another FHSA, an RRSP or a RRIF on a tax-free basis.

Funds transferred to an RRSP or RRIF will be subject to the usual rules applicable to these accounts, including taxability upon withdrawal. These transfers would not reduce, or be limited by, an individual's available RRSP contribution room. These transfers would not reinstate an individual's FHSA lifetime contribution limit.

Individuals would also be allowed to transfer funds from an RRSP to an FHSA on a tax-free basis, subject to the FHSA annual and lifetime contribution limits and the qualified investment rules. Although such transfers would be subject to FHSA contribution limits, they would not be deductible and would also not reinstate an individual's RRSP contribution room.

Treatment of FHSA Income for Tax and Income-Tested Benefit Purposes

Contributions to an FHSA would be deductible in computing income for tax purposes. In addition, income, losses and gains in respect of investments held within an FHSA, as well as qualifying withdrawals, would not be included (or deducted) in computing income for tax purposes or taken into account in determining eligibility for income-tested benefits or credits delivered through the income tax system (for example, the Canada Child Benefit and the Goods and Services Tax Credit).

Eligible Issuers

Any financial institution that is able to issue RRSPs and TFSAs would be able to issue FHSAs. This includes Canadian trust companies, life insurance companies, banks and credit unions.

Interaction with the Home Buyers' Plan (HBP)

The HBP would continue to be available as under existing rules. However, an individual would not be permitted to make both an FHSA withdrawal and an HBP withdrawal in respect of the same qualifying home purchase.

Spousal Contributions and Attribution Rules

The FHSA holder would be the only taxpayer permitted to claim deductions for contributions made to their FHSA. Individuals would not be able to contribute to their spouse or common-law partner's FHSA and claim a deduction.

That said, an individual could contribute to their FHSA from funds provided to them by their spouse. Normally, if an individual transfers property to the individual's spouse or common-law partner, the income tax rules generally treat any income earned on that property as income of the individual. An exception to these "attribution rules" would allow individuals to take advantage of the FHSA contribution room available to them using funds provided by their spouse. Specifically, these attribution rules would not apply to income earned in an FHSA that is derived from such contributions.

Marital Breakdowns

On the breakdown of a marriage or a common-law partnership, it is proposed that an amount may be transferred directly from the FHSA of one party to the relationship to an FHSA, RRSP, or RRIF of the other. In such circumstances, transfers would not re-instate any contribution room of the transferor, and would not be counted against any contribution room of the transferee.

Over-contribution, Non-qualified Investment, Prohibited Investment, and Advantage Taxes

Like TFSAs, a 1% tax on over-contributions to an FHSA would apply for each month (or a part of a month) to the highest amount of such excess that exists in that month.

When a taxpayer's annual contribution limit is reset at the beginning of each calendar year, over-contributions from a previous year may cease to be an over-contribution. A taxpayer would be allowed to deduct an over-contributed amount for a given year in the tax year in which it ceases to be an over-contribution but not earlier. However, if a qualifying withdrawal is made before an over-contribution ceases to be an over-contribution, no deduction would be provided for the over-contributed amount.

Example:

Alyssa contributes $10,000 on November 15, 2023 and does not withdraw it. This contribution exceeds Alyssa's annual FHSA contribution limit by $2,000.

Alyssa would be subject to an over-contribution tax of $40 (1% × $2,000 × 2 months) when filing her 2023 tax return in 2024. The $2,000 amount would cease to be an over-contribution on January 1, 2024, as a new annual limit of $8,000 would be available.

Alyssa would be allowed to deduct $8,000 from her 2023 net income. Presuming Alyssa did not make a qualifying withdrawal between November 15, 2023 and January 1, 2024, she would be allowed to deduct the additional $2,000 from her 2024 net income.

The Income Tax Act imposes other taxes in certain circumstances involving non-qualified investments, prohibited investments, and unintended advantages in respect of other registered plans. These rules would also apply to the FHSA.

The Minister of National Revenue would have authority to cancel or waive all or part of these taxes in appropriate circumstances. Various factors would be taken into account including reasonable error, the extent to which the transactions that gave rise to the tax also gave rise to another tax, and the extent to which payments were made from the taxpayer's registered plan.

Treatment Upon Death

Like TFSAs, individuals would be permitted to designate their spouse or common-law partner as the successor account holder, in which case the account could maintain its tax-exempt status. If named as the successor holder, the surviving spouse would become the new holder of the FHSA immediately upon the death of the original holder provided the surviving spouse meets the eligibility criteria to open an FHSA (see the discussion above under "Opening and Closing Accounts"). Inheriting an FHSA in this way would not impact the surviving spouse's contribution limits. Inherited FHSAs would assume the surviving spouse's closure deadlines. If the surviving spouse is not eligible to open an FHSA, amounts in the FHSA could instead be transferred to an RRSP or RRIF of the surviving spouse, or withdrawn on a taxable basis.

If the beneficiary of an FHSA is not the deceased account holder's spouse or common-law partner, the funds would need to be withdrawn and paid to the beneficiary. Amounts paid to the beneficiary would be included in the income of the beneficiary for tax purposes. When such payments are made, the payment to the beneficiary would be subject to withholding tax.

Non-residents

Taxpayers would be allowed to contribute to their existing FHSAs after emigrating from Canada, but they would not be able to make a qualifying withdrawal as a non-resident. Specifically, a taxpayer withdrawing funds from an FHSA must be a resident of Canada at the time of withdrawal and up to the time a qualifying home is bought or built.

Withdrawals by non-residents would be subject to withholding tax.

Reporting Requirements

Opening an Account

In order to open an FHSA, a taxpayer would be required to confirm their eligibility to an eligible issuer.

Ongoing Reporting

Financial institutions would be required to send to the CRA annual information returns in respect of each FHSA that they administer. The CRA would use information provided by issuers to administer the FHSA and provide basic FHSA information to taxpayers.

Withdrawals

In order to make a qualifying withdrawal, an individual would be required to submit a request to their FHSA issuer confirming their eligibility. Issuers would not apply withholding taxes upon receiving a valid qualifying withdrawal request.

When any withdrawals are made (qualifying or non-qualifying), the FHSA issuer would be required to prepare an information slip with the amount of the withdrawal and, in the case of a non-qualifying withdrawal, any income tax withheld on that amount.

Account Closure

The CRA would issue a reminder to all taxpayers and their FHSA issuers of when an FHSA will no longer have tax-advantaged status.

Deposit Insurance Framework

The Canada Deposit Insurance Corporation insures eligible deposits up to $100,000 per member institution, per person, per category. It is proposed that the Canada Deposit Insurance Corporation Act be amended to create a new category of insured deposits for FHSAs, as is the case for RRSPs and TFSAs.

Interest Deductibility

Like RRSPs and TFSAs, interest on money borrowed to invest in an FHSA would not be deductible in computing income for tax purposes.

Collateralization

Taxpayers must include in income the full value of any assets held within an FHSA and pledged as collateral for a loan.

Bankruptcy

FHSAs would not be afforded creditor protection under the Bankruptcy and Insolvency Act.

Posted on

November 8, 2022

by

Marie Taverna

Inflation, rising interest rates create caution across Metro Vancouver’s housing market

Home sale activity across the Metro Vancouver housing market continued to trend well below historical averages in October.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,903 in October 2022, a 45.5 per cent decrease from the 3,494 sales recorded in October 2021, and a 12.8 per cent increase from the 1,687 homes sold in September 2022.

Last month’s sales were 33.3 per cent below the 10-year October sales average.

“Inflation and rising interest rates continue to dominate headlines, leading many buyers and sellers to assess how these factors impact their housing options,” Andrew Lis, REBGV’s director, economics and data analytics said. “With sales remaining near historic lows, the number of active listings continues to inch upward, causing home prices to recede from the record highs set in the spring of 2022.”

There were 4,033 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in October 2022. This represents a 0.4 per cent decrease compared to the 4,049 homes listed in October 2021 and a 4.6 per cent decrease compared to September 2022 when 4,229 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,852, a 22.6 per cent increase compared to October 2021 (8,034) and a 1.2 per cent decrease compared to September 2022 (9,971).

“Recent years have been characterized by a frenetic pace of sales amplified by scarce listings on the market to choose from. Today’s market cycle is a marked departure, with a slower pace of sales and more selection to choose from,” Lis said. “This environment provides buyers and sellers more time to conduct home inspections, strata minute reviews, and other due diligence. With the possibly of yet another rate hike by the Bank of Canada this December, it has become even more important to secure financing as early in the process as possible.”

For all property types, the sales-to-active listings ratio for October 2022 is 19.3 per cent. By property type, the ratio is 14.3 per cent for detached homes, 21.6 per cent for townhomes, and 23.2 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,148,900. This represents a 2.1 per cent increase from October 2021, a 9.2 per cent decrease over the last six months, and a 0.6 per cent decrease compared to September 2022.

Sales of detached homes in October 2022 reached 575, a 47.2 per cent decrease from the 1,090 detached sales recorded in October 2021. The benchmark price for detached properties is $1,892,100. This represents a 1.6 per cent increase from October 2021 and a 0.7 per cent decrease compared to September 2022.

Sales of apartment homes reached 995 in October 2022, a 44.8 per cent decrease compared to the 1,801 sales in October 2021. The benchmark price of an apartment property is $727,100. This represents a 5.1 per cent increase from October 2021 and a 0.2 per cent decrease compared to September 2022.

Attached home sales in October 2022 totalled 333, a 44.8 per cent decrease compared to the 603 sales in October 2021. The benchmark price of an attached unit is $1,043,600. This represents a 7.1 per cent increase from October 2021 and a 0.5 per cent decrease compared to September 2022.

Download the October 2022 stats package.

Posted on

October 4, 2022

by

Marie Taverna

Fall is now here and it’s time to update porch décor from cheugy to chic! Fall is now here and it’s time to update porch décor from cheugy to chic!

This year we’re thinking tonal, monochromatic elegance. These front porch decorating ideas will surely pique your interest by emphasizing the effortless aesthetic of Canadian contemporary design.

|

Subscribe with RSS Reader

Subscribe with RSS Reader

TORONTO, August 31, 2023

TORONTO, August 31, 2023

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.