Posted on

February 23, 2023

by

Marie Taverna

Empty walls have their place in a home, and while a crisp, clean esthetic is always a classic choice, sometimes you just want to spruce up your space – or at least a portion of it. The much-loved gallery wall is one of the most tried and true DIY designer trends in the book to do just that!

There’s no one way to do it right. Some prefer a fine-tuned, perfectly measured grouping of similar frames, while others like to switch it up, adding varied frame styles and sizes, and different accent pieces without precise spacing.

If you’re looking for a great do-it-yourself project to tackle this winter, here are some top gallery wall design tips for you to consider:

Use the floor as your sketchpad

Don’t start hanging right away. Get an aerial view of your vision by using the floor as your testing ground; a temporary space to choose your preferred layout, colour scheme, shapes and sizes before fully committing to your new gallery wall. Lay out your pieces a few times until they suit your preference, and don’t hesitate to start over if you don’t like it the first time.

Build out from a focal point

Start by centering around a favourite frame or accent piece to emphasize on the gallery wall. Get a sense of balance, and build your spread from there. Building outwards will help you control the balance and dimensions of the overall design.

Start with the biggest pieces

If you are using a collection of frames in varied sizes, add in your larger hanging pieces first, and use the smaller ones to fill in the gaps. Don’t be afraid to mix different colours, sizes and textures on your gallery wall.

Pick the right colour scheme

Unless you’re going for an eccentric look, try to pick frames, art, photos and accent pieces that match the rest of the space. While your gallery wall is likely to be a focal point of the room, it should fit the aesthetic of the room.

Think beyond photos and art

Consider including elements that aren’t picture frames. Take inspiration from some of the boldest gallery wall artists online and try adding hanging plants, accessories like jewelry and hats, or even a collection of your favourite travel souvenirs. The space is yours to play with.

No matter what you like – and no matter how big or small the space – gallery walls can come together quickly and be among the more affordable options for adding a touch of personal style to your home.

Posted on

February 23, 2023

by

Marie Taverna

Whether you’re contemplating selling your home, or just looking to give your space a refreshing facelift, the beginning of a new year is a great time to start thinking about making some interior upgrades. According to designers and home experts, 2023 is the year to bring the outdoors in and to make a statement with bold colours, among other trends.

Here are five top interior design trends for 2023 to consider this year:

Organic interiors

Plant parents will adore 2023’s obsession with bringing the natural world indoors.

Biophilic interiors, which started gaining popularity in 2022, focus on bringing the outdoors inside to promote calmness and relaxation while reducing anxiety. You can achieve a biophilic-inspired space by introducing natural materials into your home such as wood, rattan, cork, stone, bamboo and clay.

Biophilic design calls for natural light, so opt for blinds in lieu of heavy curtains and leave window views unobstructed. Incorporate natural elements into your home too by adding water features, wood-burning fireplaces and plants.

Modern curves

Soft arches, round furniture and curvaious accessories will be a staple in 2023 home design.

Modern interiors have long been defined by sharp edges and lines, but are softening up as curves rise in popularity. Taking cues from biophilic design, modern curves reflect imperfect and organic shapes found in nature, adding a touch of softness and comfort to any room.

You can incorporate curves into your home by installing domed light fixtures, adding a round rug to your floor or investing in an ionic curved “conversation” sofa for your living space.

Warm tones

Neutral hues are taking a backseat in 2023.

Browns, magentas and terracotta colours are expected to surge in popularity this year, bringing warm, welcoming and earth tones into homes. If you aren’t up to the challenge of repainting your walls, there are many ways to embrace trendy colours. You can swap out your existing couch cushions or covers for a new colour, hang unique artwork or invest in smaller, colourful accent furniture pieces.

Statement stones

Marble will continue to be the material of choice for many bathrooms and kitchens in 2023, but this material will take on a more vibrant feel.

Breaking away from typical shades of white, 2023 will use marble as a statement piece, embracing rich colours, prominent veining and high contrast. Harness the power of bold stones to create a focal point in your home this year, whether it’s an eye-catching kitchen backsplash or a showstopping centre island. Calacatta or Arabescato marbles can be found in various shades and patterns, and can offer a punch of red, blue or green to the room of your choice.

Old is new again

Whether you call it a return to the classics or a nostalgic longing for the past, many homes will incorporate traditional designs this year.

Intricate moulding, millwork and vintage furniture will find their way into interiors as homeowners experiment with mixing old and new décor in 2023. Traditionalism will also appear in the structure of the home, as the popularity of open-concept layouts fade and separate dining rooms and enclosed kitchens make a return.

Hop on the trend by adding thrifted finds, heirlooms and trinkets to any room to add unique character and a vintage vibe to your space.

Posted on

February 23, 2023

by

Marie Taverna

Shopping for a home with a budget of $1 million will get you very different results depending on where you’re looking in Canada. In some housing markets, a million-dollar budget is enough for a large detached home, while in other cities, the same amount can buy a roomy condominium in a walkable downtown neighbourhood.

From coast to coast, here’s a sample of $1 million listings in Canada:

505 -128 Pears Avenue, Toronto, Ont.

List price: $975,000

Size: 713 square feet

Rooms: 1+1 bedrooms, 1 bathroom

Listing Agent: Cailey Heaps Estrin and Amanda Gaskey, Royal LePage R.E. Services Heaps Estrin Team

1302 Rue Montarville, Saint-Bruno-De-Montarville, Que.

List price: $989,000

Rooms: 3 bedrooms, 2+1 bathrooms

Listing Agent: Marie-France Dupont, Geneviève St-Cyr, Isa-Maude Lacaille and Catherine Proulx-Michelin, Royal LePage Privilège

75 158 171 Street, Surrey, B.C.

List price: $950,000

Size: 1,690 square feet

Rooms: 4 bedrooms, 4 bathrooms

Listing Agent: Allie McLaughlin, Royal LePage Wolstencroft Realty

1008-1500 Hornby Street, Vancouver, B.C.

List price: $998,800

Size: 1,046 square feet

Rooms: 2 bedrooms, 2 bathrooms

Listing Agent: Linda Fong Kenny, Royal LePage Westside

650 Broadview Avenue, Ottawa, Ont.

List price: $995,000

Size: 1,818 square feet

Rooms: 3 bedrooms, 2 bathrooms

Listing Agent: John Gomes, Royal LePage Performance Realty

505-837 2 Avenue SW, Calgary, Alta.

List price: $949,000

Size: 1,709 square feet

Rooms: 2 bedrooms, 2 bathrooms

Listing Agent: Alexandra Hripko, Royal LePage Benchmark

36 Fairway Drive NW, Edmonton, Alta.

List price: $1,050,000

Size: 3,670 square feet

Rooms: 6 bedrooms, 6 bathrooms

Listing Agent: Jason Thomas and Raj Sharma, Royal LePage Summit Realty

210 Bently Drive, Halifax, N.S.

List price: $1,029,000

Size: 4,439 square feet

Rooms: 4 bedrooms, 5 bathrooms

Listing Agent: Simon Zhu, Royal LePage Atlantic – NS

401-5429 Roblin Boulevard, Winnipeg, Man.

List price: $995,000

Size: 2,332 square feet

Rooms: 2 bedrooms, 2 bathrooms

Listing Agent: Laura Foubert, Royal LePage Dynamic Real Estate

Posted on

February 23, 2023

by

Marie Taverna

The first resale policy of its kind in Canada, homes bought and sold in British Columbia will now be automatically enrolled in a mandatory multi-day rescission period, according to new legislation.

The Homebuyer Protection Period took effect in British Columbia on January 3rd, 2023. Also known as the Homebuyer Recission Period (HBRP) or cooling-off period, the new policy requires a three-business-day interval after a purchase offer is accepted on a home, allowing purchasers to rescind their contract if they choose to.

Although similar laws exist abroad in countries such as France and New Zealand, B.C. is the first province in the country to implement a protection period for resale and new construction homes, according to the provincial government.

Here’s a roundup of everything you need to know about the B.C. Homebuyer Protection Period:

What is the purpose of the cooling-off period?

By allowing up to three business days for a buyer to retract their offer, the protection period gives purchasers more time to consider whether buying a property is right for them, especially in a high-pressure sales environment. The three-day wait also gives buyers time to complete due diligence as part of the transaction, such as securing financing or arranging a home inspection.

According to the BC Financial Service Authority (BCFSA), the protection period applies to all residential real property transactions, regardless of whether a real estate professional is involved in the purchase or not. The protection period cannot be waived by the buyer or the seller.

How does the policy work?

The protection period takes effect the next full business day after an offer is accepted. For example, if an agreement is accepted on Monday afternoon, the rescission period would expire on Thursday at 11:59 p.m. If the purchase agreement contains conditions such as a home inspection, these clauses will run concurrently with the rescission period.

Only a few exemptions apply under the protection period, such as properties that are located on leased land, under a court order or sold at auction.

Real estate professionals are required to provide disclosures on HBRP regulations, which include information about rescission rights, exemptions and a calculation of the amount that the buyer must pay to the seller in the event of rescission.

What happens if a buyer rescinds their offer?

Should the buyer choose to cancel their contract during the cooling-off period, they are required to pay 0.25% of the purchase price, or $250 for every $100,000, to the seller. On a $1 million home, this would equal $2,500.

The fee to the seller is paid out of the deposit the buyer provides upon acceptance of the offer, and the remainder is refunded to the purchaser. In cases where a deposit is not provided with the agreement, payment can be provided directly to the seller or through the buyer’s representative to give to the seller or their agent. The buyer must notify the seller in writing that they are retracting the offer.

For more information on British Columbia’s Homebuyer Protection Period, visit the provincial government’s website or review BCFSA’s HBRP consumer guide.

Posted on

February 23, 2023

by

Marie Taverna

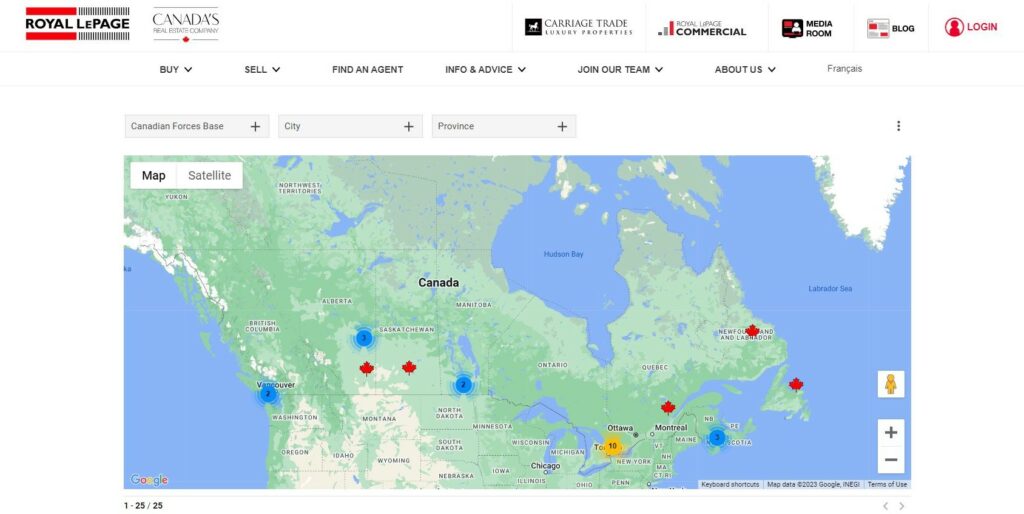

Many military members and their families find themselves moving between bases across Canada during their years of service. Between house hunting, offer negotiation and packing, moving to a new home is taxing enough without the additional stressors those working in the Canadian military can face during relocation. To better serve our military members, Royal LePage offers a network of relocation experts who are available from coast to coast to make the moving process as smooth as possible.

Whether you’re being transferred or moving onto a military base for the first time, Royal LePage has agents across the country who are there to help. Royal LePage’s community of REALTORS® are available to support military members with their various real estate needs, including providing up-to-date information on the market, finding homes that fit a specific criteria, or connecting buyers to other real estate experts across the nation.

The Canadian Forces Base map on royalepage.ca shows users the location of Royal LePage brokerages available within close proximity to base locations. Users can simply browse through the map and click on the red maple leaf markers to bring up a list of local Royal LePage offices in their desired location.

Are you or someone you know looking for assistance with military relocation? Visit our website for more information on our services and to connect with a member of our network.

Posted on

February 23, 2023

by

Marie Taverna

Despite several consecutive hikes in interest rates over the past year, home prices in Canada have remained relatively stable thanks to low inventory. In major housing markets across the country, a $1-million price tag is not uncommon, but the type of property available at this price point can vary from one city to another.

In examining what a budget of approximately $1 million – give or take $50,000 – can buy in Canada’s major housing markets, Royal LePage determined that the average home in Canada valued between $950,000 and $1,050,000 in December of 2022 had 3.2 bedrooms, 2.6 bathrooms and 1,763 square feet of living space, inclusive of all property types. Data for the report was provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

“The mythical million dollar house may not be the mansion it once was, yet a million-dollar budget will still buy a luxurious home in many parts of Canada,” said Phil Soper, president and CEO of Royal LePage. “For those who live in our most expensive cities, low seven figures will get you a lovely, if more modest home.”

In today’s post-pandemic landscape, more Canadians than ever before have the option to work fully remotely, resulting in the ability to choose the city or town where they want to live without being restricted by the local job market.

“Wider acceptance of fully remote employees has given more Canadian homebuyers the flexibility to live and work wherever they like. For those who prioritize square footage, outdoor space and luxurious features, $1 million will go a lot further in cities outside of Toronto and Vancouver,” noted Soper.

Here are a few highlights from the Royal LePage Million-Dollar Properties Report:

- Nationally, a typical $1-million home boasts an average of 3.2 bedrooms, 2.6 baths and almost 1,800 square feet of living space.

- Remote work has given homebuyers greater flexibility to choose where they want to live, including more affordable cities where a million-dollar budget may stretch farther.

- $1-million homes in the Greater Toronto Area and Greater Vancouver offer less square footage and fewer bedrooms and bathrooms than the national average.

- Unlike Canada’s two other largest metropolitan centres, the Greater Montreal Area boasts an average home size that is 523 square feet larger than the national average.

- Halifax, Edmonton and Winnipeg boast the largest average square footage of all major cities in Canada at this price point.

Posted on

February 15, 2023

by

Marie Taverna

February 14th is just around the corner! While Valentine’s Day is a great excuse to visit our local restaurants, flower shops and chocolatiers, it’s also the perfect opportunity to make a donation that supports healthy love!

|

|

|

|

|

|

|

Please honour your sweetheart, children, friends, or even yourself by donating $14 this February 14th. 100% of your gift will fund programs that teach young people in Canada how to build and nurture relationships with romantic partners and friends that are defined by these feelings, actions and behaviours:

-

A comfortable pace

-

Trust

-

Honesty

-

Independence

-

Fun

-

Respect

-

Taking responsibility

-

Equality

-

Kindness

-

Healthy conflict

After donating, you’ll gain access to a ‘healthy love’ graphic and content you can share on social media to start a conversation about what defines a healthy relationship. We encourage you to spread the word and encourage your followers to join you in this important work. Together, we can prevent younger generations from experiencing and perpetrating domestic violence.

Happy Valentine’s Day!

|

Posted on

February 6, 2023

by

Marie Taverna

Lagging Inventory Builds Demand as Bank of Canada Signals Hold on Interest Rates

REBGV Market Activity – January 2023

The current housing market in Greater Vancouver presents a timely opportunity for astute buyers. As interest rates have risen over the past year, the average home price has experienced downward pressure, leading to a decrease in the average cost of housing and the potential to build equity in the longer term for those willing to take advantage of this market correction. As interest rates settle in 2023, property values are expected to consolidate and begin to increase in the latter half of the year, resulting in positive equity growth for early buyers.

“Due to seasonality, market activity is quieter in January. With mortgage rates having risen so rapidly over the last year, we anticipated sales this month would be among the lowest in recent history,” said Andrew Lis, REBGV’s director, economics and data analytics. “Looking forward, however, the Bank of Canada has said that it will pause further rate increases as long as the incoming economic data continues to support this policy stance. This should provide more certainty for home buyers and sellers in the market.”

Detached housing in Greater Vancouver has experienced the largest decrease in value, with an average price of $1,909,101 in January, a 17% drop from its peak in February 2022 of $2,306,603. On the other hand, the condo market has remained relatively stable, with an average sales price of $758,855 in January, a 12% decrease from the all-time high in February

2022 of $846,610.

Inventory and New Listings Off to a Slow Start

Total inventory across all asset classes in January was 7,389 active listings, a 19% year-over-year increase. The condo market saw the most new listings with 1,699, while the detached market had the lowest January total in recent history with only 1,035 new listings.

The lack of new inventory is creating increased competition for desirable homes, particularly in the low-rise category. Buyers who held off last year on making a move are now competing for quality homes, and in some cases finding themselves in multiple offer scenarios given the insufficient number of listings on the market. Sellers looking to list their home in the remaining winter months may be pleasantly surprised by the attention a well maintained, well priced home will receive in this current market.

Bank of Canada Announcement Provides Assurances to Consumers

On January 25th, in light of higher than anticipated employment numbers in December 2022, The Bank of Canada raised its benchmark interest rate by 25 basis points, to 4.5%. While this was the Bank’s eighth consecutive interest rate increase, the announcement was primarily significant due to the Bank’s inclusion of forward guidance that it expects to hold off on future rate hikes. Economists are already predicting that the Bank of Canada will turn its focus to easing monetary policy by the end of this year. This shift allows consumers to once again rely on mortgage interest rates remaining steady and with that, renews confidence that real estate will not see the declines in value in 2023 that we saw in 2022.

Opportunity Knocks

A contrarian mindset has been beneficial for past purchasers who chose to buy during the market corrections in 2019 and 2009. While the Covid-driven anomalistic growth trend which saw values increase 42% between June 2020 and February 2022 may be behind us, savvy buyers are keen to pick up properties off the peak with less competition than the recent years afforded.

“We know the peak for prices in our market occurred last spring. Over the coming months, year-over-year data comparisons will show larger price declines than we’ve been reporting up to now,” said Lis. “It’s important to understand that year-over-year calculations are backward-looking. These price declines already happened, and what we are seeing today is that prices may have found a footing, even if it’s an awkward one sandwiched between low inventory and higher borrowing costs.”

Posted on

February 2, 2023

by

Marie Taverna

When renovating a home, the major concerns are often making the space more functional, stylish, and cozy. But when you have a pet, or are planning to get one, some of those design considerations may change to best suit your four-legged family member’s needs.

Here are a few tips to help make your home more pet-friendly:

Avoid carpet flooring

Carpets can gather dirt and stains like no other. Many pets shed, and some may feel the occasional need to relieve themselves in the wrong place. Plus, animals can easily tip over glasses and plates with their tails while exploring tabletops. Avoid a time-consuming and potentially expensive clean-up, and opt for durable and easy-to-clean flooring like laminate, vinyl, stone, or ceramic.

Get washable, wipeable furnishings

When it comes to your couch and other furniture, choose fabrics and textures that are less of a magnet for pet fur and, if necessary, are somewhat claw-resistant. Consider certain types of synthetic fibres that can be more resistant to damage. You may also want to apply a protective layer of wipeable paint… just in case you end up with paw prints on your walls.

Design a ‘pet pad’

As a way to minimize mess and not give the impression that you have a Tasmanian devil for a pet, consider setting up a designated play area for your furry friend. Retrofit a small portion of your home with a comfy bed, bowls for food and water, a storage bin for toys, and scratch pads. If they feel like they have their own space, it may keep your pets from spreading toys around the house and taking things from other rooms. This can also help contain any potential messes to one area of your home… preferably one that has durable floors.

Safety-proof your yard

Outside of the home, plant only pet-friendly flowers and plants in your garden, avoiding toxic vegetation like tulips, lilies and certain kinds of mulch. Provide your pet with an outdoor shelter and some shade for hot summer days. Ensure you build a sturdy fence around the yard to help keep them from running away. This should also prevent skunks, raccoons and other critters – including your neighbours’ pets – from setting up shop on your property and harming or disturbing your furry friend.

Posted on

February 2, 2023

by

Marie Taverna

Classic European inspired 5 bedroom, 4 bath executive home located in the prestigious “The Uplands” neighbourhood in Anmore. Experience stunning mountain views in a private rural lot, just a short drive for the city. Perfect for entertaining, with a dream kitchen complete with solid wood cabinets, SS appliances, granite countertops & expansive kitchen island. Family room French doors open to massive outdoor deck, complete with 2 gas hookups. Rest easy in the large primary bedroom complete with gas fireplace, walk in closet, shower & soaker tub. Property boosts in ground sprinklers, aircon, custom blinds & beautiful wooden floors. Walkout basement has suite potential with private balcony, 2 bedrooms, & rec room. Don’t miss out on this perfect balance of natural & elegance.

http://share.jumptools.com/studioSlideshow.do?collateralId=230354&t=2918&b=1

Posted on

February 2, 2023

by

Marie Taverna

Fraser Valley real estate sales record slowest annual start in ten years; January new listings lowest in over thirty years

Posted on

February 2, 2023

by

Marie Taverna

Home sales decline below long-term averages and inventory remains low to start 2023

Inventory remains low in Metro Vancouver while home sales dipped well below monthly historical averages in January.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,022 in January 2023, a 55.3 per cent decrease from the 2,285 sales recorded in January 2022, and a 21.1 per cent decrease from the 1,295 homes sold in December 2022.

Last month’s sales were 42.9 per cent below the 10-year January sales average.

“Due to seasonality, market activity is quieter in January. With mortgage rates having risen so rapidly over the last year, we anticipated sales this month would be among the lowest in recent history,” said Andrew Lis, REBGV’s director, economics and data analytics. “Looking forward, however, the Bank of Canada has said that it will pause further rate increases as long as the incoming economic data continues to support this policy stance. This should provide more certainty for home buyers and sellers in the market.”

There were 3,297 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in January 2023. This represents a 20.9 per cent decrease compared to the 4,170 homes listed in January 2022 and a 173.4 per cent increase compared to December 2022 when 1,206 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 7,478, a 32.1 per cent increase compared to January 2022 (5,663) and a 1.3 per cent increase compared to December 2022 (7,384).

For all property types, the sales-to-active listings ratio for January 2023 is 13.7 per cent. By property type, the ratio is 10.2 per cent for detached homes, 13.4 per cent for townhomes, and 16.7 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“We know the peak for prices in our market occurred last spring. Over the coming months, year-over-year data comparisons will show larger price declines than we’ve been reporting up to now,” said Lis. “It’s important to understand that year-over-year calculations are backward-looking. These price declines already happened, and what we are seeing today is that prices may have found a footing, even if it’s an awkward one sandwiched between low inventory and higher borrowing costs.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,111,400. This represents a 6.6 per cent decrease over January 2022 and a 0.3 per cent decrease compared to December 2022.

Sales of detached homes in January 2023 reached 295, a 52.6 per cent decrease from the 622 detached sales recorded in January 2022. The benchmark price for a detached home is $1,801,300. This represents a 9.1 per cent decrease from January 2022 and a 1.2 per cent decrease compared to December 2022.

Sales of apartment homes reached 571 in January 2023, a 56.6 per cent decrease compared to the 1,315 sales in January 2022. The benchmark price of an apartment home is $720,700. This represents a 1.1 per cent decrease from January 2022 and a one per cent increase compared to December 2022.

Attached home sales in January 2023 totalled 156, a 55.2 per cent decrease compared to the 348 sales in January 2022. The benchmark price of an attached home is $1,020,400. This represents a three per cent decrease from January 2022 and a 0.8 per cent increase compared to December 2022.

Download the January 2023 stats package.

|

Subscribe with RSS Reader

Subscribe with RSS Reader