Posted on

January 28, 2021

by

Marie Taverna

Keep Your Foundation Strong

|

|

| |

Considering a major renovation to your home? When discussing the project with your partner, acknowledge any personal friction that may arise between the two of you during the undertaking.

A survey conducted by Houzz, a leading platform for home remodeling and design, discovered that while 46 percent of respondents found the experience of remodeling and redecorating with their significant other to be collaborative, the same amount of survey respondents found the experience to be frustrating, and 12 percent even admitted to considering a separation or divorce mid-remodel! Here are some tips to calm the stress of remodeling, and focus instead on the enjoyment you have to look forward to in your beautiful new home.

-

Be upfront with your ideas and reasons for renovating.

-

Allocate tasks according to each person's strengths and preferences.

-

Recognize that you'll need to show some flexibility along the way, so communicate your "must-haves" up-front, together with areas where you're more open to compromise.

-

Agree on a budget, and prioritize where the money will be allocated.

-

Promise to communicate throughout the project, and not to take opinions personally.

Of course, there are times when remodeling won't solve your home requirements, or when the cost of the project outweighs the benefits.

Please call so we can talk through your home wants and needs, and discuss moving options that will provide the lifestyle you're looking for without the stress, cost and time that a major remodel would entail.

|

Posted on

January 28, 2021

by

Marie Taverna

| |

Hygge (pronounced "hoo-guh") is a Danish expression referring to "well-being" that has captured the hearts of North Americans, especially during our frigid winter months.

The concept of hygge involves finding pleasure in simple, everyday things. For example, in today's world, it's more important than ever that our homes become a peaceful sanctuary where we feel safe and secure. The calming notion of snuggling by a fire, wrapped in a cozy blanket with a steaming cup of tea and a good book at hand is a soothing image to help visualize the concept of hygge during our blustery Canadian winters.

The easiest way to introduce hygge into your home is to dedicate one room to include only the things that bring you joy. Your bedroom can be a good place to start.

With so many of us working from home, your computer may have found its way into your bedroom. Do your best to seek out another corner of your home to relocate your "home office" to. In that same vein, remove all work-related and personal clutter from the room, keeping only the items that channel your inner calm.

Think "cozy and comforting" when introducing things back into your bedroom. Layers of soft bedding in soothing colours, lots of throw pillows, and plush rugs to sink your toes into are easy additions, while copious candles and live plants can complete the mood.

Let's embrace our Canadian winter with a little Danish inspiration!

|

Posted on

January 28, 2021

by

Marie Taverna

| |

Wondering if you and your home simply aren't right for each other anymore? Let us count the ways that could indicate it's time to move on:

1. Your home doesn't fit your family anymore. Your growing family may have outgrown the space, or conversely empty nesters may find themselves resenting the cost and labour of maintaining space they simply don't need anymore.

2. The neighbourhood has changed. Or perhaps it's you that's changed. For example, maybe you welcomed the influx of new businesses to the area a few years ago. Now, you find yourself annoyed by the increased noise and traffic they've brought in, and you yearn for a quieter lifestyle.

3. Your schools aren't A+. While you may not have had children when you first moved in, their subsequent arrival could now be spurring your desire to seek out a better school district.

4. You're feeling removed. You may have originally chosen your home for the actual property itself, but now it's sunk in how far it is from friends, family, work and other important support systems.

5. It hasn't aged well. Your home may be needing repairs and replacements faster than you can keep up. At this point you will need to weigh the costs, financially and also in stress and time, between fixing your home versus moving to a move-in-ready property.

6. Your financial situation has changed. You may find yourself newly single, or dealing with your or your partner's job loss. Moving to a more affordable home can ease your financial stress.

7. You're just ... over it. Sometimes you just want a change, plain and simple. You want to see what's on the market, and ideally connect with one that ignites a spark in you.

Let's talk about what your ideal home would look like. We'll work together to make sure you make the right move, for the right reasons!

|

Posted on

January 28, 2021

by

Marie Taverna

Congratulations!

You are among the top five per cent of Royal LePage agents in your regional market!

Dear Marie,

I am thrilled to offer my sincere congratulations on achieving Royal LePage Top Tier status and earning the 2020 Royal LePage Director’s Platinum Award! It is a remarkable accomplishment to be recognized among the top performers in our national network of more than 18,000 REALTORS®.

Your dedication and hard work over this past year, and your ability to rise to the challenges before you, are a shining example of the foundation our organization is built upon. It is because of people like you that Royal LePage is Canada’s Real Estate Company.

Once again, congratulations and best wishes for the year ahead!

Sincerely,

Phil Soper

President and CEO

Royal LePage

Posted on

January 28, 2021

by

Marie Taverna

Canadian Retail Sales (Nov) - January 22, 2021

|

|

|

Canadian retail sales rose for the seventh consecutive month in November by 1.3% on a seasonally-adjusted basis, defying Statistic Canada's preliminary estimate of no change. Sales were up in 7 of 11 subsectors, representing 53% of retail sales. The increase was led by higher sales at food and beverage stores. Compared to the same time last year, retail sales were up by 7.5%.

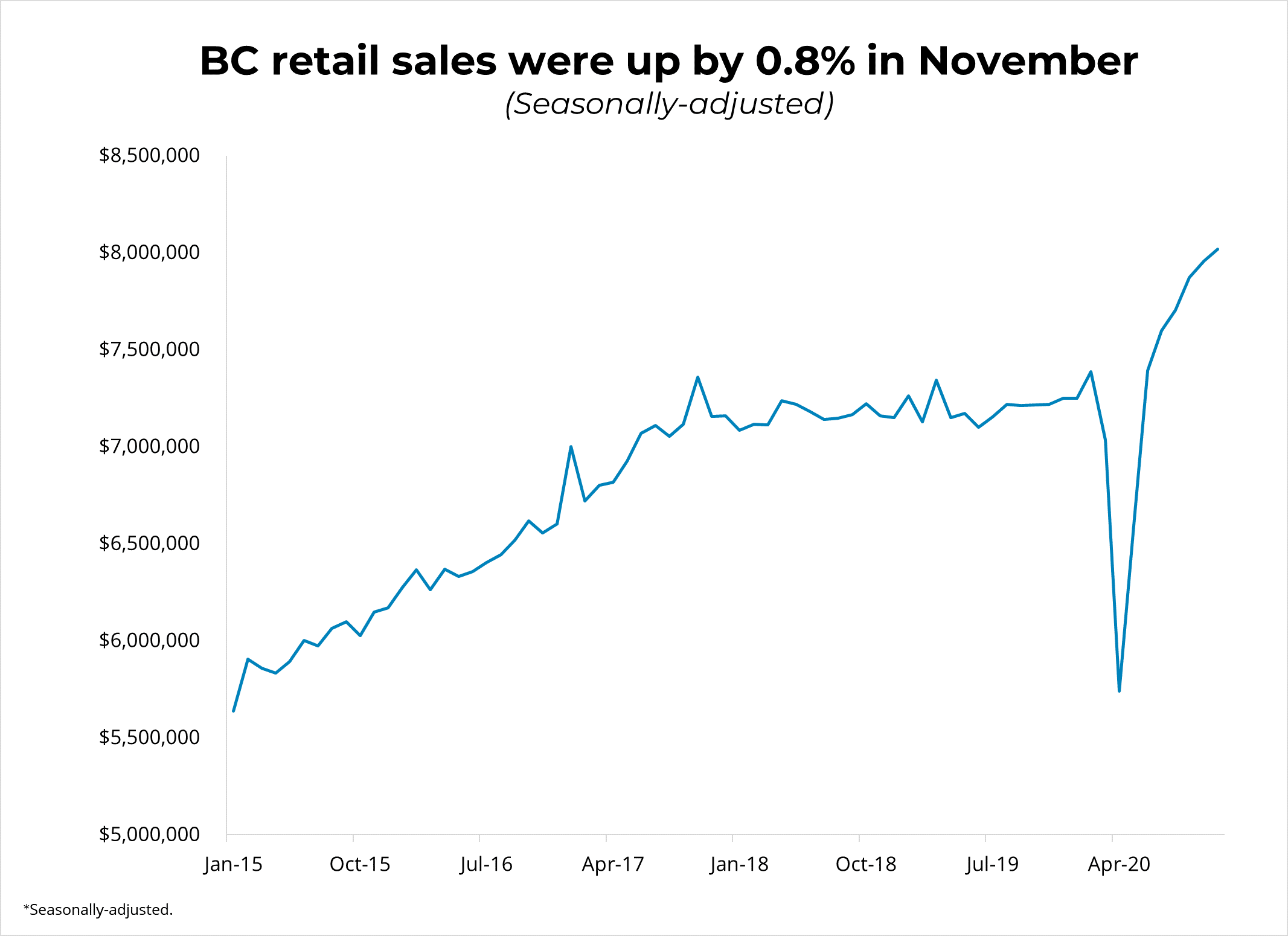

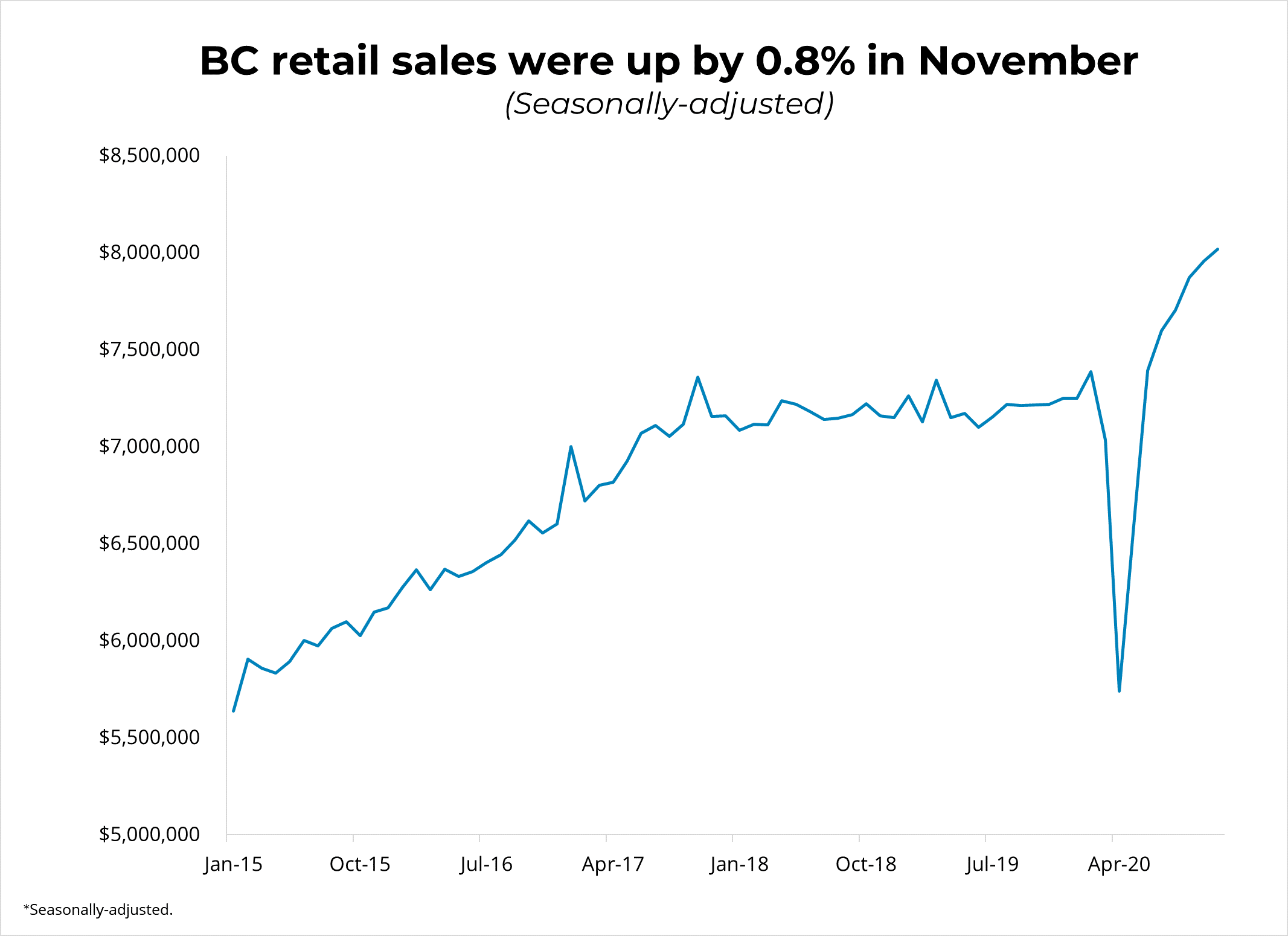

Sales were up in all provinces except for Manitoba. In BC, seasonally-adjusted retail sales were up by 0.8% ($8.0 billion) and by 1.4% ($3.7 billion) in Vancouver. Contributing the most to the increase were sales at electronic and appliance stores, while sales were down at auto dealers and gas stations. Compared to the same time last year, BC retail sales were up by 11.1%.

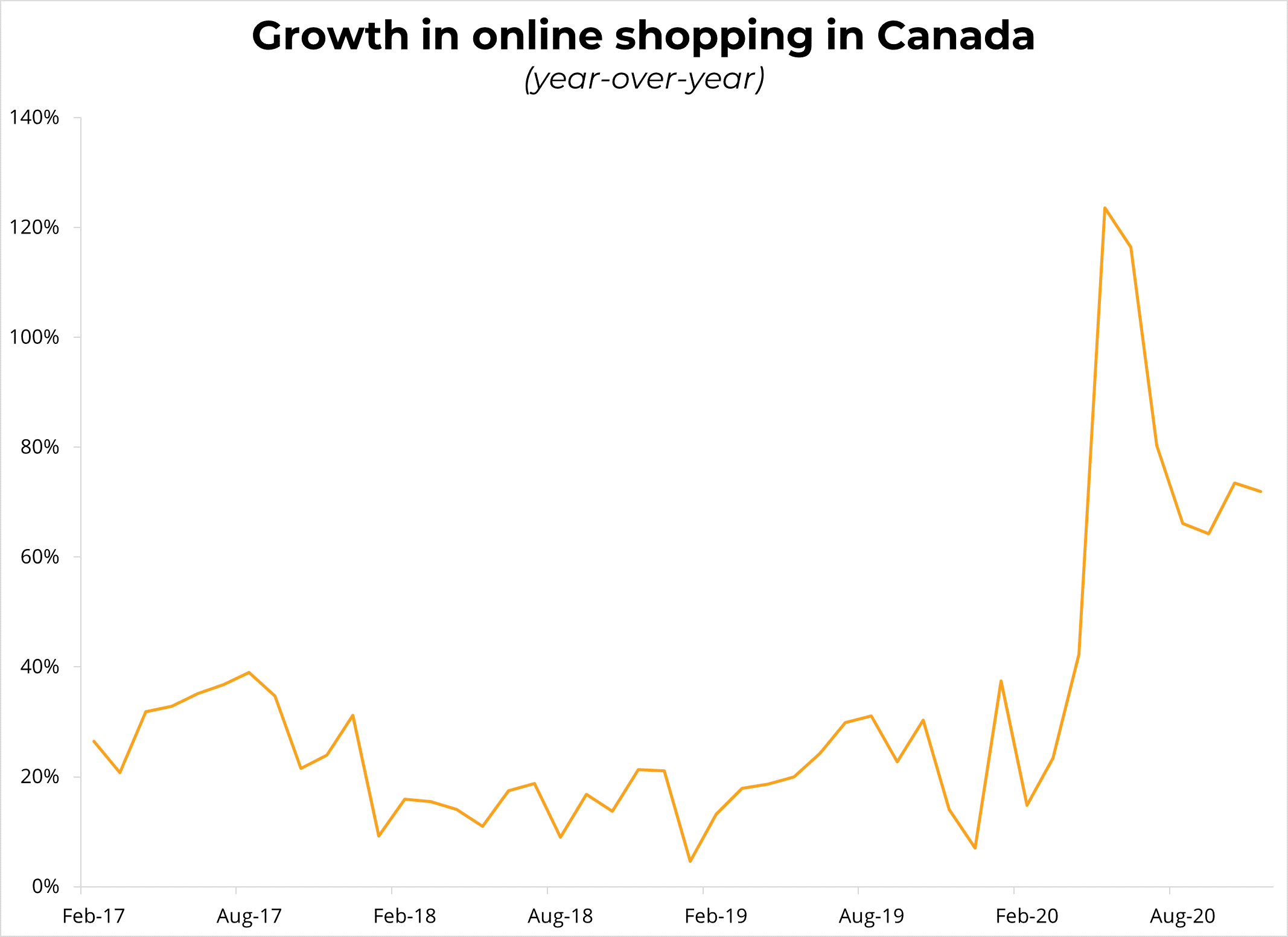

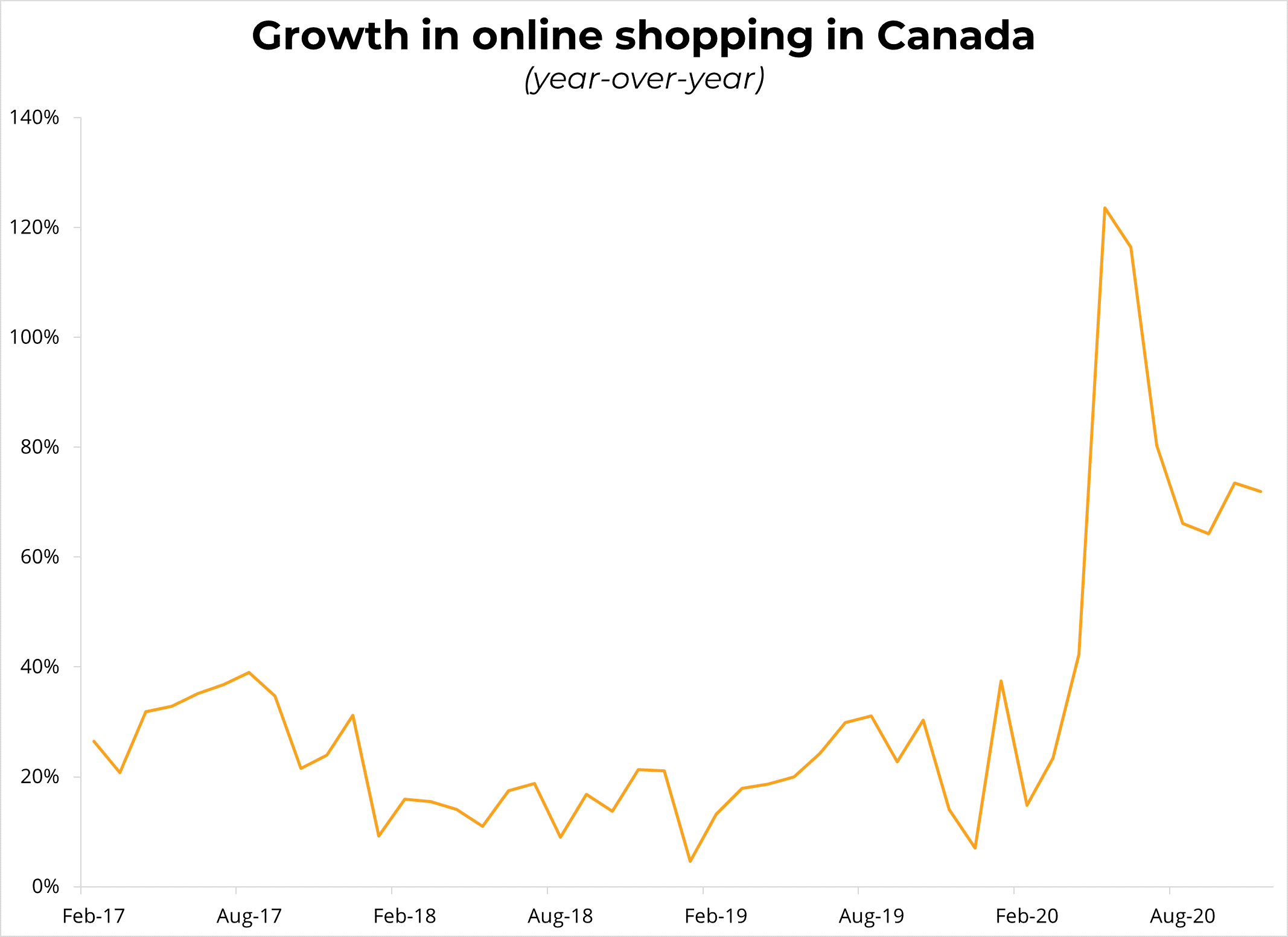

In November, Canadian e-commerce sales totaled $4.3 billion, accounting for 7.4% of total retails sales, which is up from 5.4% in the previous month. Meanwhile, e-commerce sales were up by 76% from a year ago. This excludes Canadians purchasing from foreign e-commerce retailers.

November was a pleasant surprise in retail sales, as consumers likely pulled forward their purchases in anticipation of the holiday rush, as well as promotional events such as Black Friday. Early estimates from Statistics Canada are showing a December decline, as COVID-19 cases increase and multiple provinces implement stricter lockdown measures. Growth in retail sales is expected to slow until the vaccine becomes more widely available.

Link: https://mailchi.mp/bcrea/canadian-retail-sales-nov-january-22-2021

|

|

For more information, please contact:

|

|

Posted on

January 28, 2021

by

Marie Taverna

COVID-19 Recovery Dashboard - January 27, 2021

|

|

This month’s COVID-19 Recovery Dashboard shows that home sales staged a remarkable recovery during the pandemic and recession in 2020 that will fuel momentum in 2021. However, record low levels of supply across the province will likely translate into considerable upward pressure on prices until listings pick-up. Consumer confidence is still weak amid rising COVID-19 cases and tightened restrictions, which have reduced movement around the province. Meanwhile, business confidence is up as manufacturing and international trade have recovered from their pre-pandemic levels, and the vaccine rollout has led many businesses to expect a rise in sales in 2021. For a more comprehensive overview of BC's economic recovery, click here.

About BCREA’s COVID-19 Recovery Dashboard

The BCREA Economics team has created the COVID-19 Recovery Dashboard to help REALTORS® monitor BC’s economic recovery. This dashboard focuses on the sectors and activities that have been most significantly impacted by the pandemic, including:

- Housing Markets

- Retail, Restaurant Reservations and Movement

- Jobs and Hours Worked

- Manufacturing and International Trade

- Business and Consumer Confidences

- Tourism

To monitor the province’s progress, we benchmark each indicator to February 2020, the month before the pandemic was declared. This dashboard is updated each month.

BCREA's updated COVID-19 Recovery Dashboard is available  here. here. |

|

For more information, please contact:

Kellie Fong

Economist

778.357.0831

kfong@bcrea.bc.ca |

|

Posted on

January 28, 2021

by

Marie Taverna

Presented by Enercare

According to Natural Resources Canada, water heating represents 15 to 25 percent of our household energy bill and it is the second largest portion of energy utility costs, after home heating. So before calculating the right water heater size you need for your household, you should consider switching to an eco-friendly water heater.

Next you have to make sure to get the right capacity tank for your family’s needs. Getting one with too much capacity will cost more to rent and operate. As a general rule, below is a guideline of the size of tank you might need. While it does not necessarily factor the number of bathrooms in the house and your hot water usage, it should give you a good estimate:

| Number of gallons/litres |

Number of people in the household |

| 30-40 gallons (114 -151 litres) |

1-2 |

| 40-50 gallons (151-189 litres) |

2-3 |

| 50-60 gallons (189-227 litres) |

3-4 |

| 60-80 gallons (227-303 litres) |

5 people + |

Source: What Size Water Heater Do I Need

If you want to make a more precise calculation, you have to check two factors:

The First Hour Rating (FHR): it means how many gallons of water a heater can produce at any given hour. You can see this number on the EnergyGuide label of the water heater.

Peak Hour Demand: this corresponds to the amount of hot water your household uses during a busy hour, like in the morning for example. The easy method to calculate is the number of people living in your household multiplied by 12 (it corresponds to the FHR). For example, if you are 4 people in your household 4 x 12 = 48 which corresponds to your FHR. So you will want to buy a water heater of about 50 to 60 gallons (189-227 litres).

Once you know what size water heater you need, you can start shopping. You might consider renting. In your calculations, remember that the life expectancy of a water heater is about 7 to 15 years before being replaced. When you rent, make sure to also take in consideration the following: Natural Resources Canada explains that “Every energy-using appliance has two price tags. We know the first: the purchase or renting price. The second price tag is considered less in the purchasing or rental decision, but is just as real; it is the operating cost of the appliance which is the cost to operate the heater. It is wise to rent a model that is EnergyStar, as you will save in the long run.”

Posted on

January 28, 2021

by

Marie Taverna

Winterizing Tips to Protect your Home and Save Money

Presented by Enercare

When the cold front comes in, the name of the game is to keep it out while reducing energy costs and avoiding major repair headaches once the ice thaws. Getting your home prepared for winter in Canada is a must. Here’s how:

According to Hydro One, up to 40 percent of home heat loss in winter is due to air leakage. If you were to add up all the cracks and leaks in the average Canadian home, it would be like having a hole in your wall the size of a basketball. Shocking, right? To deal with this, install or replace old weather-stripping and caulking around the house. Once all the doors and windows are sealed, plug the less obvious air leaks by finding hidden drafts using a lit stick of incense. Light the incense and pass it around baseboards, light fixtures, and electrical outlets, anywhere there may be an air leak. If the smoke wavers, that’s where you have a draft. You can also use a damp hand to locate leaks; any drafts will feel cool to your hand.

Now for the energy saving part. You might assume that fans are only useful in the summer, but they can also push hot air downward when running in reverse (read: running clockwise). Next, if you have a programmable thermostat, set it to turn on the heat when you’re heading home or when your kids are on their way back from school. There’s no need to pay for heating when no one is home.

Once or twice during winter months, replace or clean your furnace filters. We can’t stress this enough. Not only does it maintain healthier equipment, it can also lower your heating bill. Dirty furnace filters have a tendency to restrict air flow and increase energy use. Now is also the time to give your furnace and boiler a tune-up. You don’t want to find yourself in the middle of a snowstorm with a technical problem. By scheduling a professional cleaning and inspection each fall, you can be confident that your HVAC units won’t leak, produce inconsistent temperatures, or turn on and off unexpectedly. Just make sure when you’re looking for a technician or company that they’re qualified, licensed, and insured.

Before the first snowfall, finish up your winterization by protecting your outdoor air conditioner from falling leaves, snow, and ice. Cover it with a breathable material that doesn’t lock in moisture, which could be detrimental to the finish and inner components. Keep your gutters free of leaves, sticks, and other debris so that melting snow can flow freely, preventing ice dams that can cause water damage. Turn off the water to your outdoor garden hose spigots and drain the lines. Lastly, and arguably most importantly, prevent your basement from flooding by looking for pipes that aren’t insulated and run through unheated spaces and wrap them in insulation sleeves to prevent freezing and breakage.

There you have it. Once all these steps are complete, your home will be toasty, warm, and ready to take on the frostiest of winters. For a little extra romance as you keep out the cold, sit by the fireplace, wrap yourself in a cozy blanket, and pour yourself a cup of hot cocoa.

Learn more about Enercare’s .

Posted on

January 27, 2021

by

Marie Taverna

$495,900.00

Welcome to “Place on the Park.”

This lovely top floor,2 bedroom corner unit, is move in ready. This home has been fully renovated over the last 5 years.

Renos include fully update kitchen/solid wood cabinets/quartz counter tops. New S/S appliances.

Leveled engineered hardwood floors & tiled flooring. Freshly painted walls, trim & doors.

Updated bath with cheater door from M/B. Front loading washer/dryer. Living room has a cozy gas fireplace, vaulted ceiling with fan.

This home has lots of windows for natural light. New window screens/2 balconies.

Large principle bedroom. 2nd bedroom perfect for office or den.

1 storage locker+ in suite large closet. 1 parking spot.

Just a short stroll to WestCoast Express & buses/brand new Poco rec centre/shopping/restaurants/brewery/parks/schools & daycares.

Posted on

January 15, 2021

by

Marie Taverna

Canadian recreational house prices soar 11.5% as remote work drives demand in cottage country

TORONTO, ON, November 30, 2020 – According to Royal LePage, year-over-year price appreciation in Canada’s recreational property markets soared during the first nine months of 2020, driven by Canadians’ ability to work remotely. The aggregate price of a single-family home in Canada’s recreational market rose 11.5 per cent to $453,046 and the aggregate price of a condominium rose 9.7 per cent to $280,830. The aggregate price of a waterfront property increased 13.5 per cent to $498,111.

“The pandemic has effected enormous economic and health challenges upon the nation; it has also opened a world of possibility for thousands of Canadians,” said Phil Soper, president and CEO, Royal LePage. “On lake and on sea, upon soaring mountain tops and on expansive farmlands, many Canadians are embracing a bold, new work-from-home doctrine: ‘I can live anywhere in this huge land.’

“In addition to the new wave of pandemic-era buyers, simple demographics have been buoying the exurban market as more and more of the giant Baby Boom generation retire,” Soper continued. “Interest in all types of recreational property is soaring, and I have never seen the number of cottages, cabins, chalets and farmhouses for sale at such a low level relative to demand.”

Eighty-four per cent of Royal LePage recreational property experts, representing 45 of Canada’s most popular recreational markets, reported an increase in buyers who were interested in working remotely from the property. Fifty-four per cent of regions surveyed reported a significant increase in buyers who sought to purchase a primary residence in a recreational market, enabled by their ability to work remotely.

Recreational property markets also saw an uptick in retiree buyers. While retirees are historically a significant buyer demographic for the recreational property market, the pandemic has spurred demand as retirees advance their plans to improve their quality of life by moving to cottage country. Sixty-eight per cent of regions reported an increase in retiree buyers compared to last year.

As a result of the COVID-19 pandemic, the typically brisk spring market was pushed to late summer and early fall with many regions seeing record-breaking autumn sales. As demand outpaced supply, 86 per cent of the regions surveyed reported less inventory than the previous year.

Nationally, Royal LePage is forecasting that the price of a recreational property in 2021 will increase 8 per cent year-over-year.

In this album, you will find shareable posts and images highlighting winter recreational real estate trends across Canada.

Posted on

January 15, 2021

by

Marie Taverna

Royal LePage: Canadian home prices forecast to rise 5.5% by the end of 2021 as low inventory and unmet demand set to fuel price increases

Housing demand exceeded expectations in the second half of 2020. The supply of homes available for sale failed to keep pace, driving home prices higher and pushing unmet buyer demand into the new year. According to the Royal LePage Market Survey Forecast, the aggregate[1] price of a home in Canada is set to rise 5.5 per cent year-over-year to $746,100 in 2021, with the median price of a two-storey detached house and condominium projected to increase 6.0 per cent and 2.25 per cent to $890,100 and $522,700, respectively.[2]

“The leading indicators we analyze are pointing to a market that favours property sellers in the all-important spring of 2021,” said Phil Soper, president and CEO, Royal LePage. “Across the country, a large number of hopeful buyers intent on improving their housing situation were not able to find the home they were looking for this year, as the inventory of properties for sale came nowhere near to meeting surging demand. With policy makers all but promising record low, industry supportive interest rates to continue, we do not see this imbalance improving in the new year. The upward pressure on home prices will continue.

“There was a clear shift towards larger properties and single-family dwellings in 2020, as families repurposed homes to become their office, school classroom, gymnasium and restaurant during the pandemic,” Soper continued. “We expect this trend to moderate as life returns to normal in the months ahead. It is also worth noting, that Canada welcomed a new generation of first-time homeowners this year, encouraged by lower financing costs and softer demand for city centre condominiums. Urban living remains attractive for many.”

The value of single-family houses and homes outside of major urban markets are forecast to continue to outpace city core condominiums in the year ahead, driven both by Canadians seeking larger homes in a time where remote work has become more commonplace, and broad-based demographic trends, including baby-boomer retirement.

“Mega-trends that predate the pandemic are pushing home prices higher in secondary markets outside of our largest cities. Corporate Canada’s pandemic-driven move to work-from-home operations has simply accelerated relocation patterns already underway,” said Soper. “The huge baby-boomer demographic began post-children migration to suburban and recreational-style communities in the middle of the last decade, and material numbers of the equally populous millennial generation have been exiting city centre condos in search of space as they began families.”

Soper added that the trend of high demand outside of urban centres will slowly ease as listings in city centres become more competitive against growing prices in suburban and exurban markets.

Immigration is critical to the housing market both indirectly, as it is supportive of economic growth, as well as directly through housing demand. In October, the federal government announced its plan to add more than 1.2 million immigrants over three years, a significant jump from previous years. Previously published Royal LePage research[3] into this demographic shows that newcomers to Canada typically rent for three years before purchasing, after which they have a material impact on new household formation and overall housing demand. An increase in immigration is supportive of both the resale market and investment demand for rental condominiums.

Nationally, the condominium segment is expected to see healthy demand in most of Canada’s largest cities. A notable exception is the Greater Toronto Area where a softer condominium market began emerging in the second half of 2020. Within the region, modest price gains for larger units outside of the city centre is expected to continue to offset softer demand in the downtown core. With the return of international university student rental demand and newly arrived immigrants in the second half of 2021, demand for centrally located units should increase.

The concern regarding the impact of potential mortgage defaults related to mortgage deferrals during the summer has eased significantly, as many Canadians who deferred payments have begun repayment. According to CMHC, as of September 30, 2020, the organization’s entire insured book of business has 5 per cent of loans with a payment deferral in place; a decline from approximately 8 per cent in August.[4]

“The first half of 2021 will be something of an economic and social tug-o-war between advancing medical science and surging housing demand,” concluded Soper. “The real estate brokerage industry has developed protocols that allow us to safely sell property during the pandemic, yet some would-be sellers will remain cautious and not list their properties while high levels of COVID-19 transmission remain the norm, restricting available housing supply.”

Royal LePage 2021 Market Survey Forecast Price Table:

rlp.ca/rlp2021_forecast_table

MARKET SUMMARIES

Greater Toronto Area

In the Greater Toronto Area, the aggregate price of a home in 2021 is forecast to increase 5.75 per cent year-over-year to $990,300. During the same period, the median price of a standard two-storey home is expected to rise 7.5 per cent to $1,185,800, while the median price of a condominium is forecast to increase 0.5 per cent to $600,800. The relatively flat median price projection for the condominium segment reflects a modest increase in median price for condominiums in the 905 area, offsetting a slight dip in median price for the City of Toronto.

“Single family homes remain in high demand. We expect lighter activity as we near the winter holidays but if inventory does not improve in early 2021, we could have another year of strong price appreciation,” said Debra Harris, vice president, Royal LePage Real Estate Services Ltd. “Low inventory is expected to put upward pressure on prices but we could see low unit sales if there isn’t product to sell.”

Performance within the condominium segment is expected to remain varied with higher demand for larger units in the 905 area. Harris added that while there has been a recent surge in condominium listings, the historically starved Toronto condo market can withstand an increase in condo supply without significantly impacting price in the short term. With the federal government’s new and aggressive immigration targets as well as the expected return of rental demand from university students in the fall, resale demand for condominiums should be significantly higher in the second half of the year.

“Many young people returned home to save money during the pandemic and we expect them to want to get back into city life when the vaccine becomes available. The question is whether consumer confidence in the condo market will be healthy given the surge in listings. The reality is that current inventory is much healthier than where we were last year,” said Harris. “For the many young professionals who were discouraged by strong competition in the condo market in previous years, this window may be their opportunity to find a home they can get excited about living in.”

Greater Montreal Area

In the Greater Montreal Area, the aggregate price of a home in 2021 is forecast to increase 6.0 per cent year-over-year to $514,900. During the same period, the median price of a standard two-storey home is expected to rise 7.0 per cent to $656,200, while the median price of a condominium is forecast to increase 3.75 per cent to $382,600.

“The pandemic has sparked our imagination in the sense that it’s given people the opportunity to take on real estate projects that would have been impossible without the option of remote work,” said Dominic St-Pierre, vice-president and general manager, Royal LePage Quebec. “Buying a property became the main objective of many households, and for some, the only way to get some fresh air during the pandemic. We expect demand will only ease when Canadians truly come out of lockdown, that is to say when travel and regular activities can resume.”

St-Pierre added that Montreal’s real estate market has proven to be surprisingly resilient in the face of 2020’s economic uncertainty and the effects of the global pandemic on urban lifestyle.

Despite the exodus of Montrealers to the suburbs over the course of the last several months, demand on the island for single-family homes, and some condominiums, has reached new heights. Well-priced properties are selling quickly, due to a lack of inventory and accumulated demand prompted by health and safety restrictions.

“In advance of upcoming mass distribution of the vaccine and a return to normal business activity, it is possible that prolonged safety restrictions and their impact on the precarious job market, could lead to an increase in mortgage defaults, which would inject inventory into the real estate market,” suggested St-Pierre. “However, pent-up demand has been so high in the Greater Montreal Area that such a boost in inventory would be insufficient to cool the market, as properties would be absorbed immediately.”

In 2021, Greater Montreal’s condominium market will vary from one neighbourhood to the next.

“Generally speaking, the number of condos for sale should continue to increase, especially in the downtown core, where prices could stabilize or even dip slightly in some cases, attracting first-time homebuyers who can take advantage of record low interest rates,” predicts St-Pierre. “Elsewhere in the region, condo prices could increase. One of the driving factors in condo demand will be the return of foreign students to the city centre, providing improved revenue for landlords who have seen rental prices shrink.”

Greater Vancouver

In Greater Vancouver, the aggregate price of a home in 2021 is forecast to increase 9.0 per cent year-over-year to $1,262,600. During the same period, the median price of a standard two-storey home is expected to rise 10.0 per cent to $1,671,700, while the median price of a condominium is forecast to increase 3.5 per cent to $684,300.

“I am confident we will continue to see prices rise next year. Vancouver has proven to be a rather resilient market,

with high demand and quite low inventory,” said Randy Ryalls, managing broker, Royal LePage Sterling Realty. “In March, we couldn’t have imagined this is where we’d be today, but despite public health concerns, consumer confidence remains high. With very attractive mortgage rates and the promise of a vaccine on the horizon, demand is likely to remain strong.”

Ryalls noted that the current market conditions create a tough situation for buyers, who are oftentimes competing for properties; something he expects is likely to continue through 2021.

“We are seeing multiple offers on almost every reasonably-priced detached listing. There simply isn’t enough inventory to meet the demand,” said Ryalls. “A balanced Vancouver market has about 15,000 active listings available. Right now, we’re sitting at roughly 10,000. If we reach the end of January without an injection of inventory, we will continue to see upward pressure on prices in the spring. I expect a strong seller’s market in 2021.”

Ryalls added that while the condominium market is not as strained as the single-family detached sector, demand remains strong.

Ottawa

In Ottawa, the aggregate price of a home in 2021 is forecast to increase 11.5 per cent year-over-year to $624,000. During the same period, the median price of a condominium is expected to increase 7.5 per cent to $417,900, while the median price for a two-storey detached home is forecast to rise 12.0 per cent to $656,300.

“Ottawa real estate continues to see high demand from Toronto buyers who are looking for less density and more outdoor spaces. Living in Ottawa gives you access to great schools and healthcare, a good job market and you can maintain a city lifestyle while affording a much larger home than what is offered in the GTA,” said Jason Ralph, managing partner, Royal LePage TEAM Realty. “Many local buyers struggled to find what they were looking for in 2020 due to low inventory. With their return to the market in the spring coupled with continued demand from the GTA, prices are forecast to rise significantly.”

Ralph added that while inventory is critical to a healthy spring market, demand is expected to continue to outpace supply.

“Ottawa has very low inventory across all housing types, and the single-family home market is especially competitive,” said Ralph. “We do not see inventory relief coming in the spring, which is expected to result in multiple offers and further price increases. However, despite price gains, Ottawa remains very affordable compared to capital cities internationally, as well as large urban centres in Canada.”

Calgary

In Calgary, the aggregate price of a home in 2021 is forecast to increase 0.75 per cent to $469,600 year-over-year. During the same period, the median price of a condominium is forecast to decrease 1.0 per cent to $258,000, while the median price of a two-storey detached home is forecast to rise 1.5 per cent to $514,800.

“Inventory for detached homes has not seen similar lows since 2001. Buyers are eager to get into the market, but they may have to broaden their search to find a good selection to choose from if they are looking for detached homes in popular neighbourhoods,” said Corinne Lyall, broker and owner, Royal LePage Benchmark. “While spring is expected to bring new inventory to the market, we are also anticipating a healthy level of demand from buyers, resulting in a balanced market.”

As a result of low interest rates, Lyall added that buyer demand has stabilized and the downturn in the oil market is promoting a more diversified economy. The federal government’s recent increase in immigration targets may spur the condo market, providing more price stability and a potential opportunity for price gains. The condominium market is expected to dip modestly in median price, however, high demand from entry-level buyers and single professionals will continue to absorb some oversupply.

Edmonton

In Edmonton, the aggregate price of a home in 2021 is forecast to increase 1.5 per cent year-over-year to $375,600. During the same period, the median price of a two-storey detached home is forecast to increase 1.5 per cent to $430,700, while the median price of a condominium is expected to rise 1.0 per cent to $215,100.

“In the second half of 2020, demand has outpaced supply and inventory is currently the lowest it’s been in five years. Some single-family homes are even attracting multiple offers and I expect to see the buyers who didn’t transact this fall, return in the spring. The question is whether the inventory will be there,” said Tom Shearer, broker and owner, Royal LePage Noralta Real Estate. “In 2020, many sellers took their homes off the market due to their concerns regarding COVID-19. If we find ourselves again with a limited supply of houses on the market, prices will move upward.”

Shearer added the challenges that the Edmonton real estate market has faced in recent years have been absorbed into current pricing as sellers have now made their listings more competitive.

“There is excellent value in Edmonton,” added Shearer. “Homeownership is possible for most professionals, and young families can find detached properties in desirable neighbourhoods.”

Halifax

In Halifax, the aggregate price of a home in 2021 is forecast to increase 7.5 per cent year-over-year to $400,700. During the same period, the median price of a two-storey detached home is forecast to rise 9.0 per cent to $435,300, while the median price of a condominium is forecast to increase 7.0 per cent to $322,300.

“The number of listings in Halifax is the lowest it has been in 16 years and demand is still strong. As remote work becomes more permanent, buyers are moving back to the Maritimes,” said Matt Honsberger, broker and owner, Royal LePage Atlantic. “Halifax will continue to be in high demand as buyers from outside of Atlantic Canada seek affordability and the Maritime lifestyle while easily accessing the best of the city. You can live on the outskirts of Halifax and be downtown in 15 minutes. It’s the best of both worlds.”

Honsberger says while current demand for condominiums is lower than detached homes, there are signals that demand for condos may increase in 2021.

“While international students make up a smaller percentage of condo renters and buyers than other Maritime cities, a return to pre-COVID demand will stimulate the condominium market as students are expected to return in autumn 2021,” said Honsberger. “The timing of new build projects has also been pushed out, which could dampen supply in the new year.”

Winnipeg

In Winnipeg, the aggregate price of a home in 2021 is forecast to increase 4.75 per cent year-over-year to $348,700. During the same period, the median price of a two-storey detached home is expected to rise 5.0 per cent to $401,600, while the median price of a condominium is forecast to increase 1.25 per cent to $230,100.

“Approximately 95% of listings that were added to the market in November, sold. That’s unheard of in Winnipeg,” said Michael Froese, broker and manager, Royal LePage Prime Real Estate. “Even with the increased COVID-19 restrictions, demand remains strong. Heading into the new year, there would have to be a significant rise in our seasonal supply of listings to meet it.”

Froese added that strong demand for homes in the outlying communities is expected to remain a trend in 2021, as companies and individuals continue to normalize remote work and buyers look for homes that fit their new needs. Homes and communities that offer these types of amenities are thriving as buyers seek as much space as possible for their dollar.

Regina

In Regina, the aggregate price of a home in 2021 is forecast to increase 2.75 per cent year-over-year to $335,600. During the same period, the median price of a two-storey detached home is forecast to increase 3.0 per cent to $417,400, while the median price of a condominium is forecast to increase 1.5 per cent to $226,000.

“Low inventory continues to result in multiple offer scenarios as buyers seek larger homes. Consumer confidence is healthy and if we see a significant lift in inventory in the new year, we should have a brisk spring market” said Mike Duggleby, broker and owner, Royal LePage Regina Realty. “There is a high degree of uncertainty, but if current trends continue into 2021, there will be upward pressure on prices.”

Duggleby added that condominiums, after years of oversupply, are proving to be popular with investors who see current prices as below their value.

“Condominium investors have two streams of demand – university students and young immigrant families. If the Canadian government hits its newly revised immigration target and university students return in the fall, demand for condominiums will increase.”

Royal LePage 2021 Market Survey Forecast Price Table:

rlp.ca/rlp2021_forecast_table

Royal LePage Royalty-Free Media Assets:Royal LePage’smedia roomcontainsroyalty-free assets, such as images and b-roll, that are free for media use.

About the Royal LePage Market Survey Forecast

The Royal LePage Market Survey Forecast provides year-over-year price expectations for Canada’s nine largest markets. Housing values are based on the Royal LePage National House Price Composite, produced through the use of company data in addition to data and analytics from its sister company, RPS Real Property Solutions, the trusted source for residential real estate intelligence and analytics in Canada. Commentary on housing and forecast values are provided by Royal LePage residential real estate experts, based on trend analysis and market knowledge.

About Royal LePage

Serving Canadians since 1913, Royal LePage is the country’s leading provider of services to real estate brokerages, with a network of over 18,000 real estate professionals in over 600 locations nationwide. Royal LePage is the only Canadian real estate company to have its own charitable foundation, the Royal LePage Shelter Foundation, dedicated to supporting women’s and children’s shelters and educational programs aimed at ending domestic violence. Royal LePage is a Bridgemarq Real Estate Services Inc. company, a TSX-listed corporation trading under the symbol TSX:BRE. For more information, please visit www.royallepage.ca.

For further information, please contact:

Katie Raskina

Proof Strategies

kraskina@getproof.com

416 969-2709

[1] Royal LePage’s aggregate home price is based on a weighted model using median prices and includes all housing types.

[2] Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian valuation company. Price forecast reflects Q4 2021 over Q4 2020 projections.

Posted on

January 15, 2021

by

Marie Taverna

|

Metro Vancouver housing market shows resilience in 2020 January 2021

Strong December activity brought Metro Vancouver’s* 2020 home sales total in line with the region’s long-term annual average.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 30,944 in 2020, a 22.1 per cent increase from the 25,351 sales recorded in 2019, and a 25.7 per cent increase from the 24,619 homes sold in 2018.

Last year’s sales total was 2.8 per cent below the 10-year sales average.

“When the pandemic began in March, the housing market came to a near standstill. We knew, however, that shelter needs don’t go away in times of crisis, they intensify," Colette Gerber, REBGV Chair said. “The real estate community worked closely with our regulatory bodies and public health officials in the spring to ensure appropriate precautions and protocols were implemented so BC REALTORS® could help residents safely meet their housing needs."

Home listings on the Multiple Listing Service® (MLS®) in Metro Vancouver reached 54,305 in 2020. This is a 4.6 per cent increase compared to the 51,918 homes listed in 2019 and a 1.3 per cent increase compared to the 53,614 homes listed in 2018.

Last year’s listings total was 2.7 per cent below the region’s 10-year average.

“After adapting to the COVID-19 environment, local home buyer demand and seller supply returned at a steady pace throughout the summer, fall and winter seasons," Gerber said. "Shifting housing needs and low interest rates were key drivers of this activity in 2020. Looking ahead, the supply of homes for sale will be a critical factor in determining home price trends in 2021.”

The MLS® HPI composite benchmark price for all residential properties in Metro Vancouver ends the year at $1,047,400. This is a 5.4 per cent increase compared to December 2019.

The benchmark price for apartments increased 2.6 per cent in the region last year. Townhomes increased 4.9 per cent and detached homes increased 10.2 per cent.

December Summary

REBGV reports that residential home sales in the region totalled 3,093 in December 2020, a 53.4 per cent increase from the 2,016 sales recorded in December 2019, and a 0.9 per cent increase from the 3,064 homes sold in November 2020.

Last month’s sales were 57.7 per cent above the 10-year December sales average and is the highest total for the month on record.

“Robust December sales outpaced long-term averages in what’s traditionally the quietest month of the year in real estate. This was part of an unusual seasonal pattern the market followed last year, which can be attributed in large part to the pandemic,” Gerber says.

There were 2,409 detached, attached and apartment properties newly listed for sale on the MLS® in Metro Vancouver in December 2020. This represents a 51.7 per cent increase compared to the 1,588 homes listed in December 2019 and a 40.8 per cent decrease compared to November 2020 when 4,068 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 8,538, a 0.8 per cent decrease compared to December 2019 (8,603) and a 23.2 per cent decrease compared to November 2020 (11,118).

For all property types, the sales-to-active listings ratio for December 2020 is 36.2 per cent. By property type, the ratio is 35.2 per cent for detached homes, 50.4 per cent for townhomes, and 33.1 per cent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

Sales of detached homes in December 2020 reached 1,026, a 71.3 per cent increase from the 599 detached sales recorded in December 2019. The benchmark price for detached homes is $1,554,600. This represents a 10.2 per cent increase from December 2019 and a one per cent increase compared to November 2020.

Sales of apartment homes reached 1,474 in December 2020, a 40 per cent increase compared to the 1,053 sales in December 2019. The benchmark price of an apartment property is $676,500. This represents a 2.6 per cent increase from December 2019 and is unchanged from November 2020.

Attached home sales in December 2020 totalled 593, a 62.9 per cent increase compared to the 364 sales in December 2019. The benchmark price of an attached home is $813,900. This represents a 4.9 per cent increase from December 2019 and a 0.1 per cent decrease compared to November 2020.

|

Posted on

January 15, 2021

by

Marie Taverna

In which cozy Curated Interior breakfast nook would you most like to enjoy your first sip of fresh morning coffee?

A. French Bistro

B. Neutral Banquette

C. Coastal Cool

D. Pops of Magenta

Posted on

January 15, 2021

by

Marie Taverna

Royal LePage: More than half of Canada’s largest real estate markets see double-digit price growth as national home values soar 9.7% in fourth quarter

Fourth quarter regional highlights:

TORONTO, January 15, 2021 – According to the Royal LePage House Price Survey released today, the aggregate[1] price of a home in Canada increased 9.7 per cent year-over-year to $708,842 in the fourth quarter of 2020, as strong seller’s market conditions continued to shape Canada’s real estate market through the end of the year. The significant year-over-year increase in aggregate price was driven by price gains for larger properties. Sixty-four per cent of all regions surveyed showed year-over-year median price gains of more than 10 per cent for two-storey homes.

The Royal LePage National House Price Composite is compiled from proprietary property data, nationally and in 62 of the nation’s largest real estate markets. When broken out by housing type, the median price of a standard two-storey home rose 11.2 per cent year-over-year to $840,628, while the median price of a bungalow increased 10.0 per cent to $592,899. The median price of a condominium increased 3.9 per cent year-over-year to $509,239. Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

“In April 2020, we issued our pandemic period forecast for Canadian real estate, the principle prediction being that unexpectedly soft spring home prices, historically low interest rates, and years of pent-up demand would trigger a sharp recovery of sales volumes and rising property prices in the second half of the year,” said Phil Soper, president and CEO of Royal LePage. “As we close the books on the strangest year in my long career, ‘recovery’ proved to be an understatement. Looking at fourth quarter results we can state without hyperbole that the health crisis triggered a real estate boom.

“High levels of unresolved housing demand and low inventory levels will likely characterize the 2021 spring market, putting further upward pressure on housing values, particularly in the detached and larger townhome segments, as families with access to extremely low borrowing costs trade traditionally desirable urban locations for more personal space,” he continued.

Nationally, Ontario posted the highest year-over-year aggregate home price gains in dollar value during the fourth quarter. During this period, the aggregate price of a home in Markham increased $133,932 to $1,100,436, the highest dollar value increase in aggregate home price. Markham was followed by Vaughan, which increased by $132,699 to $1,130,483; Burlington, which increased by $115,475 to $950,796; Pickering, which increased by $110,905 to $856,725; and, Oakville, which increased by $109,912 to $1,215,405.

“Confined to their homes, Canadians are struggling to adapt their properties to accommodate the need for an office, school classroom and gym, and find themselves longing for more living space,” said Soper. “Yet buying a house is not like buying a car; for most it is a long-term commitment. Post-crisis, some employers will be accommodating of work-from-home employee requests, and some businesses will require that their teams work together in offices again. Many will adopt a hybrid model. Home shoppers should look at prospective neighbourhoods through a post-pandemic eye, paying careful attention to the things that will matter when we drop our masks, including restaurants, access to entertainment and even walkability.”

Soper added that the surge in sales that characterized the second half of the year is a sign that Canadians feel confident buying and selling properties during the pandemic.

“The real estate industry has shown that buying and selling property can be done safely as much of the search and purchase process can now be done online,” he said. “Our real estate agents can help families looking for a home with efficient digital showings. Physical private viewings of a short-listed property should be done in compliance with best practice and public health guidelines. Clients can use their phone or computer to complete the transaction, leveraging today’s advanced technologies.”

While many Canadians have been seeking larger homes outside of urban centres, demand for properties in Canada’s largest urban centres have remained high. Ottawa’s aggregate price increased 14.9 per cent year-over-year to $568,608 during the fourth quarter, the greater regions of Montreal, Toronto and Vancouver increased 12.4 per cent, 10.4 per cent and 7.2 per cent to $487,380, $936,510 and $1,155,346, respectively.

Strong demand in the fourth quarter also resulted in price stability in Canada’s energy and agriculture regions. During the period, the aggregate home price in Saskatoon, Regina and St. John’s increased year-over-year by 6.3 per cent, 3.4 per cent and 0.8 per cent to $400,173, $327,517 and $325,833, respectively. Edmonton and Calgary’s aggregate home prices remained relatively stable, dipping 0.1 per cent and 0.5 per cent to $372,515 and $467,041, respectively.

Demand from local buyers and those relocating back to the Maritimes put significant upward pressure on prices. During the quarter, Halifax posted the highest increase in aggregate price, rising 17.1 per cent year-over-year to $377,469. Charlottetown posted the second highest increase in aggregate price rising 12.7 per cent year-over-year to $344,823, during the same period.

In December 2020, Royal LePage issued its 2021 forecast stating that the national aggregate price of a home is expected to increase 5.5 per cent year-over-year. To read more about Royal LePage’s national and major urban centre forecast, please go to rlp.ca/2021-forecast.

REGIONAL SUMMARIES

Greater Toronto Area

The aggregate price of a home in the Greater Toronto Area (GTA) increased 10.4 per cent year-over-year to $936,510 in the fourth quarter of 2020. Broken out by housing type, the median price of a standard two-storey home increased 11.9 per cent year-over-year to $1,102,155 in the fourth quarter, and the median price of a bungalow rose 12.8 per cent year-over-year to $923,047. During the same period, condominiums in the region continued to see healthy price appreciation, with the median price rising 3.6 per cent year-over-year to $593,811.

With the exception of condominiums, similar strong home price gains were seen in the City of Toronto where the aggregate price of a home rose 7.4 per cent year-over-year to $960,368 in the fourth quarter. Broken out by housing type, the median price of a standard two-storey home increased 10.6 per cent year-over-year to $1,446,184, and the median price of a bungalow rose 12.3 per cent year-over-year to $1,001,083. During the same period, the median price of a condominium grew 1.4 per cent year-over-year to $634,081.

“Throughout the second half of 2020, buyers were looking for as much space as they could afford. While many buyers shifted their target neighbourhood away from the city centre, so few properties for sale meant that most detached listings saw multiple-offer scenarios,” said Debra Harris, vice president, Royal LePage Real Estate Services Ltd. “2020 did bring some balance to the region’s condominium market but larger units, often in the greater region, are still in high competition.”

Harris added that pent-up demand in the GTA remains significant for detached homes and inventory levels will be a leading indicator of price appreciation in the spring market.

“The GTA real estate market could absorb a short-term influx of detached home listings and remain in a seller’s market. If inventory remains low, prices can only go up,” said Harris.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in the Greater Toronto Area will increase 5.75 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Greater Montreal Area

In the Greater Montreal Area, the aggregate price of a home posted a 12.4 per cent increase year-over-year reaching $487,380 in the fourth quarter of 2020. When broken down by housing type, the median price of a standard two-storey home increased 13.6 per cent year-over-year to $619,099 in the fourth quarter, and the price of a bungalow rose 15.3 per cent year-over-year to $391,493. During the same period, condominiums in the region continued to see strong price appreciation, although at a slower pace than single-family homes, with the median price rising 8.1 per cent year-over-year to $367,113.

In the core of Montreal, the aggregate price of a home rose 10.8 per cent year-over-year to $613,268. Broken out by housing type, the median price of a standard two-storey home increased 13.3 per cent year-over-year to $836,790, and the price of a bungalow rose 12.1 per cent year-over-year to $582,225. During the same period, the median price of a condominium grew 7.1 per cent year-over-year to $442,317.

“Conditions were favourable to make 2020 a year of strong growth for Montreal’s real estate market,” said Dominic St-Pierre, vice-president and general manager of Royal LePage for the Quebec region. “During the first wave of the health crisis, it was difficult to predict how it would impact the economy and, more importantly, consumer behaviour. We could have seen a price correction if buyers had left the market. But low interest rates, combined with increased household savings from remote work and new buyer incentives, played a key role in a market that was already highly competitive before the pandemic. In the suburbs and on the Island of Montreal, activity in the single-family segment resulted in double-digit price increases in most neighbourhoods of the Greater Montreal Area.

“Historically, the Montreal core has always been the hottest spot for both sales activity and prices. No one could have predicted before COVID-19 that the pace of markets on the outskirts of Montreal would outpace the city,” said St-Pierre.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in the Greater Montreal Area will increase 6.0 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Greater Vancouver

The aggregate price of a home in Greater Vancouver increased 7.2 per cent year-over-year to $1,155,346 in the fourth quarter of 2020. Broken out by housing type, the median price of a standard two-storey home increased 8.8 per cent year-over-year to $1,507,279 in the fourth quarter, and the median price of a bungalow increased 6.8 per cent to $1,265,285. During the same period, the median price of a condominium increased 3.3 per cent year-over-year to $662,120.

In the city’s centre, the aggregate price of a home rose 5.7 per cent year-over-year to $1,306,820 in the fourth quarter. Broken out by housing type, the median price of a standard two-storey home increased 7.3 per cent year-over-year to $2,113,504, and the price of a bungalow rose 4.1 per cent year-over-year to $1,424,474. During the same period, the median price of a condominium grew 3.9 per cent year-over-year to $784,351.

“Multiple offers were common throughout the fourth quarter and almost every detached home was attracting competitive bids. Buyer confidence is strong and current low interest rates make purchasing even more attractive,” said Randy, general manager, Royal LePage Sterling Realty. “Buyers are worried they will be priced out of the market and with our low inventory of homes for sale in the region, prices are expected to go up in the spring.”

Ryalls added that while new listings slowed in the fourth quarter, which is consistent with seasonal trends, the pipeline of buyers continues to grow.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Greater Vancouver will increase 9.0 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Ottawa

The aggregate price of a home in Ottawa increased 14.9 per cent year-over-year to $568,608 in the fourth quarter of 2020. During the same period, the median price of a two-storey home increased 14.8 per cent to $595,991, while the median price of a bungalow increased 15.9 per cent to $588,320, and the median price of a condominium increased 13.8 per cent to $385,525.

“The strong seller’s market is expected to persist through 2021, as demand continues to outpace supply in Ottawa,” said Jason Ralph, managing partner, Royal LePage TEAM Realty. “The city is more affordable than Vancouver or Toronto and that’s attractive to both first-time buyers and young professionals from across the country, especially those with families.”

Ralph noted that prices are set to continue a steady upward climb as potential buyers who were unsuccessful purchasing in 2020 re-enter the upcoming spring market.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Ottawa will increase 11.5 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Calgary

The aggregate price of a home in Calgary dipped slightly by 0.5 per cent year-over-year to $467,041 in the fourth quarter of 2020. During the same period, the median price of a two-storey home decreased 0.5 per cent to $512,107, while the median price of a bungalow increased 0.5 per cent to $493,164, and the median price of a condominium decreased 3.7 per cent to $248,840.

“Calgary remains an attractive place to purchase a home, partly due to its affordability relative to other major cities in Western Canada,” said Corinne Lyall, broker and owner, Royal LePage Benchmark. “With inventory levels the lowest we’ve seen in nearly two decades, specifically in the single-family detached market, I expect a brisk spring market in 2021.”

Lyall added that all signs point to continued stability in the region as an increase in immigration next year will likely create new opportunities for investors, and those looking to relocate to the region as remote work remains a viable option for many.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Calgary will increase 0.75 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Edmonton

The aggregate price of a home in Edmonton dipped slightly by 0.1 per cent year-over-year to $372,515 in the fourth quarter of 2020. During the same period, the median price of a two-storey home remained flat at $427,530, while the median price of a bungalow increased 0.4 per cent to $360,996, and the median price of a condominium decreased 1.3 per cent to $217,141.

“Edmonton’s housing market has been relatively flat throughout the pandemic, with sellers hesitant to list their homes due to safety concerns. However, the resilience of Edmonton’s home prices during the pandemic is reassuring to both buyers and sellers,” said Tom Shearer, broker and owner, Royal LePage Noralta Real Estate. “I anticipate a brisk spring market, as consumer confidence rises once a vaccination plan is well underway.”

Shearer added that demand for detached homes, driven by young families, remains strong and low inventory in this segment of the market is expected to put upward pressure on prices in the new year.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Edmonton will increase 1.5 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Halifax

The aggregate price of a home in Halifax increased 17.1 per cent year-over-year to $377,469 in the fourth quarter of 2020. During the same period, the median price of a two-storey home increased 17.5 per cent to $399,282, while the median price of a bungalow increased 19.4 per cent to $335,744, and the median price of a condominium increased 4.0 per cent to $301,615.

“Inventory levels have hit historic lows in recent months, putting continued upward pressure on prices,” said Matt Honsberger, broker and owner, Royal LePage Atlantic. “Local buyers are looking for more space, and now, more than usual, they are competing with out-of-province buyers, many of whom are returning to the Maritimes. The option of remote work has altered the landscape of the real estate market.”

Honsberger added that many new construction projects are experiencing delays due to uncertainty surrounding the pandemic, further contributing to the supply shortage.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Halifax will increase 7.5 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Winnipeg

The aggregate price of a home in Winnipeg increased 7.1 per cent year-over-year to $330,273 in the fourth quarter of 2020. During the same period, the median price of a two-storey home increased 11.4 per cent to $372,915, while the median price of a bungalow increased 3.7 per cent to $307,841, and the median price of a condominium increased 0.2 per cent to $231,500.

“That remote work will remain an option indefinitely is a reality for many Canadians, resulting in continued high demand for homes with more space,” said Michael Froese, broker and manager, Royal LePage Prime Real Estate. “As long as the supply shortage continues in Winnipeg and the surrounding communities, prices will remain buoyant.”

Froese added that the pace of sales has been exceptionally brisk. In the fourth quarter of 2020, the median number of days a detached home spent on the market was ten, compared to 27 during the same time period in 2019.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Winnipeg will increase 4.75 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Regina

The aggregate price of a home in Regina increased 3.4 per cent year-over-year to $327,517 in the fourth quarter of 2020. During the same period, the median price of a two-storey home increased 4.2 per cent to $402,903, while the median price of a bungalow increased 2.1 per cent to $295,421, and the median price of a condominium rose 8.2 per cent to $222,210.

“The trend of steadily increasing prices that we’ve seen over the last year in Regina will likely extend into the spring, as the need for more space continues to drive demand,” said Mike Duggleby, broker and owner, Royal LePage Regina Realty. “We are experiencing an inventory shortage, like many cities in Canada. Until supply can keep up with growing demand, prices will keep climbing.”

Duggleby added that the return of international students to the region will put further upward pressure on prices, specifically in the condominium segment.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Regina will increase 2.75 per cent in the fourth quarter of 2021, compared to the same quarter in 2020.

Royal LePage Home Price Data:

Royal LePage House Price Survey Chart: rlp.ca/house-prices-Q4-2020

Royal LePage Royalty-Free Media Assets:

Royal LePage’s media room contains royalty-free assets, such as images and b-roll, that are free for media use.

About the Royal LePage House Price Survey

The Royal LePage House Price Survey provides information on the three most common types of housing, nationally and in 62 of the nation’s largest real estate markets. Housing values in the Royal LePage House Price Survey are based on the Royal LePage Canadian Real Estate Market Composite, produced quarterly through the use of company data in addition to data and analytics from its sister company, RPS Real Property Solutions, the trusted source for residential real estate intelligence and analytics in Canada. Commentary on housing and forecast values are provided by Royal LePage residential real estate experts, based on their opinions and market knowledge.

About Royal LePage

Serving Canadians since 1913, Royal LePage is the country’s leading provider of services to real estate brokerages, with a network of over 18,000 real estate professionals in over 600 locations nationwide. Royal LePage is the only Canadian real estate company to have its own charitable foundation, the Royal LePage Shelter Foundation, dedicated to supporting women’s and children’s shelters and educational programs aimed at ending domestic violence. Royal LePage is a Bridgemarq Real Estate Services Inc. company, a TSX-listed corporation trading under the symbol TSX:BRE. For more information, please visit www.royallepage.ca.

For further information, please contact:

Katie Raskina

Proof Strategies

kraskina@getproof.com

(416) 969-2709

[1] Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions and includes both resale and new build.

|

Subscribe with RSS Reader

Subscribe with RSS Reader