Posted on

June 22, 2023

by

Marie Taverna

Welcome to 2110 Anita Drive in the ever-popular Maryhill family friendly neighbourhood. This home has been updated through the years. Stunning kitchen with white painted wood cabinets, stone counters, SS appliances & black accents. Large laundry/pantry off dining area/family room. 3-year-old roof & gutters .Lovely real hardwood flooring. 3 bedrooms up+2 baths. Lots of windows for light. Beautiful soundproofed 1 bedroom suite down with updated kitchen & 3-piece bath. Separate entrance with a patio area. Large rec room with a 3-piece bath. Workout area, teen/student hangout, home office, etc.

Fabulous kid & dog friendly fully fenced backyard. New gazebo on the raised patio. 2 sheds & workshop for extra storage. Imagine entertaining in this lovely backyard oasis.

Posted on

June 22, 2023

by

Marie Taverna

Posted on

June 22, 2023

by

Marie Taverna

As home prices and interest rates continue to rise, whilst inventory remains extremely tight, Canada’s first-time buyers are feeling increasingly worried about missing out on their desired home because they don’t have enough of a down payment.

According to a recent survey released by Sagen™, conducted by Environics Research with a series of questions for Royal LePage, 67% of first-time buyers (those that purchased a home within the last two years) said that before buying, they worried they might miss out on the property they really wanted because of an insufficient down payment. This reflects a five point increase compared to the same survey question in 2021 (62%), and a ten point increase over the 2019 result (57%).

When the same question was asked to first-time intenders – those who plan to buy their first home in the next two years – 63% reported feeling worried that they will miss out due to an insufficient down payment, a three point increase from the same survey question in 2021 (60%).

“Canadians continue to face challenges in entering the real estate market, be it high interest rates, strict mortgage qualification standards, or difficulty saving enough money in a reasonable time period for a down payment,” said Phil Soper, president and CEO, Royal LePage. “That first transaction is the most difficult, and in today’s environment, first-time buyers are faced with large price tags, high carrying costs and the added challenge of qualifying for lending at higher rates due to the stress test.

“Still, they continue to prioritize home ownership, and view it as a milestone worth achieving. With household savings still sitting above historical norms, due to accumulation during pandemic lockdowns, many Canadians will have a leg-up on their down payment when they are ready to enter the market,” added Soper.

Here are a few highlights from the Royal LePage 2023 Canadian First-time Homebuyer Survey:

- In Greater Calgary, the percentage of first-time homebuyers who were worried about their down payment has increased substantially, from 42% in 2021 to 69% in 2023

- 74% of first-time homebuyers in the Greater Toronto Area, 71% in Greater Vancouver and 67% in the Greater Montreal Area reported feeling worried that they would not have a large enough down payment to purchase a home they really wanted

- More than a third of first-time buyers (35%) received financial assistance in a lump sum payment toward their purchase, while a quarter of buyers (25%) received support on their monthly mortgage payments

Are you thinking about buying your first home, and looking for tips on how to get into the market? Tom Storey, sales representative with Royal LePage Signature Realty, shares his advice for buyer hopefuls preparing for home ownership.

Posted on

June 8, 2023

by

Marie Taverna

Listed for $1,538,000

Welcome to 2110 Anita Drive in the popular MaryHill family friendly neighbourhood.

This home has been updated through the years.

Stunning kitchen with white painted wood cabinets/quartz counters/SS appliances & black accents.

Large laundry/pantry off dining area/family room.

3-year-old roof & gutters. Lovely real hardwood flooring.3 bdrms up+2 baths.

Lots of windows.

Beautiful soundproofed 1 bdrm suite down with updated kitchen & 3-piece bath.

Separate entrance with a patio area.

Rec room with a 3-piece bath, great gym/teen/student hangout/home office,etc.

Fabulous kid & dog friendly fully fenced backyard.New gazebo on the raised patio.

2 sheds+workshop for extra storage.Imagine entertaining in this lovely backyard oasis.

First showing at sneak peak June 8th 6-8pm.

Open houses Sat June 10 & Sunday June from 2-4

http://www.listings.360hometours.ca/15845

Posted on

June 2, 2023

by

Marie Taverna

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium. Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.

From the moment you walk in you will be impressed with this quality-built home by Quadra.

Spacious living & dining room area.

Gourmet kitchen with solid wood cabinets,large pantry, granite counter tops,SS appliances&gas stove.

With 3 bedrooms & 1 den. Primary suite with 4-piece bath & wall in closet.

2nd bedroom can be other primary bedroom with connecting 5-piece bath.

Lots of storage.In suite laundry.

Air-conditioning. 2 parking spots & one is wider. Lrg storage locker with roller door.

Stroll to shopping, transit&recreation.

Perfect location & size for downsizers that are moving from a home or anyone that wants just a little more space in a condo.

Year-round use of the glass solarium+BBQ hookup, perfect for entertaining...

Posted on

June 2, 2023

by

Marie Taverna

Warmer weather and sunnier skies are upon us. With the Victoria Day long weekend (aka the unofficial start to summer) on the horizon, thousands of Canadians are preparing to reopen the cottages for the season once again. Of course, you can’t just jump straight into enjoying a weekend away at the cabin without a little maintenance work first. Unwinterized properties that have been vacant for the last several months will need some love and attention to get them up and running again post-winter.

If you’re thinking of re-opening your cottage this weekend or sometime soon, here are a few tips to make the process smooth and simple:

Start the reopening process before you arrive

Before you make the long drive to the cottage, begin the reopening process a couple of weeks before you plan to access the property.

Start by calling your utility providers to turn on the power, internet, gas and any other services you may have paused during the off season. While you’re at it, it doesn’t hurt to schedule a chimney inspection and a cleaning of your septic tank or outhouse to ensure your cottage’s major systems are up to par. Check in with your insurance provider to make sure that the policy for your property, boats, ATVs and trailers are up to date. Don’t forget to pack your reopening essentials too, like batteries, tools, keys and cleaning supplies.

Take a walk around the property

Upon arrival, do a thorough walk about your lot to look for signs of weather damage. Inspect the roof for missing shingles, blocked gutters, leaks or any branches that may have fallen during the winter. On the ground, keep an eye out for signs of rot on your deck or siding, broken windows or wildlife that may have made their way indoors during the winter.

Once inside, inspect your cottage for dampness, pests or unpleasant odours. Get some fresh air running through your cottage and flush out any stale smells by opening all of the windows and doors. This is also a good opportunity to look for any mould or mildew that may be lurking around window sills and entryways. If there is any serious damage to the property, be sure to alert your insurance provider immediately.

Restore the utilities

Once your property looks safe inside and outside, it’s time to boot up the electricity and water again.

When closing your cottage, you likely drained the pipes and shut off the water supply. Before you turn on the taps, inspect your pipes for leaks or cracks that may have occurred from freezing — a burst pipe is not a fun way to start out the cottage season! If pipes were disconnected, be sure to reconnect them before starting your water pump, filling your water heater and replacing the filter. Once you turn your main valve on, allow water to run through one faucet for a few minutes to flush the water lines. Water systems vary by property – some draw from a well while others draw water from a lake – so enlist the help of a professional if necessary.

When it comes to turning your cottage’s electricity back on, inspect your metre and power lines before flipping on the main switch. Go room by room to ensure major appliances, lights and outlets are working as they should.

Restock the essentials

Before you officially break out the Muskoka chairs and settle in, remember to check those smaller to-do items off your list. Ensure that your smoke alarms and carbon monoxide detectors have fresh batteries and replace the filter in your central air system if you have one. Don’t forget to refill fire extinguishers and top up the first aid kit with new supplies before you kick back and relax.

Looking for insights into Canada’s most popular cottage country markets? Check out the latest findings in the Royal LePage 2023 Spring Recreational Property Report.

Posted on

June 2, 2023

by

Marie Taverna

Many Canadians are keen to get a foot on the investment property ladder. For some, that means prioritizing an income property ahead of their own home.

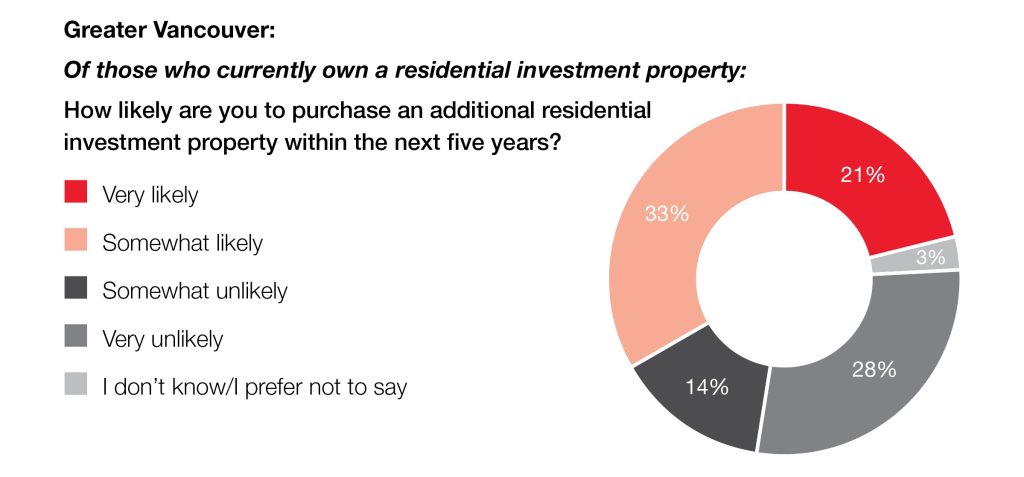

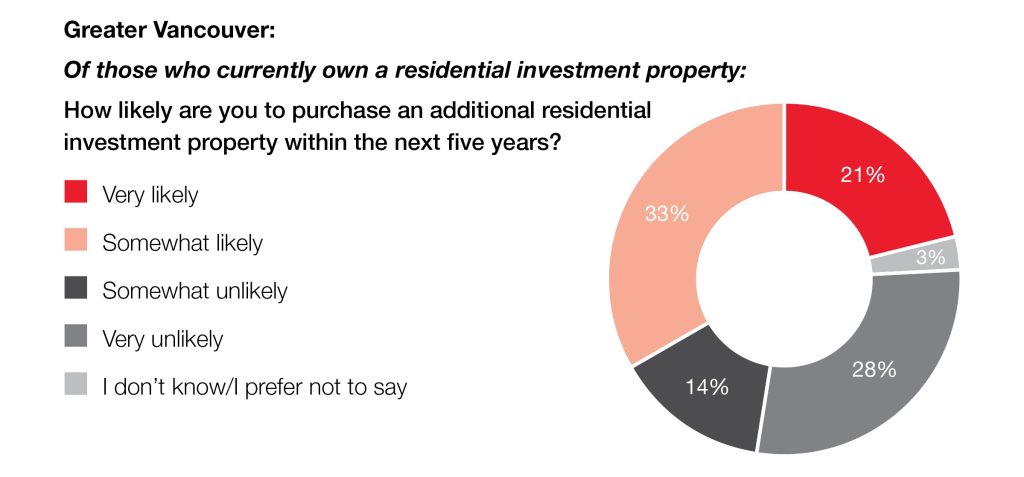

According to a recent Royal LePage survey conducted by Leger,1 21% of investors in the Greater Vancouver region do not own their primary residence (a combination of those who rent and live rent-free) – notably higher than the national average of 15% (14% in the GTA and 15% in the GMA). 54% of investors in the region say that they are likely to purchase an additional residential investment property within the next five years. This is higher than the national figure (51%), and those in the greater regions of Toronto (47%) and Montreal (52%).

The appetite for real estate investment is strong in the Greater Vancouver area. Unlike stocks or other investment types, real estate investing offers the convenience of dual utility – you can live in your home or rent it out as a source of income. There is a positive association between home ownership and the creation of personal wealth in Vancouver. Buying an investment property is an important financial decision for many investors who are looking to take advantage of anticipated long-term price growth in the region. As trusted advisors to our clients, we often guide prospective investors to not just buy the market, but to focus on buying the opportunity, especially during slower seasonal periods and market corrections

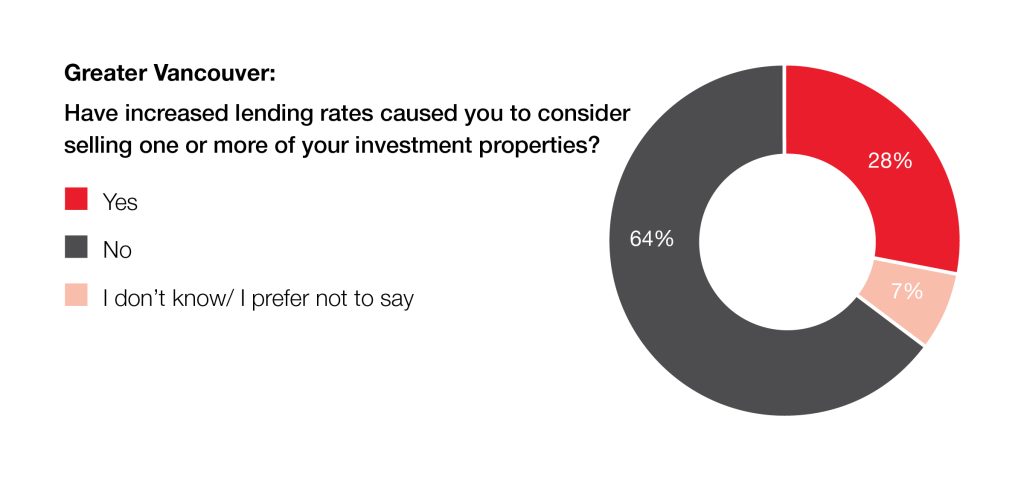

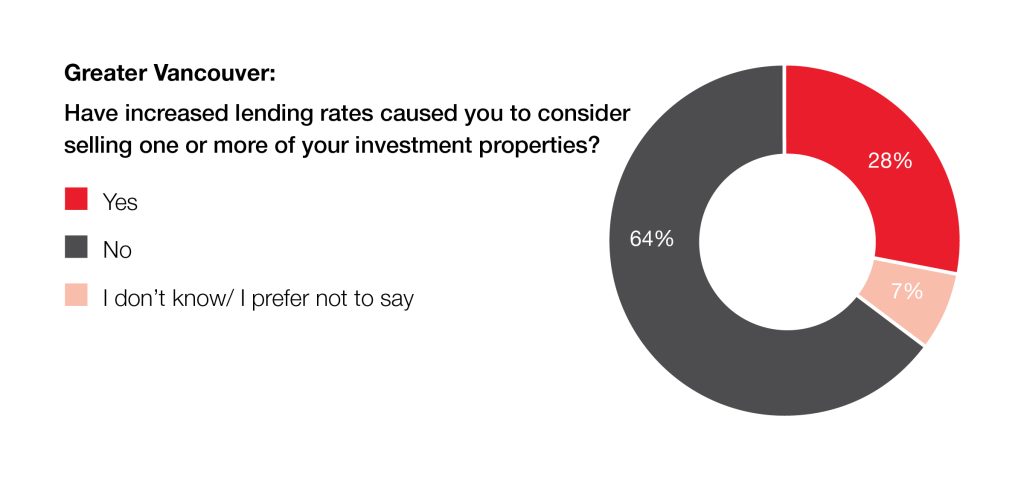

According to the survey, 28% of investors in Greater Vancouver say that increased lending rates have caused them to consider selling one or more of their investment properties. When asked about their plans for the future, 28% of investors in the region say they are likely to sell one or more of their investment properties within the next two years.

When the pandemic took hold, many in the industry, including myself, thought there would be a slowdown in investor appetite as buyers moved away from condos and opted for more space in the suburbs. However, those changes never fully materialized – investor confidence has held firm. In fact, it came back stronger than ever with the help of record low interest rates. In today’s post-pandemic era, despite higher borrowing costs, I expect more people will enter the investor segment as rates hold and eventually ease. Buyers will be looking for opportunities in the market.

Continue reading for more insights into the national real estate investor market.

1 An online survey of 1003 Canadians 18+, who own one or more residential investment properties, was completed between March 2, 2023, and March 17, 2023, using Leger’s online panel. No margin of error can be associated with a non-probability sample (i.e., a web panel in this case). For comparative purposes, though, a probability sample of 1003 respondents would have a margin of error of ±3%, 19 times out of 20. N.B

Posted on

June 2, 2023

by

Marie Taverna

Despite higher lending rates and lower levels of inventory, the desire to own a home in Canada remains strong, especially among those who see ownership as a way to support their financial future. Canadians continue to look to the housing market as a means of building generational wealth and an additional source of income, and many are planning to try their hand in real estate investing within the coming years.

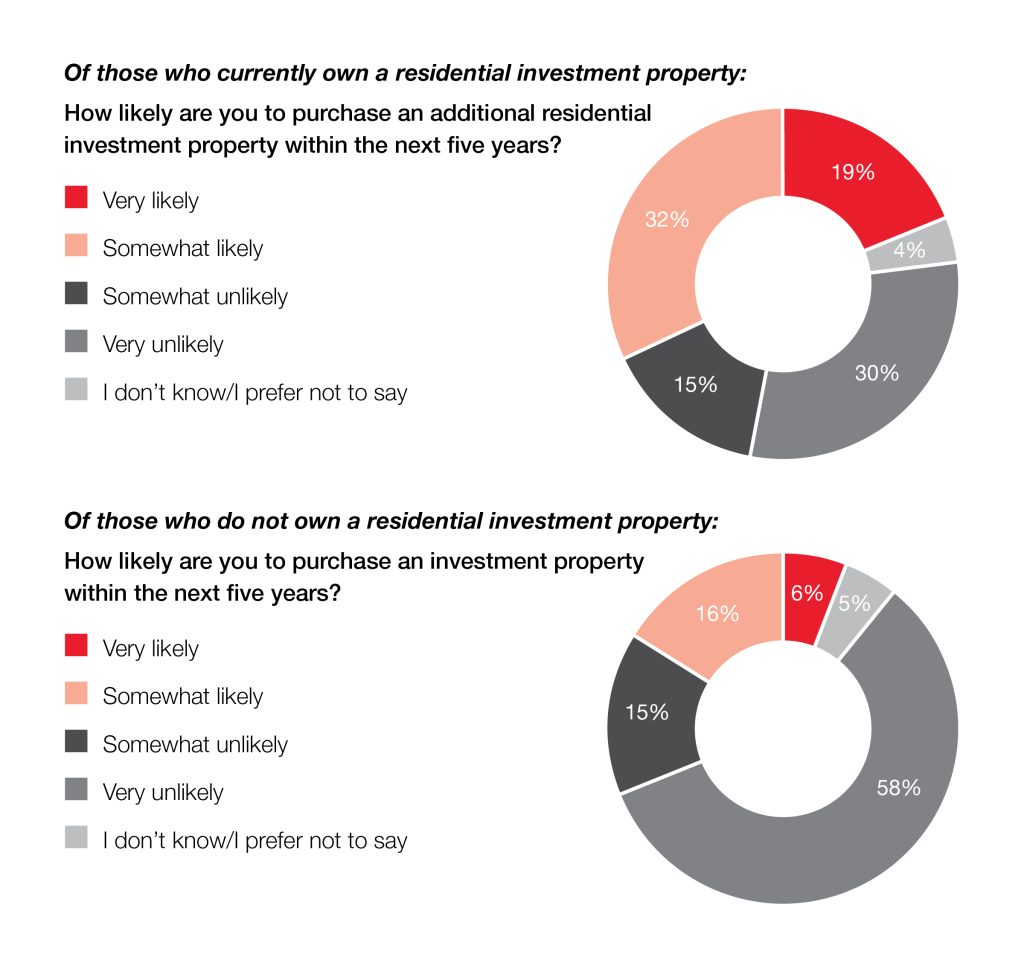

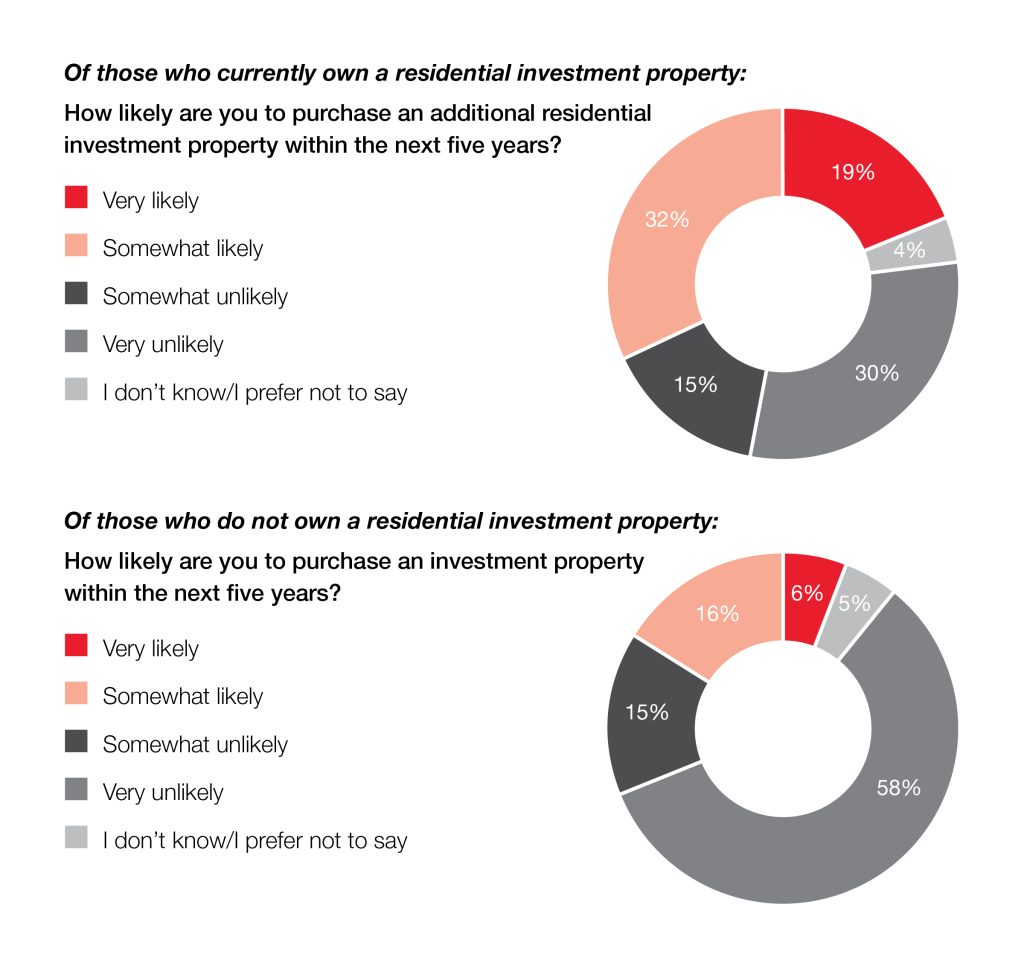

According to a recent Royal LePage survey conducted by Leger,1 23% of Canadians who do not own a residential investment property say that they are likely to purchase one in the next five years, and more than half (51%) of current investors say that they are likely to purchase an additional residential investment property within the same time period. Overall, 26% of all Canadians, current investors or otherwise, plan to buy an investment property before 2028.

“We know that the value of home ownership is strong among Canadians – it is clear that possessing real estate remains a desirable means for building wealth over time. Many choose to invest in real estate not only as a way of generating income and reaping the benefits of value appreciation, but to provide an opening into the market for future generations of their family, ” said Phil Soper, president and CEO, Royal LePage. “Despite the hurdles of low home supply and increased lending rates, young people are more inclined than ever to make real estate investing a part of their financial planning for the future. In fact, survey results tell us that many of them are actually prioritizing an investment property over owning their primary residence.”

15% of Canadian residential investors do not own their primary residence (12% rent and 3% live for free with family or friends); the majority of whom are aged 18-34.

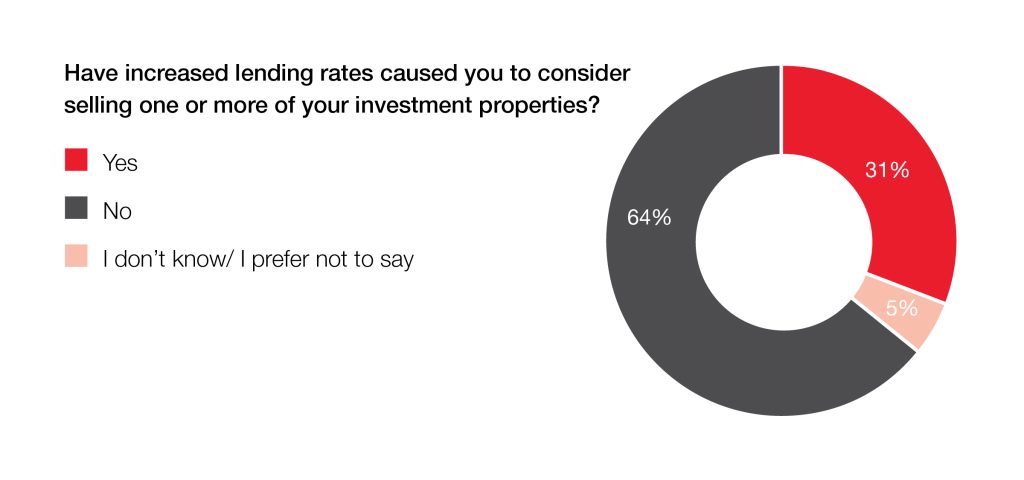

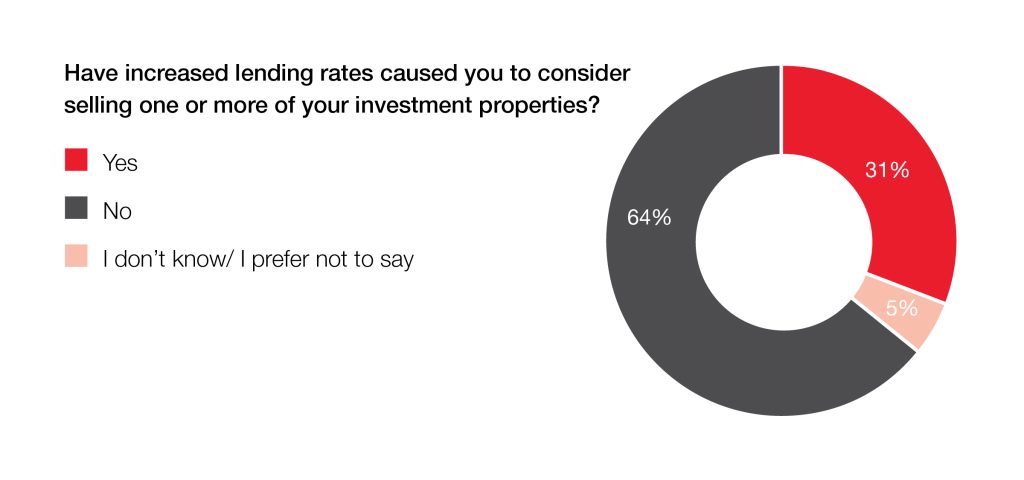

The increased cost of borrowing has had a significant impact on variable-rate mortgage holders in Canada over the past year, and those with investment properties have also been feeling the effects. Increased lending rates have caused nearly one third of investors (31%) to consider selling one or more of their properties. Investors aged 18 to 34 are the most likely to weigh the decision of selling at least one of their investment properties (54%).

“Much higher mortgage rates and the increased cost of home maintenance and utilities have prompted some over-leveraged investors to consider selling,” said Soper. “That said, there was speculation that the investor segment would experience a serious downturn during the pandemic, as pre-construction projects were postponed and condos in downtown neighbourhoods emptied out, driving landlords to cut rental rates to keep tenants. Given widespread housing shortages across Canada, residents quickly returned to urban centres as the health scare was contained. Rents not only rebounded, they rose sharply and it became obvious that the sector’s downturn was temporary.”

Here are a few highlights from the Royal LePage 2023 Real Estate Investors Report:

- 11% of Canadians – approximately 4.4 million people – currently own an investment property

- Nearly one third of investors in Canada (31%) have considered selling one or more of their investment properties due to higher lending rates

- 20% of investors in the Greater Montreal Area say they are likely to sell one or more of their investment properties within the next two years; this percentage rises to 24% and 28% in the greater regions of Toronto and Vancouver

Continue reading for regional insights into the investor markets in the Greater Toronto Area, Greater Montreal Area and Greater Vancouver.

Posted on

June 2, 2023

by

Marie Taverna

From graduates moving back home after finishing post-secondary school, to elderly parents living with their adult children, more Canadians are choosing to cohabitate with family members.

Although the tradition of generations residing together under one roof is not a new concept, the trend has become more common in North America in recent years. In an effort to communally raise young children and care for elderly family members, as well as share housing costs in an increasingly competitive market, many Canadians are choosing to share their living space with relatives.

Though there are many financial and emotional benefits to living with family, the arrangement can feel chaotic at times if your home isn’t set up to function with multiple families. If you’re weighing the decision to cohabitate, here are a few tips on how to convert your home into a space that supports multi-generational living.

Include separation of space

Everyone needs their own downtime when living together, so it’s important to create a sense of privacy and separation when cohabitating with multiple families.

If space and budget permits, building a secondary unit on the property can offer the ultimate in-law suite or apartment for adult children. Converting your basement into a separate apartment with its own kitchenette, bathroom and living space is also a convenient way to provide separate living quarters within the same household.

If a major renovation isn’t on the cards, try adding some extra privacy through the use of interior soundproofing, room dividers and separate entrances. By building more than one entryway into the home, you can streamline the flow of foot traffic through multiple doors, while giving occupants a greater sense of autonomy.

Before undertaking any major renovation or construction project, contact your municipality’s building department to ensure you have obtained the correct permits and are informed of any additional requirements regarding separate entrances, addresses, utilities, etc.

Mindfully consider your layout

Living with multiple generations under one roof may require some creativity.

Multi-generational households may choose to include one or two bedrooms on the main level of the home in addition to the bedrooms upstairs. This is not only beneficial for elderly occupants who will find it easier to navigate one level, but can also provide some additional privacy by separating the bedrooms over two floors. If you live in a single-floor property, consider converting rooms on opposite sides of the home into bedrooms, if possible.

It’s also important to strike a balance between separation and togetherness. Open concept layouts in shared dining, living and kitchen areas offer a place for families to gather. Larger communal areas can not only accommodate more people, but also lend enough breathing room for wheelchairs, walkers and space for getting around furniture.

When living with many people, it’s important to maximize every square foot for multi-tasking too. Consider converting some of the underutilized spaces of your home – such as the attic, garage or den – into flexible spaces that can be adapted into areas for hobbies, a home office, a kids’ playroom, or extra storage.

Keep accessibility in mind

If your multi-generational household includes older family members, it’s crucial to think about their accessibility needs – today and in the future.

Layouts that include wider doorways and hallways, removing doors where possible and adding ramps or stairlifts, can be beneficial for those with mobility constraints. Consider the amount of space needed for mobility devices to comfortably turn circles in each room. Slip-resistant flooring like carpet, good lighting, grab handles and railings are also important to factor in when retrofitting your home for elderly occupants.

The Canada Mortgage and Housing Corporation (CMHC) offers online guides for designing accessible spaces in the home.

Take advantage of tax credits

If you’re renovating your home for the purposes of multi-generational living, then you may be entitled to a tax break.

As of 2023, the federal Multigenerational Home Renovation Tax Credit is available as a refundable credit towards the creation of a secondary unit that a ‘qualifying individual’ will live in, such as a parent, grandparent, sibling or spouse. The credit is applicable on the renovation of, or addition to, an eligible dwelling that a qualifying individual will reside in. Applicants can claim up to $50,000 in rebates during the taxation year in which the renovation period ends.

Posted on

June 2, 2023

by

Marie Taverna

Spring has officially sprung, and with the arrival of warmer weather, now is an opportune time to give your home a post-winter deep clean. A thorough spring cleaning goes beyond everyday surfaces and tackles the nooks and crannies of your living space. It’s a great time to start fresh by purging old and underused items in your garage, closets and cabinets. It’s also the perfect opportunity to perform a maintenance checkup on major household appliances, like your washing machine, stove and fridge.

Conducting a yearly maintenance checkup is not only beneficial in extending the lifespan of your appliances, but also ensures that they will be running optimally when you need them the most. Is there anything worse than your dryer breaking down before an important job interview, or the oven giving out just as your guests are set to arrive for a dinner party, or your air conditioner malfunctioning in the dead of summer?

Here’s a maintenance checklist to help ensure your large home appliances are in top shape this spring:

Fridge maintenance

- Coils: To clean your coils, locate where they are on your fridge – whether they’re at the bottom or at the back of the appliance – and remove the access panel. Gently remove any debris and dirt with a vacuum or brush before replacing the panel. Cleaning your fridge coils annually can actually help to reduce your electricity bill, as dirtier coils require more time and energy to chill food.

- Water filter: If your fridge has a water filter, clean or replace this every five to six months to avoid impurities and contaminants in the water.

- Door seals: If the door seals are leaking or don’t seem tight enough, replacing these will ensure your refrigerator is running in an energy efficient manner.

Oven and stove maintenance

- Stovetop: While it’s important to give your stovetop a regular clean, a deeper scrub down is vital for preventing overheating and potential fire hazards from baked-on food particles. For electric stovetops, wipe down the cooking surface with warm, soapy water before applying a layer of glass cooktop cleaner or baking soda paste and leaving to dry. Once fully hardened, remove the paste with a scrubber or non-abrasive tool to remove baked-on food and stains. If you have a coil stove top, carefully remove each coil by hand and wash down without fully submerging in water before reassembling. For gas cooktops, be sure to remove the grates and burner caps, and wash with hot water and soap. Carefully wipe down the surface of the stove without getting the igniters or electrical components wet.

- Range hood: Oven range hood filters must be cleaned or replaced to ensure proper functioning of the appliance. You can clean your filter by letting it soak in hot water and degreasing dish soap before scrubbing off the remaining debris. Allow the filters to dry completely before reinserting.

- Oven door seals: Similar to refrigerator door seals, these are required to ensure ovens can heat efficiently, and should be regularly cleaned with warm water and soap, and replaced if/when necessary.

- Oven drip pans and racks: Ensure oven drip pans and racks are routinely cleaned to avoid potential fire hazards. Soak greasy items in hot water with degreasing dish soap or cleaning vinegar to remove splatters, stains and food particles.

Dishwasher maintenance

- Rust removal: Remove any visible rust from your dishwasher by running an empty cycle with a calcium, lime and rust remover solution. A water and baking soda paste or a combination of water and vinegar can also be effective against rust.

- Spray/pump area: Clean around this area in the base of your dishwasher to promote seamless drainage.

- Filter: Hard water and leftover food can build up in your dishwasher. Cleaning the filter will extend the life of your appliance and ensure this build-up is not continually being released onto your dishes during the cleaning cycle. To clean, simply pull the cylindrical filter from the base of your dishwasher and gently wash it with a brush under warm running water.

Washing machine maintenance

- Hose lines: Prevent flooding in your home by ensuring no cracks or breakage are present in your washer’s hose lines. Perform a thorough check once per year, and replace them every five years.

- Washer drum: Prevent build up in the drum of your washing machine by regularly running a cleaning cycle with a dedicated cleaner or water and bleach every few months. Using a damp rag, thoroughly wipe the rubber liner and inside of the door.

Dryer maintenance

- Dryer vent: In addition to clearing out your dryer’s lint trap after each load, the dryer vent should be cleaned at least once per year to clear out lint build up and to prevent fire hazards. Disconnect the dryer before pulling it away from the wall and removing the dryer duct. Use your vacuum cleaner inside and around the vent to catch leftover lint. Remember to clean the exterior vent too by removing the cover and removing any debris.

- Dryer drum: Using a damp rag, clean the inside of your dryer drum, the rubber liner and the door. If necessary, soak and wash the lint trap, but ensure it is completely dry before replacing it.

Air Conditioner maintenance (outdoor unit)

- Condenser unit: Spring is the best time to run maintenance on your HVAC A/C unit. The weather is warm enough to run a cooling test cycle, yet not cool enough to withstand a few days with no air conditioning if your unit requires major repairs. Begin by turning off the power and removing the winter cover from your outdoor unit. Remove the cage and pull out any leaves and debris that may have accumulated on the bottom.

- Fins and fan: Using a paint brush or other long bristled brush, carefully brush away any trapped dirt and debris that may be caught in the air conditioning unit’s fins and condenser fan. If necessary, vacuum the fins to pick up fine dust. It is safe to use a garden hose to wash the inside and outside of your unit, but avoid using a pressure washer as this can damage the fins. Reassemble the unit before turning the power back on.

- Filters and vents: Replace filters and clean out vents on a regular basis (every one to two months) to ensure clean air is circulating through your home.

Be sure to run through this appliance maintenance checklist every spring to keep your appliances operating safely and optimally, and save you money in the long run.

Posted on

June 2, 2023

by

Marie Taverna

The spring market is off to a healthy start. Buyer activity picked up earlier than was anticipated in the first quarter of 2023, pushing home prices up over the final quarter of last year. As a result, home prices in Canada are expected to continue climbing, albeit at a much slower rate than the last two years.

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 4.5% in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast was revised upward to reflect an earlier-than-expected boost in activity in Canada’s major housing markets.

Following activity levels in the first quarter of 2023 that surpassed the Company’s expectations – a vigorous return of buyer demand coupled with ultra-low housing supply conditions – Royal LePage has adjusted its quarterly forecast for the remainder of the year. On a quarter-over-quarter basis, the national aggregate home price is expected to continue rising modestly but steadily over the next nine months.

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” said Phil Soper, president and CEO of Royal LePage. “While we do not expect huge price gains this year, some sense of normalcy is returning to the market.”

According to the Royal LePage House Price Survey released today, the aggregate price of a home in Canada decreased 9.2% year-over-year to $778,300 in the first quarter of 2023. On a quarter-over-quarter basis, however, the aggregate price of a home in Canada rose 2.8%, as buyers began to come off the sidelines following the Bank of Canada’s decision last month to pause interest rate hikes for the first time in a year.

“There has been nothing ‘typical’ about Canada’s housing market since the start of the COVID-19 pandemic. Lockdowns brought the housing market to a grinding halt in early 2020 before the work-from-home revolution catapulted it into a two-year, all-season frenzy of record sales volumes and aggressive price growth,” said Soper. “As markets do, this market overshot, and the inevitable correction was triggered when the Bank of Canada began to rapidly raise interest rates. The downturn came swiftly, and the real estate industry remained depressed for twelve months, a longer correction than the aftermath of the financial crisis thirteen years ago. We have turned the corner and the housing economy is growing again; none too soon for many buyers, who have been waiting patiently for prices to bottom out.”

Read Royal LePage’s first quarter release for national and regional insights.

First quarter press release highlights:

- Single-digit price gains in first quarter driven by early return of sidelined buyer demand and continued shortage of inventory

- Greater regions of Toronto, Montreal and Vancouver post quarterly aggregate price gains of 4.8%, 1.3% and 1.3%, respectively in the first quarter

- Royal LePage urges OSFI to heed the economic dangers that would accompany new, aggressive mortgage restrictions

Posted on

June 2, 2023

by

Marie Taverna

Competition among buyers in Metro Vancouver’s housing market heats up as summer arrives

While the year started slower than usual, Metro Vancouver’s housing market is showing signs of heating up as summer arrives, with prices increasing for the sixth consecutive month.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,411 in May 2023, which is a 15.7 per cent increase from the 2,947 sales recorded in May 2022, and a 1.4 per cent decline from the 10-year seasonal average (3,458).

“Back in January, few people would have predicted prices to be up as much as they are – ourselves included,” Andrew Lis, REBGV’s director of economics and data analytics said. “Our forecast projected prices to be up modestly in 2023 by about two per cent at year-end. Instead, Metro Vancouver home prices are already up about six per cent or more across all home types at the midway point of the year.”

There were 5,661 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in May 2023. This represents an 11.5 per cent decrease compared to the 6,397 homes listed in May 2022, and was 4.3 per cent below the 10-year seasonal average (5,917).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,293, a 10.5 per cent decrease compared to May 2022 (10,382), and 20.6 per cent below the 10-year seasonal average (11,705).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for May 2023 is 38.4 per cent. By property type, the ratio is 28.5 per cent for detached homes, 45 per cent for townhomes, and 45.5 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“You don’t have to squint to see the reason prices continue to increase. The fundamental issue remains that there are more buyers relative to the number of willing sellers in the market. This is keeping the amount of resale homes available in short supply,” Lis said. “And in a surprising twist, MLS® sales in May snapped back closer to historical averages than we’ve seen in the recent past, despite mortgage rates being where they are now, and new listing activity having been slower than usual this spring. If mortgage rates weren’t holding back market activity so much right now, I think our market would look a lot like the heydays of 2021/22, or even 2016/17.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,188,000. This represents a 5.6 per cent decrease over May 2022 and a 1.3 per cent increase compared to April 2023.

Sales of detached homes in May 2023 reached 1,043, a 30.7 per cent increase from the 798 detached sales recorded in May 2022. The benchmark price for a detached home is $1,953,600. This represents a 6.7 per cent decrease from May 2022 and a 1.8 per cent increase compared to April 2023.

Sales of apartment homes reached 1,730 in May 2023, a 7.9 per cent increase compared to the 1,604 sales in May 2022. The benchmark price of an apartment home is $760,800. This represents a two per cent decrease from May 2022 and a 1.1 per cent increase compared to April 2023.

Attached home sales in May 2023 totalled 608, a 16.7 per cent increase compared to the 521 sales in May 2022. The benchmark price of an attached home is $1,083,000. This represents a 4.7 per cent decrease from May 2022 and a 0.2 per cent increase compared to April 2023.

Download the May 2023 stats package.

|

Subscribe with RSS Reader

Subscribe with RSS Reader

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.

Fabulous large 1st floor 1600+sq ft condo & a 200+ enclosed solarium.