Posted on

March 25, 2024

by

Marie Taverna

For the fifth consecutive time, the Bank of Canada has chosen to hold its overnight lending rate at its current level of 5%.

In its scheduled interest rate announcement for March 6th, Canada’s central bank declared that it would hold the policy rate at 5% and “continue to normalize the Bank’s balance sheet.”

Although the annual rate of inflation fell to 2.9% in January, the Bank pointed to underlying inflation factors, such as shelter costs, as justification for keeping rates where they are. In its announcement, the BoC stated that it would like to see further easing of inflation and price stability in the economy before it begins making cuts.

“In the six weeks since our January decision, there have been no big surprises. Economic growth has remained weak, and inflation has eased further as higher interest rates restrain demand and relieve price pressures. But with inflation still close to 3% and underlying inflationary pressures persisting, the assessment of Governing Council is that we need to give higher rates more time to do their work,” said Tiff Macklem, Governor of the Bank of Canada, in a press conference following the Bank’s decision.

When will interest rates come down?

Though there has been no cut to the overnight lending rate in almost four years, economists anticipate that the BoC will begin to reduce rates later this year – possibly in its scheduled June announcement – if inflation reduces further towards the central bank’s target of 2%.

The Bank of Canada will make its next announcement on April 10th, 2024.

Read the full March 6th report from here.

Posted on

March 25, 2024

by

Marie Taverna

As we approach the start of spring, you may be thinking about all of the projects around the house that you can finally start when warmer weather arrives – opening up the pool, adding those perennial flower beds to your lawn, or perhaps changing up your wall colours.

If you’re thinking about adding a fresh coat of paint to your interior spaces, why not take some inspiration from the most influential paint brands around?

Here are the 2024 colours of the year:

This warm and cozy shade of pink evokes “our desire to nurture ourselves and others,” according to Pantone. A lighter and softer hue compared to 2023’s Viva Magenta, Peach Fuzz promotes a sense of welcoming and comfort, making it an ideal colour for relaxation spaces, such as a bedroom or living room. Peach Fuzz pairs well with similar hues of pink, maroons and purples, or jewel tones.

Designed to promote feelings of “confidence and individuality,” this versatile soft black created by Behr can be easily paired with a variety of colour swatches. Whether you’re looking for a dark accent wall in your living area, or a bold statement shade in the dining room, Cracked Pepper transcends various interior design trends, textures and moods.

If you want a room to feel like a breath of fresh air, then adding Upward to your walls is the way to go. This silvery-blue hue feels light and breezy, stimulating feelings of calmness and creativity. Sherwin-Williams recommends complimenting this soft blue with grays, melon green or deep shades of navy.

Breaking away from typical shades of gray and white, Glidden has proclaimed Limitless as the new go-to neutral. This soft yellow is said to liven up spaces with ease, complimenting both warm and cool colours, whether you choose to pair Limitless with an earthy green, warm beige or rust-coloured red. It’s a colour for all seasons.

Borrowing inspiration from “the hues experienced through travels and moments that span beyond routine,” this Benjamin Moore bold blue can be used in both modern and traditional interiors. Blue Nova is well-suited for pairing with shades of ivory, burnt orange or colourful pastels.

Posted on

March 25, 2024

by

Marie Taverna

More and more, people are adopting greener lifestyles, whereby daily choices are made to significantly improve not only personal well-being, but the health of the planet too.

Homeowners are embracing the eco-friendly movement by making conscious decisions about the products they bring into their homes. This includes cleaning supplies, as they are known to contain chemicals that are harmful when ingested, inhaled, or come into contact with our skin.

If you’ve been thinking about switching out commercial cleaning products for a greener cleaning solution, then keep reading. We’ve got you covered with four key considerations when making the move to all-natural cleaning products.

Be sure to read to the end for a comprehensive list of cleaning ingredients you can use if you prefer the DIY route.

1. Harness the power of natural cleaning solutions

Sometimes people are hesitant to switch to natural cleaning products because they’re unsure if they will actually clean or disinfect surfaces. In most situations, natural cleaning products are strong enough to take care of everyday cleaning in your home. If you’re wondering which products are effective, click here for HGTV’s list of ‘The Best Natural Home Cleaning Products’.

2. Utilize bulk cleaning products

For additional sustainability and to cut down on single-use plastics, consider investing in refillable glass spray bottles to use with a bulk supply of cleaning liquids or tabs. Not only are you saving money, but displaying glass bottles can add to the aesthetic of your home. Many major retailers have several refill options available in a variety of pleasant scents to personalize your cleaning experience.

3. Avoid these ingredients

When it comes to selecting household cleaners, it’s crucial to be wary of greenwashing. Greenwashing refers to companies falsely marketing their products with misleading wording or packaging, while persuading the consumer to believe the product is natural or healthy.

Many mainstream cleaning products contain harmful ingredients, and even go as far as including known carcinogens. Protect yourself by reading the label, avoiding harsh chemicals and ensuring the cleaning solutions you are purchasing contain organic and biodegradable substances.

Some examples of chemicals to avoid include ammonia, chlorine, phosphates, synthetic fragrances, parabens, butoxyethanol, ethanolamine, sulfates, phthalates, phenols and triclosan.

4. Integrate DIY options into your cleaning routine

New to do-it-yourself cleaning products? Making your own cleaning products is cost-effective and eco-conscious. Organic, biodegradable ingredients like vinegar, baking soda, and essential oils can be combined to create effective cleaning solutions. Be sure to do your research when creating a disinfecting solution – potency is important!

Here is a comprehensive list of ingredients that are commonly used in natural cleaning products and you can use them:

- Lemon: Effective degreaser with a fresh scent.

- Vinegar: Mix equal parts water and vinegar for an all-purpose cleaner to use for windows, glass, and general surface cleaning. Bonus: Click here for a list of things NOT to clean with vinegar

- Baking Soda: Add water to create a paste for a gentle exfoliating cleaner.

- Essential Oils: Add a few drops to natural cleaners for a pleasant fragrance.

- Bonus tip: Many essential oils have additional antibacterial properties

- Castile Soap: Dilute with water to create a versatile all-purpose cleaner, or a foaming hand soap.

- Olive Oil: Mix with lemon juice for a natural wood polish that leaves surfaces shiney and repels dust.

- Hydrogen Peroxide: Use as a disinfectant for kitchen and bathroom surfaces.

- Rubbing alcohol: Use to remove stickiness from surfaces, or mix with water for a disinfectant or window cleaner.

As with any other cleaning product you use for the first time, complete a spot-test to avoid possible damage to your home.

These natural cleaning solutions will help kick-start your transition into cleaning products that are healthy for your family and the environment.

Posted on

March 25, 2024

by

Marie Taverna

Real estate prices in Canada’s recreational markets expected to rise in 2024 as buyers make a return

Recreational home prices on track to increase 5% this year amid improved consumer confidence, cuts to interest rates

With warmer weather on the way, Canadians will soon be able to once again enjoy weekends on the water and warm summer nights relaxing by the fire pit. In the lead up to prime time in the country’s recreational housing markets, many potential buyers are expected to make a move on purchasing that lakeside cabin or family cottage this year, increasing competition for tight supply and pushing property prices up.

According to the recently-released Royal LePage® 2024 Spring Recreational Property Report, the median price of a single-family home in Canada’s recreational regions is forecast1 to increase 5.0% in 2024 to $678,930, compared to 2023, as a boost in consumer confidence will bring sidelined buyers back to the market.

“Across the nation there was a sizable rise in demand for all types of housing during the pandemic, but nothing could match the ‘gold rush fever’ that occurred in recreational property markets,” said Phil Soper, president and CEO, Royal LePage. “With city offices closed and the wide availability of high-speed internet allowing people to take video meetings on lakefronts and mountain tops, excess demand pushed recreational property prices to unprecedented heights.

“Inflation reared its ugly head, interest rates soared and the economic downturn that followed pushed cottage, cabin and chalet prices off those pandemic peaks, yet the fundamental demand for recreational living has not abated. We believe that this market segment will see a resurgence of activity in 2024,” continued Soper.

In 2023, the weighted median2 price of a single-family home in Canada’s recreational property regions decreased 1.0% year over year to $646,600. This follows a year-over-year price decline of 11.7% in 2022. When broken out by housing type, the weighted median price of a single-family waterfront property decreased 7.9% year over year to $1,075,500 in 2023, and the weighted median price of a standard condominium decreased 1.5% to $420,300 during the same period.

Drop to interest rates could heat up buyer activity

According to a survey of 150 Royal LePage recreational real estate market professionals across the country,3 41% of respondents reported less inventory compared to the same time last year; 33% of respondents said that their region has similar levels of inventory. However, 64% reported similar or more demand from buyers for recreational homes. This sustained and growing demand for a limited number of available properties is expected to put upward price pressure on Canada’s recreational market.

Sixty-two per cent of experts said they believe demand will increase slightly in their region when interest rate cuts are made, while 21% expect demand will increase significantly.

“Recreational property purchases are not as heavily impacted by mortgage rates as those in the residential market. That said, consumer confidence in general will get a boost when we see a cut to the Bank of Canada’s key lending rate, expected later this year. This lift in activity will put upward pressure on prices. And, if this coincides with an influx of inventory, we should see a boost in sales as well,” concluded Soper.

Highlights from the release:

- All of Canada’s provincial recreational markets expected to see an increase in single-family home prices in 2024, with Ontario forecast to see the highest level of price appreciation at 8.0%

- Condominiums in Atlantic Canada’s recreational property market recorded the highest provincial year-over-year weighted median price appreciation in 2023, rising 16.9%

- Despite a modest decrease over the past year, the national weighted median single-family home price in Canada’s recreational real estate market remains 59% above 2019 levels

Posted on

March 5, 2024

by

Marie Taverna

Posted on

March 5, 2024

by

Marie Taverna

Window coverings can make or break the aesthetic in any space. Curtains are a great way to change the appearance of a room, making it feel brighter and even bigger. However, choosing the wrong curtains may have the opposite effect.

Here is a guide to picking the right curtains for your space:

To Add Width

If your window is narrow or you want to widen the look of your space, extend your curtain rod on either side of the window to cover an area of 10 to 12 inches outside the frame. Avoid slat blinds or Roman blinds if you’re trying to make your windows look wider. These options will sit inside the frame, making the window look even more narrow.

To Add Height

Place your curtain rod flush to the ceiling or below to add a lengthening effect to the room. Make sure your drapes are long enough to be flush with the floor to make the most of this effect, ensure that you avoid contact with heating elements or floor vents. Avoid fixing your curtain rods just above your window if you’re trying to create the illusion of higher ceilings.

To Add Privacy Without Sacrificing Light

Opt for fabrics such as thick linen or double-lined cotton to prevent your neighbours from seeing your living room dance parties. Black-out curtains are a great option to preserve energy and enhance privacy. You may also opt to install roller shades in your bedrooms for additional privacy.

Need more design inspiration? Our blog has ideas for every room in your home, visit blog.royallepage.ca.

Posted on

March 5, 2024

by

Marie Taverna

Spring isn’t only a time of renewal for us. As the days get longer, your houseplants are beginning to wake up from their winter dormancy. Now is the perfect time to give them the tender love and care they need to thrive all year long.

Follow these tips for happier houseplants:

1. Repot: This is the ideal time to give plants a bit of extra space to grow by repotting, allowing their roots to stretch out and absorb more fertilizer. If your plants still have room for growth, add some fresh soil to the top.

2. Prune: Most indoor plants take well to pruning. In fact, pruning often encourages new growth. To start, cut off any leaves that are yellow, bruised, or shrivelled. Next, cut off any stems that have grown long and leggy or have put out only small new growth. New stems should form in their place!

3. Fertilize: There’s nothing like a good dose of nutrients to get your plants going after their winter rest! Now is the time to restart your fertilizing routine to give your plants the nutrients they need to thrive.

4. Dust and Wash: Did you know dust accumulation on leaves prevents light absorption in plants? Give your plants a little spring bath by supporting the underside of the leaf with your palm, and wiping the surface with a damp paper towel or soft cloth. You can also put your plants in the bath and give them a shower with tepid water – just be sure not to overwater!

In need of more spring cleaning inspiration? Our blog features interior design trends, home improvement projects, and homeowner advice to enhance your life and investment. Visit blog.royallepage.ca.

Posted on

March 5, 2024

by

Marie Taverna

Your home should be the safest place in the world. Whether you live in a condo, apartment, townhome, or detached home, there are plenty of devices that can help you monitor and protect your home, helping you feel safer than ever.

Use smart cameras to monitor indoor and outdoor spaces

Home security cameras are more connected than ever. Most of today’s smart cameras allow you to monitor your home from anywhere in the world using Bluetooth and Wi-Fi connections. Aim to cover your front, back, and living areas for basic coverage. Cameras can go near windows, on flat surfaces or be mounted on the wall.

Smart doorbells are also a great option for condo and homeowners alike. Built-in cameras offer audio and video to let you see who’s at your door, and some even provide free intelligent alerts that can differentiate between people, packages, and animals.

Install a smart lock on your front door

Smart locks allow you to control your front door locks remotely via your phone or tablet with a Wi-Fi or Bluetooth connection. This is an excellent choice for families with kids or teenagers who stay at home alone after school or for pet owners who need to let in a dog walker or cat sitter.

Stay alert with smart smoke and carbon monoxide detectors

Smart smoke and carbon monoxide detectors sound alarms just like traditional models, but can also deliver life-saving alerts to your devices should you be away. Many of these devices can be synced with your smart home security system as well.

I know how important it feels to come home to a space that feels safe and secure. If you need help protecting your home, don’t hesitate to get in touch. I can connect you with my network of trusted local experts.

Posted on

March 5, 2024

by

Marie Taverna

According to the Royal LePage® House Price Survey released today, the aggregate price of a home in Canada increased 4.3 per cent year over year to $789,500 in the fourth quarter of 2023. On a quarter-over-quarter basis, however, the national aggregate1 home price decreased slightly by 1.7 per cent, highlighting that elevated borrowing costs continue to affect market activity, as Canadians adapt to the higher interest rate environment.

“I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark,” said Phil Soper, president and CEO of Royal LePage. “The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow. We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate.”

The Royal LePage National House Price Composite is compiled from proprietary property data nationally and regionally in 63 of the nation’s largest real estate markets. When broken out by housing type, the national median price of a single-family detached home increased 4.4 per cent year over year to $816,100, while the median price of a condominium increased 4.0 per cent year over year to $583,900. On a quarter-over-quarter basis, the median price of a single-family detached home decreased 2.1 per cent, while the median price of a condominium declined modestly by 0.6 per cent. Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian real estate valuation company.

In December, Royal LePage issued its 2024 Market Survey Forecast, projecting that the aggregate price of a home in Canada will increase 5.5 per cent in the fourth quarter of 2024, compared to the same quarter in 2023.

“Similar to what we witnessed last spring, when the Bank of Canada paused rates for the first time in a year causing sales activity and prices to increase almost immediately, the first sign of rate cuts – even if only by 25 basis points – could create a flurry of activity in the real estate market, releasing pent-up demand. Those who have been holding off listing their homes will follow close behind,” added Soper.

1 Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions and includes both resale and new build.

Learn more:

Posted on

March 4, 2024

by

Marie Taverna

SURREY, BC – Home sales in the Fraser Valley posted a second consecutive bump in February as new listings continue to rise and trend slightly above the 10-year seasonal average.

The Fraser Valley Real Estate Board recorded 1,235 transactions on its Multiple Listing Service® (MLS®) in February, a 32 per cent increase over January but still 21 per cent below the 10-year average for sales in the region. New listings increased to 2,797 in February, up 18 per cent from January and 4 per cent above

the 10-year average.

“There is somewhat of a buzz in the market right now,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “We are seeing new listings come onto the market and REALTORS® continue to see more traffic at open houses, however buyers are still exercising caution. We aren’t out of the woods just yet, but

the signs are pointing to a further increase in activity as we head into spring.”

Active listings in February were 5,561, up by 14 per cent over last month and up by 26 per cent over February 2023. With a sales-to-active listings ratio of 22 per cent, overall market conditions are edging into a seller’s market. The market is considered balanced when the ratio is between 12 per cent and 20 per

cent.

“All indications suggest we will see the Bank of Canada’s overnight rate begin to decrease mid-year, which is encouraging for buyers and sellers,” said FVREB CEO Baldev Gill. “With that confidence and the spring market on the horizon, we recommend anyone looking to buy or sell to seek the knowledge and guidance

of a professional REALTOR® who can provide detailed analysis and intimate knowledge of the local market.”

The average number of days homes are spending on the market is dropping, with single-family detached homes spending 35 days on the market, down from 44 days in January, apartments spending 29 days on the market, down from 41 days in January and townhomes moving more quickly at 28 days, down from 33

days on the market in January.

After six months of decreases, overall Benchmark prices posted a slight bump in February, edging up 0.9 per cent from January and up 4.8 per cent over February 2023.

MLS® HPI Benchmark Price Activity

- Single Family Detached: : At $1,485,600, the Benchmark price for an FVREB single-family detached home increased 1.3 per cent compared to January 2024 and increased 8.4 per cent compared to February 2023.

- Townhomes: : At $831,000, the Benchmark price for an FVREB townhome increased 0.7 per cent compared to January 2024 and increased 6.7 per cent compared to February 2023.

- Apartments: At $546,100, the Benchmark price for an FVREB apartment/condo increased 1.2 per cent compared to January 2024 and increased 7.2 per cent compared to February 2023.

To read the full statistics package, click here.

Posted on

March 4, 2024

by

Marie Taverna

Affordable housing was the top priority in BC Budget 2024 and the government plans to make significant capital commitments to get middle-income earners into market homes and provide more supports and protections for renters.

Here are the highlights for property buyers, renters, and small business.

The first-time homebuyers’ exemption

Effective April 1, 2024, the threshold is increased from $500,000 to $835,000, with the first $500,000 exempt from property transfer tax. The phase out range is $25,000 above the threshold, with the complete elimination of the exemption at $860,000.

The newly built home exemption threshold

This threshold now eliminates the PTT for eligible first-time home buyers on new homes up to $1,100,000 from the previous $750,000. The phase out range is $50,000 above the threshold, with the complete elimination of the exemption at $1,150,000 for qualifying newly built homes.

New purpose-built rental buildings

Buyers of new qualifying purpose-built rental buildings will be exempt from the PTT starting January 1, 2025 and ending December 31, 2030. This exemption builds on the further two per cent property transfer tax exemption for new purpose-built rentals announced in Budget 2023 and the rental housing revitalization tax exemption provided in Budget 2018.

PTT exemptions dates

- Increase threshold for first time home buyers’ exemption – begins April 1, 2024.

- Increase threshold for newly built home exemption – begins April 1, 2024.

- Enhanced exemption for new purpose-built rental buildings – begins January 1, 2025 and ends December 31, 2030.

The government estimates these new PTT exemption thresholds will save homebuyers about $8,000 and British Columbians over $100 million annually, and up to 14,500 homebuyers – twice as many as before – will now be eligible for the PTT exemption.

PTT revenue growth is expected to average 8.6 per cent annually over the next two years.

Note: For more than two decades, Greater Vancouver REALTORS® have been advocating for changes to the PTT, meeting with politicians and providing submissions each year. Government has finally listened.

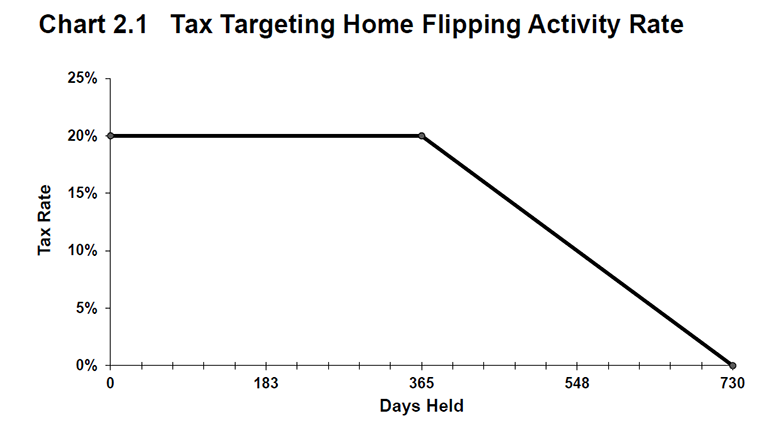

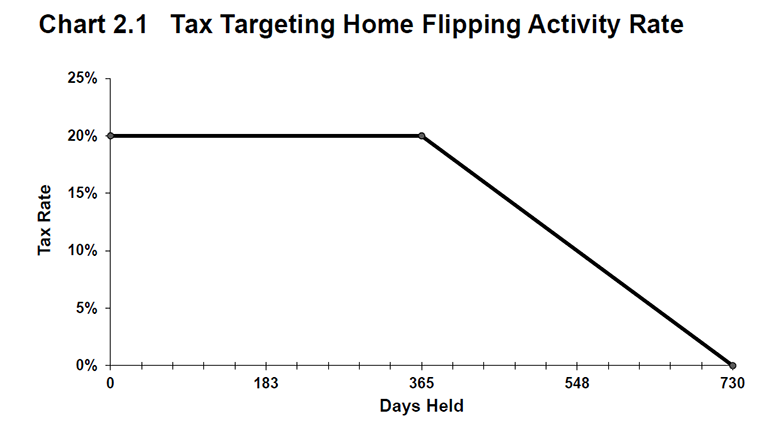

The government is bringing in a new flipping tax, effective January 1, 2025, on the profit made from selling a residential property, including a presale assignment, within two years of buying it.

The rate is 20 per cent within the first year of purchase, declining to zero between 366 and 730 days. The tax will not apply to land or portions of land used for non-residential purposes.

There are exemptions for

- those adding to the supply of housing or engaging in real estate development and construction

- life circumstances including separation or divorce, death, disability or illness, relocation for work, involuntary job loss, a change in household membership, personal safety, or insolvency

In addition to these exemptions, individuals selling their primary residence within two years of purchase can exclude a maximum of $20,000 when calculating their taxable income.

The government estimates the tax would generate $44 million in revenue in the 2025/2026 fiscal year, which is slated for affordable housing.

Source: BC Budget 2024, page 66.

BC Builds, launched in February 2024, includes $198 million over three years and leverages government-owned, public, and underused land, and low-cost financing to bring down construction costs and deliver more middle-class rental and market housing.

Forgivable loans up to $40,000 for homeowners to build and rent secondary suites below market rates to quickly increase affordable rental supply. An annual income-tested tax credit of up to $400 per year for renters.

Allowing small-scale, multi-unit affordable housing including townhomes, duplexes, and triplexes through zoning changes and proactive partnerships.

Streamlining permitting to reduce costs and speed up approvals to get homes built faster.

Strengthening enforcement of short-term rental regulation.

A new, one year electricity affordability credit for all households, regardless of income starting in April 2024. Households will save on average $100 a year on their electricity bills.

Commercial and industrial customers will receive savings of about 4.6 per cent based or about $400 on their 2023/24 electricity bills.

More than $1 billion in new spending measures to help protect British Columbians from the effects of climate change and build a greener economy.

The Climate Action Tax Credit increases to $1,005 per year for families up to four persons, up from $890 last year. Individuals will receive $504 compared to $447 last year. Start date is in July 2024.

There is $100 million in relief for the employer health tax, including the continuation of the venture capital tax credit, and the expansion of the interactive digital media tax credit.

The government estimates this years’ deficit at $5.914 billion rising to $7.773 billion by 2026.

The total debt will rise from $103 billion to $123 billion in 2024-25.

Posted on

March 4, 2024

by

Marie Taverna

|

While Metro Vancouver home sellers appeared somewhat hesitant in January, new listings rose 31 per cent year-over-year in February, bringing a significant number of newly listed properties to the market.

Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,070 in February 2024, a 13.5 per cent increase from the 1,824 sales recorded in February 2023. This was 23.3 per cent below the 10-year seasonal average (2,699).

“While the pace of home sales started the year off briskly, the pace of newly listed properties in January was slower by comparison. A continuation of this pattern in February would have been concerning, as it could quickly tilt the market towards overheated conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With new listings up about 31 per cent year-over-year in February, this will relieve some of the pressure that was building in January and offer buyers more choice as we enter the spring and summer markets.”

There were 4,560 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in February 2024. This represents a 31.1 per cent increase compared to the 3,478 properties listed in February 2023. This was 0.2 per cent below the 10-year seasonal average (4,568).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 9,634, a 16.3 per cent increase compared to February 2023 (8,283). This is three per cent above the 10-year seasonal average (9,352).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for February 2024 is 22.4 per cent. By property type, the ratio is 16 per cent for detached homes, 27.9 per cent for attached, and 25.9 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Even with the increase in new listings however, standing inventory levels were not high enough relative to the pace of sales to mitigate price acceleration in February, with most segments of the market moving into sellers’ territory,” Lis said. “This competitive dynamic has led to modest price growth across all market segments this month, but it’s noteworthy that benchmark prices remain below the peak observed in the spring of 2022, before the market internalized the full effect of the Bank of Canada’s tightening cycle.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,183,300. This represents a 4.5 per cent increase over February 2023 and a 1.9 per cent increase compared to January 2024.

Sales of detached homes in February 2024 reached 560, an 8.3 per cent increase from the 517 detached sales recorded in February 2023. The benchmark price for a detached home is $1,972,400. This represents a 7.2 per cent increase from February 2023 and a 1.5 per cent increase compared to January 2024.

Sales of apartment homes reached 1,092 in February 2024, a 17.7 per cent increase compared to the 928 sales in February 2023. The benchmark price of an apartment home is $770,700. This represents a 5.6 per cent increase from February 2023 and a 2.5 per cent increase compared to January 2024.

Attached home sales in February 2024 totalled 403, a 10.1 per cent increase compared to the 366 sales in February 2023. The benchmark price of a townhouse is $1,094,700. This represents a 4.2 per cent increase from February 2023 and a 2.6 per cent increase compared to January 2024.

|

| Download the February 2024 stats package |

Posted on

March 2, 2024

by

Marie Taverna

Canadian real GDP was largely unchanged in December, declining by 0.02 per cent, following two months of growth. Goods-producing sectors contracted by 0.2 per cent, while services were essentially unchanged. Construction activity fell 0.6 per cent in December, with residential building declining by 1.6 per cent. Offices of real estate agents and brokers rose 9 per cent, following five consecutive monthly declines amid soft home sales. Preliminary estimates suggest that output in the Canadian economy rose 0.4 per cent in January, helped by the conclusion of strikes in Quebec.

Real GDP rose 0.2 per cent in the fourth quarter, close to 1 per cent on an annualized basis, erasing a 0.1 per cent decline in the third quarter. Improved net exports, driven by the strong US economy and Albertan crude oil, pushed GDP upwards. However, business investment declined for the sixth time over the most recent seven quarters. Household spending rose 0.2 per cent in the fourth quarter, driven by vehicle imports, but strong population growth meant that per capita consumption declined for the third consecutive quarter. At 6.2 per cent, the household savings rate was down slightly from the third quarter, but remains higher than pre-pandemic levels. Housing investment was down for the year, with residential construction down 10.2 per cent and ownership transfer costs down 7.7 per cent. At 1.2 per cent growth, 2023 was the slowest year for real GDP growth since 2016, excluding 2020.

Economic growth in Canada was soft in 2023, and although it flirted with recession it has so far managed to avoid one. The central bank has raised rates by 475 basis points over two years and, as of the most recent data, managed to bring inflation down to 2.9 per cent without causing a major increase in unemployment or a contraction in GDP. The "soft landing" that seemed unlikely two years ago is now visible. However, while aggregate real GDP has not contracted, per capita GDP has contracted for six consecutive quarters as economic growth has failed to keep pace with rapid population growth. Per capita, real GDP is comparable to the level of 2017. Financial markets continue to expect that rate cuts will begin in the late spring and accumulate into the summer. The next rate announcement is on next Wednesday, March 6th.

Link: https://mailchi.mp/bcrea/canadian-economic-growth-real-gdp-q42023 |

|

|

For more information, please contact:

Brendon Ogmundson

Chief Economist

Direct: 604.742.2796

Mobile: 604.505.6793

Email: bogmundson@bcrea.bc.ca

|

|

Economics Now is produced by the British Columbia Real Estate Association. Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: "Copyright British Columbia Real Estate Association. Reprinted with permission." BCREA makes no guarantees as to the accuracy or completeness of this information.

Additional economics information is available here on BCREA's website. |

|

Posted on

March 2, 2024

by

Marie Taverna

GlucksteinElements Carmen table lamp, Faux Grasscloth peel-and-stick wallpaper, Everett area rug, GlucksteinHome Limited Cardiff chair, Getaway console

Many of us want a home that feels and looks just a little more luxurious. After all, an elevated home feels comfortable, intentional, and is just a pleasure to spend time in every day. If you’re looking to upgrade your living room, bedroom, dining room, or any space at home, try these four often overlooked interior design tips to make a big impact without breaking your budget.

1. HANG CURTAINS HIGH

Window coverings add a luxurious quality to your space. But it’s not just about the material. The height and length of your drapery is an often neglected but important factor in the look of the room. It’s best to hang your drapes above the window to emphasize and extend the height of the room and add a feeling of grandeur to the space. Aim for halfway between the window and the ceiling. And be sure your curtains are long enough so the hem lightly touches the floor.

GlucksteinElements Velvet room darkening drapery panels, Ashton brushed nickel drapery hardware, Drapery brushed nickel clip ring set

2. GET THE RIGHT SIZE RUG

A rug truly sets the foundation in any room. Area rugs add warmth, texture, and a cozy softness to the space. Whether it’s the living room, bedroom, dining room, kitchen, or entryway, the right size rug is absolutely key to a more luxurious look in your home. To avoid that off balance feeling that a too-small rug creates in a room, remember that bigger is better. As a general guide, all your living room furniture -or at least the front legs of sofas and chairs- should sit on the rug. In the dining room, the rug should be large enough to fit your dining chairs, even when they’re pulled out away from the table.

GlucksteinElements Barlow area rug, GlucksteinHome Allegra daybed

3. UPGRADE BASIC LIGHTING

Most people move into a home with the lighting that already exists. Installing new lighting fixtures is a fairly easy way to uplift a room and it really makes a difference to the space. So go ahead and switch in beautiful fixtures that reflect your own personal design style. Start with bathroom lighting, your hallway light, and lighting over the kitchen island. These often overlooked areas pack a lot of impact.

4. USE WALLPAPER

Wallpaper is a pretty simple trick to add depth and a layering effect to any home. Whether your aesthetic leans modern or traditional, wallpaper can add tons of richness to a room through colour, pattern, or texture. And there are plenty of stylish options available at every budget. For an elevated look without breaking your budget, try a luxury peel-and-stick wallcovering. It’s not only easy to install, but gives you the flexibility to change up your look more often. For an even more luxurious effect, paint the baseboards and trim in a matching hue. It creates a cohesive look that will make the room feel more expansive and harmonious.

|

Subscribe with RSS Reader

Subscribe with RSS Reader

GlucksteinElements Velvet room darkening drapery panels, Ashton brushed nickel drapery hardware, Drapery brushed nickel clip ring set

GlucksteinElements Velvet room darkening drapery panels, Ashton brushed nickel drapery hardware, Drapery brushed nickel clip ring set

GlucksteinElements Barlow area rug, GlucksteinHome Allegra daybed

GlucksteinElements Barlow area rug, GlucksteinHome Allegra daybed