Posted on

October 26, 2023

by

Marie Taverna

Despite weakened activity, Canadian home prices expected to remain stable for remainder of 2023

While many Canadians have adjusted to the increased cost of borrowing, elevated interest rates continue to impact activity in markets across the country, keeping some buyers and sellers stuck on the sidelines. During the third quarter, inventory rose and sales activity softened, although this did not necessarily translate into steep price declines. Canada’s chronic shortage of housing supply is keeping property prices relatively stable.

“With activity slowing, home prices softened in some of our major markets over the last three months, following a stronger-than-expected second quarter. Prices remain up on a year-over-year basis, with today’s stable market standing in sharp contrast to the steep declines experienced in the third quarter of 2022,” said Phil Soper, president and CEO of Royal LePage. “While trading volumes in most regions remain sluggish, Canada’s housing market is on solid footing, with pent-up demand building. We don’t anticipate a material change in property prices through the remainder of the year.”

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 7.0% in the fourth quarter of 2023, compared to the same quarter last year. The previous forecast (8.5%) has been revised downward to reflect softer activity than expected in the third quarter, which resulted in a modest decline in prices in some markets, including Toronto and Vancouver.

According to the Royal LePage House Price Survey released today, the aggregate1 price of a home in Canada increased 3.6% year over year to $802,900 in the third quarter of 2023. On a quarter-over-quarter basis, however, the national aggregate home price decreased modestly by 0.8%.

“Slower activity has allowed critically low inventory levels to build marginally in many regions, yet the quantity of homes available for sale in this country remains well below the level needed to keep a lid on property price increases,” Soper continued. “Once interest rates begin to ease, even by only a small amount, we expect buyers will return to the market in large numbers and the relentless upward march of home prices will begin again. At its root, housing supply remains out of step with the growing need for it.”

Read Royal LePage’s third quarter release for national and regional insights.

Third quarter press release highlights:

- Aggregate home prices in greater regions of Toronto and Vancouver posted modest quarterly declines in Q3 of 2.8% and 1.8%, respectively. Meanwhile, Greater Montreal Area posted 0.6% aggregate price increase quarter over quarter

- More than half (57%) of regional markets in the report posted a quarter-over-quarter decline in Q3 as activity softened

- Diverging trends among major regions sees year-end forecast downgraded nationally and in the Greater Toronto Area, Edmonton and Regina; forecast maintained in the Greater Montreal Area (GMA), Greater Vancouver, Ottawa, Winnipeg and Halifax; Calgary is the only city whose forecast has been raised

- Royal LePage applauds federal government’s GST rebate policy aimed at incentivizing new construction of purpose-built rental housing

Posted on

October 26, 2023

by

Marie Taverna

Preparing your home for winter can be a daunting task. Starting early and taking time between jobs will make it much more manageable.

Your efforts will keep out the cold, keep money in your pocket through energy savings and keep your home running efficiently.

Here are six ways to winterize your home this season.

Maintain machines and appliances

Having your furnace and ventilation system serviced by a professional in the fall can prevent potential emergency calls when the temperature drops.

For improved air quality throughout your home, have your ducts cleaned annually before the onset of cold weather. Outdoor air conditioning units should be covered properly and their power disconnected during the off-season. While you’re at it, cover any lawn furniture or landscaping that will be exposed to the elements.

Conduct a thorough inspection on your yard tools too – drain fuel from your lawn mower and water from your pressure washer, and complete a maintenance check on your snowblower. This will prolong their lifespan and ensure they work efficiently when you need them. If you heat your home with wood, oil or propane, be sure to top up your supply before the cold months hit.

Seal windows, doors, decks and concrete

If the caulking or weather stripping around your windows and doors is cracked, it can let cold air and moisture in, damaging window sills while causing mildew, mold and significant heat loss. Repair and replace what is necessary and cover older windows with a protective window film until they can be replaced.

Decks, driveways and concrete surfaces are not impermeable. Purchase proper sealants or stains that you can apply yourself before ice and snow arrives, or hire a professional. Preserving the integrity of these large surfaces will only serve you in the long run, saving you from major repairs or full replacements.

Outside water

Before draining your pipes, disconnecting hoses or winterizing your sprinkler system, always turn off the outside water supply. Leaving the outside water on during winter can cause pipes to burst, leading to flooding and damage to your property. If you haven’t already, you may want to consider insulating your water pipes, especially if you leave a summer home unattended off-season or vacation for extended periods of time in the winter months.

Check your gutters

Make sure the gutters are in good condition and properly secured to your home. Prevent damage by clearing out debris to allow snow to melt and drain easily, and point the downspout away from your home. Water should always be moving away from your property to avoid flooding and water damage.

Gutter guards are a worthy investment, as they can help to keep debris and pests out. Clogged gutters can result in leaks that lead to mold and mildew, and act as a breeding ground for mosquitoes and bacteria.

Tend to the attic

Pests can cause damage to your home and your health. Safeguard your attic from birds and rodents who may move in during the winter by checking for access points and placing a screen under any vent. Contact pest control if you suspect an infestation.

To keep warm air from escaping through your roof, determine the R-Value of your current attic insulation and add more to areas not properly insulated, or completely replace the insulation if needed. For added warmth and energy efficiency, you can add insulation to your garage doors and basement.

Inspect your smoke detectors

This important task is not limited to just one season… Inspect your smoke and carbon monoxide detectors monthly, replacing batteries and cleaning them when necessary. Smart home devices can be installed to continuously monitor smoke detectors (and much more), providing added peace of mind.

If some of these tasks are not within your skillset or you simply don’t have the time, hire a general contractor for the small jobs and a certified technician for specialized tasks, such as inspecting the furnace.

Posted on

October 26, 2023

by

Marie Taverna

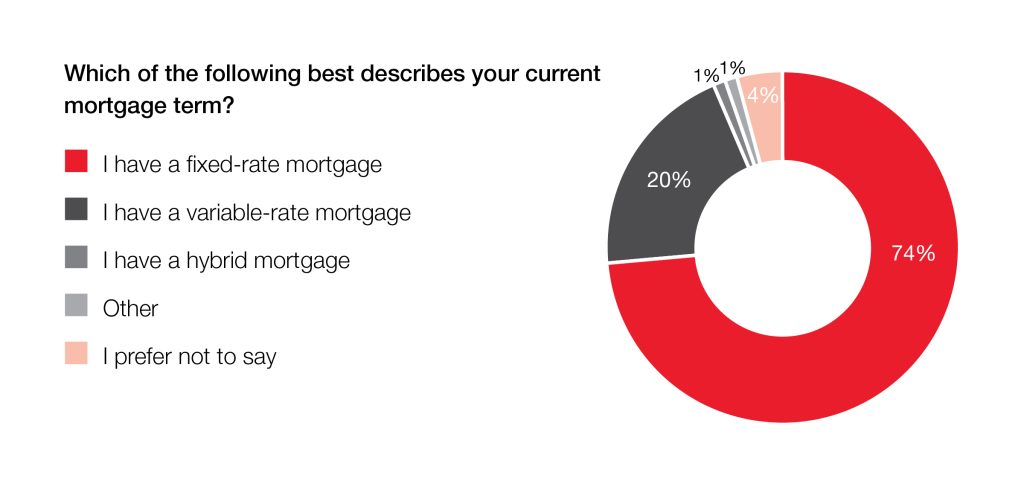

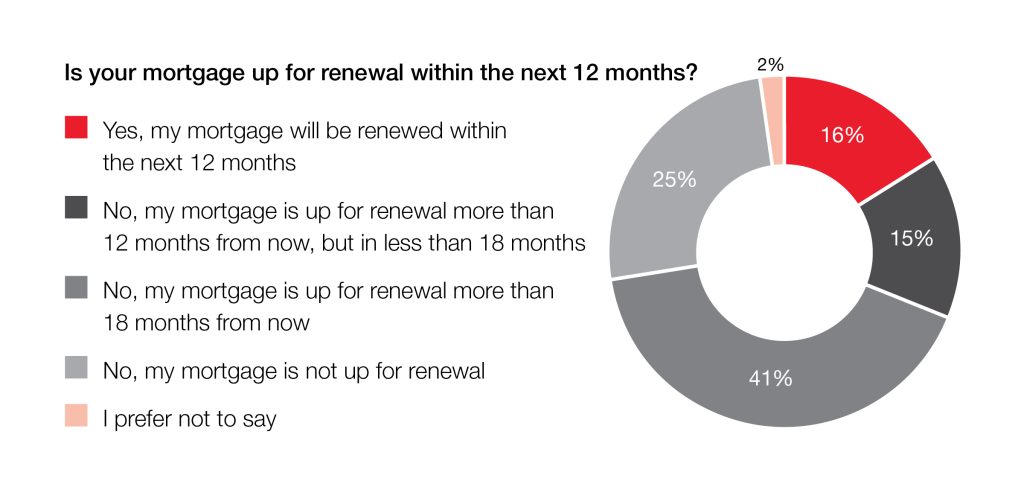

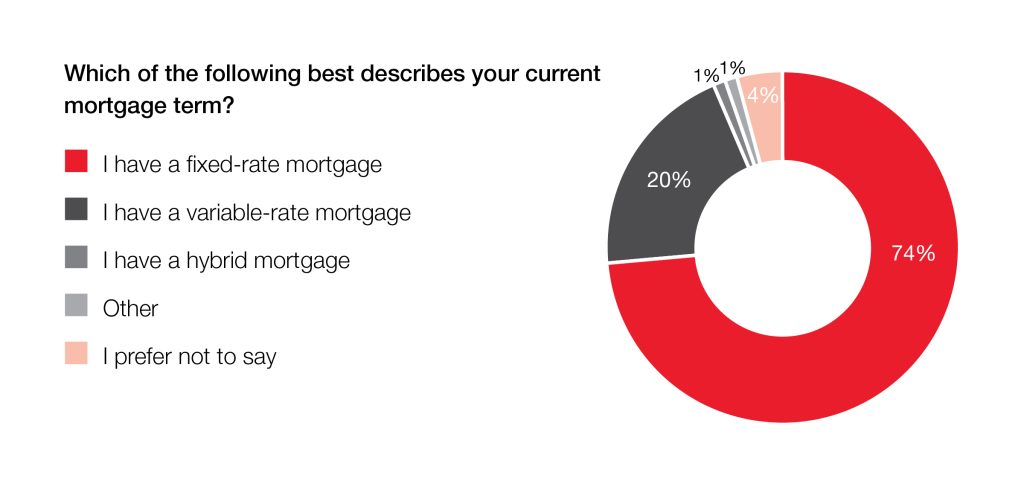

The Bank of Canada announced on October 25th it would be holding its key lending rate at 5.0%, the second consecutive hold since two quarter-point increases were made over the summer. Since March of last year, the central bank has imposed an unprecedented number of rate hikes in an effort to reduce pandemic-fueled inflation, taking interest rates from historic lows to a more than two-decade high. While approximately three quarters (74%) of Canadian mortgage holders currently have a fixed-rate agreement in place, higher interest rates have had a major impact on those with a variable-rate and hybrid mortgage.

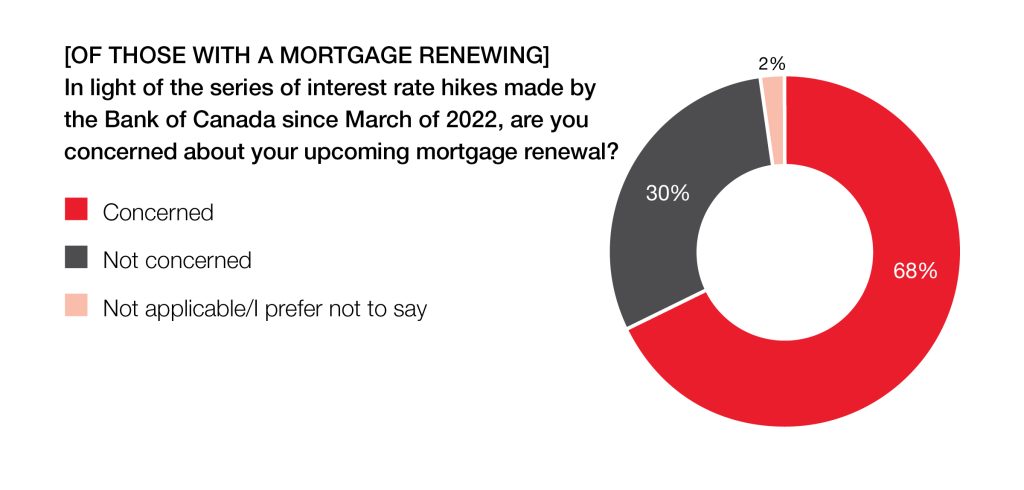

“Some Canadians with variable-rate mortgages have seen their monthly payments double or even triple over the last year and half, due to the Bank of Canada’s aggressive interest rate hike campaign aimed at tamping down high inflation. Those locked in to a fixed-rate mortgage, which most are, have been protected from those increases, at least for a short time,” said Karen Yolevski, chief operating officer, Royal LePage Real Estate Services Ltd. “While the central bank’s key lending rate is expected to come down in the medium term, the likelihood that we will return to rock-bottom rates of less than one per cent is very low. Upon renewal, fixed-rate mortgage holders will be faced with a new reality – higher monthly payments.”

According to a recent Royal LePage survey conducted by Nanos,1 74% of Canadians with a residential mortgage set to renew within the next 18 months say they are concerned about the renewal, in light of the series of interest rate hikes made by the Bank of Canada since March of 2022. 31% per cent of all mortgagees in Canada say their lending agreement is set to renew within the next year and a half (16% within 12 months and 15% in 12-18 months). That’s approximately 3.4 million people with a mortgage that is set to renew by March of 2025.2

Of those who have a variable-rate or hybrid mortgage, 64% say that higher interest rates have caused their mortgage payment to hit its trigger rate – when the mortgage payment no longer covers the interest portion – and have subsequently caused their monthly payments to increase.

“There is no doubt that Canadians’ financial stability has been put to the test over the last few years. In addition to home prices skyrocketing in 2021 and the start of 2022 – followed by interest rate increases that have caused monthly mortgage payments to rise by hundreds, if not thousands, of dollars – the cost of everyday essentials like food and fuel have also surged,” said Yolevski. “Canada’s strong employment rate and the rigorous lending practices of our major banks continue to ensure that a vast majority of households are able to navigate these financial challenges without having to sell their homes.”

For more insights, read the full press release and review the national data chart linked below.

1Nanos conducted an online representative non-probability panel survey of 2,004 Canadians, including 933 current residential mortgage holders between the ages of 27 to 75, from September 8th to 14th, 2023. The sample is geographically stratified to be representative of Canada. No margin of error applies to this research.

2Based on Statistics Canada. Table 17-10-0005-01 Population estimates on July 1st, by age and sex for Canadians aged 26-74 in 2022 and survey results indicating 45% of respondents currently hold a residential mortgage.

Posted on

October 11, 2023

by

Marie Taverna

Approximately one-third of Royal LePage real estate professionals say they are holding as many or more open houses today as they were pre-pandemic

Advancements in technology have had an incredible impact on the Canadian real estate industry. Technology has allowed consumers to be more engaged in the buying and selling process, helping to keep them informed and up to date, and offering real estate professionals useful tools to service their clients quicker and more efficiently than ever before. Online applications and digital resources proved to be especially important during the height of the COVID-19 pandemic, when viewing a home in person became increasingly challenging amid safety concerns and social distancing rules. However, the ability to walk through a property and explore a space in person is irreplaceable for many buyers.

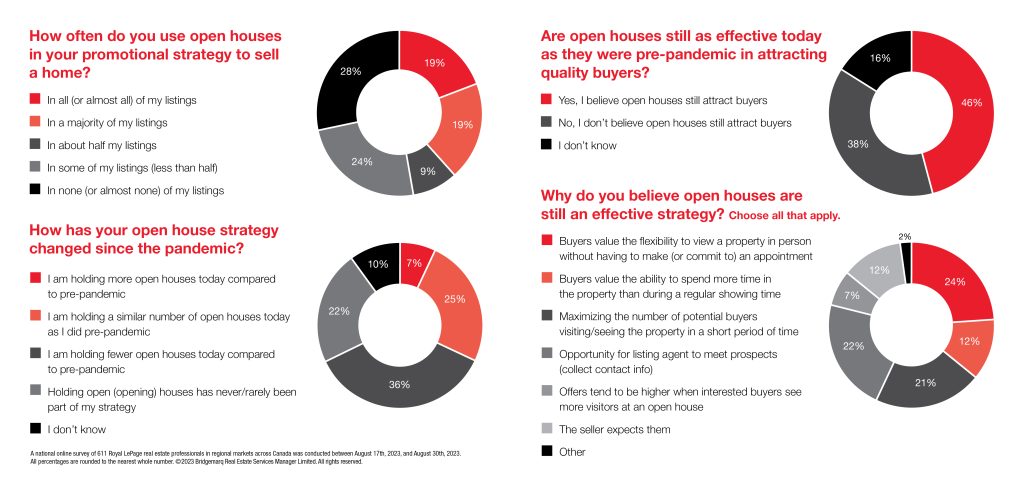

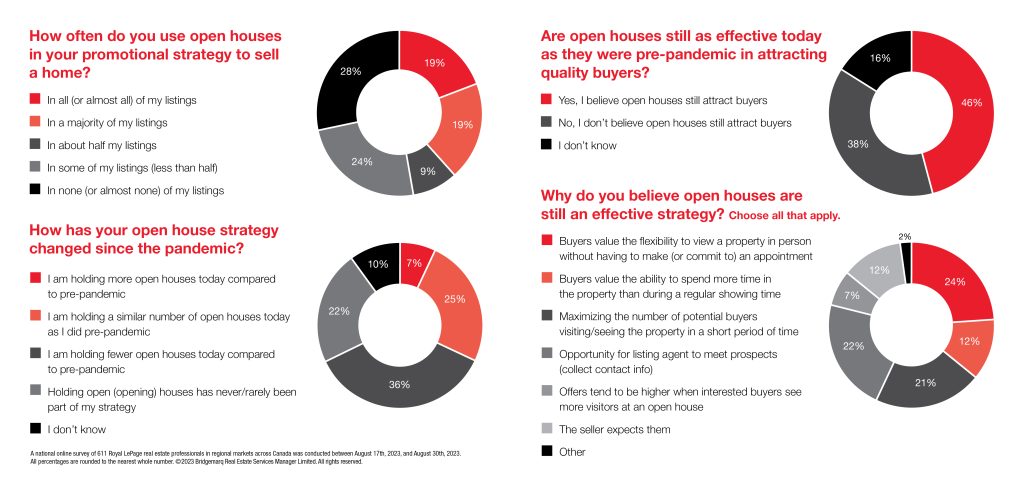

According to a recent survey1 of more than 600 Royal LePage real estate professionals across the country, 48% of sales representatives use open houses in at least half of their listings in their promotional strategy to sell a home. Nearly one-third of real estate professionals (32%) said they are holding as many or more open houses today as they were pre-pandemic, and almost half (46%) believe open houses are still as effective today as they were pre-pandemic in attracting quality buyers.

“Technology has advanced our industry by leaps and bounds, from 3D furniture renderings to virtual showings. During the pandemic, when in-person interactions were restricted by social distancing guidelines, technology was the only way many of us were able to help our clients. However, nothing can truly replace the feeling of physically walking through a home that you dream of buying,” said Shawn Zigelstein, broker and team leader, Royal LePage Your Community. “Buying a property is a very personal decision, and most purchasers want the experience of being able to view their biggest financial investment in real life, if at all possible.”

Zigelstein added that an open house also offers potential buyers the benefit of being able to leisurely view a home without the time restrictions of a formal showing.

When asked about the top reasons why open houses are still an effective selling strategy, Royal LePage real estate experts said that buyers value the flexibility to view a property in person without having to make, or commit to, an appointment (24%). Respondents also reported that open houses are an opportunity for the listing agent to meet new prospects (22%) and maximize the number of potential buyers seeing the property in a short period of time (21%).

When tasked with selling a home, real estate agents have a variety of marketing tools at their disposal. Yet, every home is unique, and each one requires a savvy, marketing-minded expert to apply the right resources in order to attract an appealing purchase offer.

“When it comes to selling a home, it’s important to give clients and their property the full-service marketing experience they deserve, complete with professional photography and videography, and a robust social media plan,” said Anne Léger, chartered real estate broker for the Tremblay Léger team at Royal LePage Humania in the Laurentians. “In the same way that our clients call on us as professionals to ensure the best result for the sale of their property, it’s essential to surround ourselves with specialists in every field so that our clients can benefit from the highest exposure and, by the same token, the best selling price. Attention to detail is always important, but particularly at a time when buyers are looking for turnkey properties. A well-listed property will give purchasers confidence and make it easier for them to move in.”

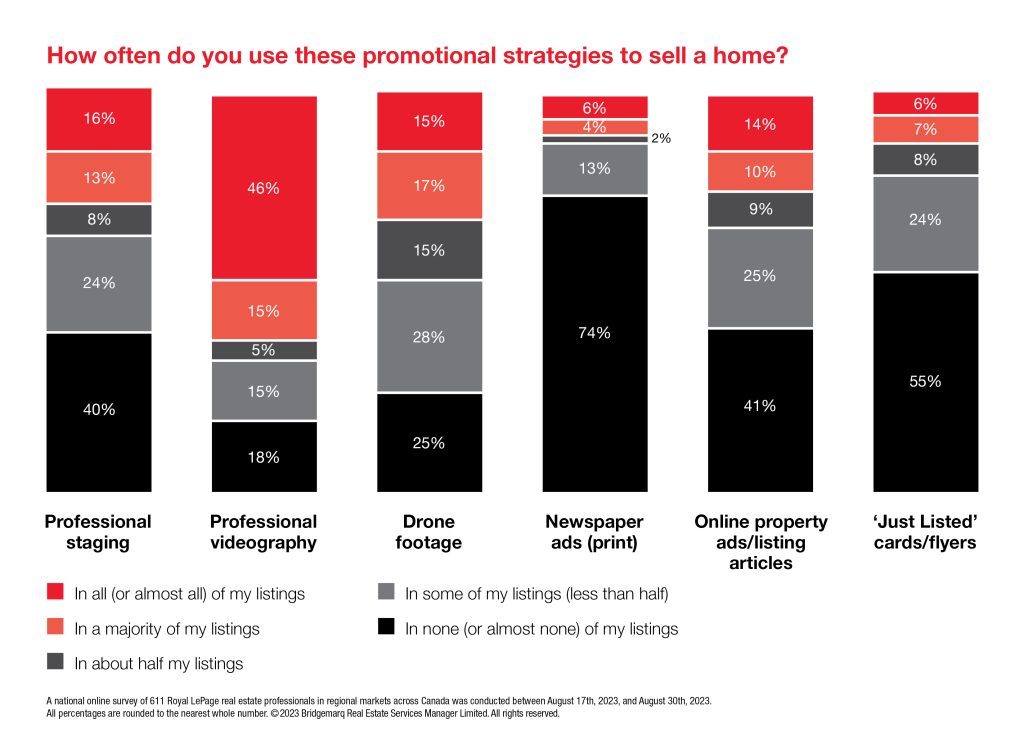

In their marketing strategy, real estate professionals use a variety of visual and digital tools to promote their clients’ listings. According to the survey, 36% of respondents use professional staging in at least half of their listings in their promotional strategy to sell a home; 67% use professional videography; 47% use drone footage; and 33% use online property ads or listing articles in at least half of their listings.

Not surprisingly, real estate professionals are utilizing less print materials when promoting their clients’ homes today. Seventy-four per cent of respondents said they use newspaper ads in none or almost none of their listings, and 55% said they use “Just Listed” cards or flyers in none or almost none of their listings.

Are you looking for an agent to sell your property? We would love to help your with your real estate needs.

Posted on

August 2, 2023

by

Marie Taverna

Strong sales push Metro Vancouver home prices past the rate hike in July

Home prices across all home types in Metro Vancouver rose again in July, as strong sales figures continue to push up against low levels of housing inventory in the region.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,455 in July 2023, a 28.9 per cent increase from the 1,904 sales recorded in July 2022. This was 15.6 per cent below the 10-year seasonal average (2,909).

“While sales remain about 15 per cent below the ten-year average, they are also up about 30 per cent year-over-year, which is not insignificant,” Andrew Lis, REBGV’s director of economics and data analytics said. “Looking under the hood of these figures, it’s easy to see why sales are posting such a large year-over-year percentage increase. Last July marked the point when the Bank of Canada announced their ‘super-sized’ increase to the policy rate of one full per cent, catching buyers and sellers off guard, and putting a chill on market activity at that time.”

There were 4,649 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in July 2023. This represents a 17 per cent increase compared to the 3,975 homes listed in July 2022. This was 5.2 per cent below the 10-year seasonal average (4,902).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 10,301, a four per cent decrease compared to July 2022 (10,734). This was 14.4 per cent below the 10-year seasonal average (12,039).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for July 2023 is 24.9 per cent. By property type, the ratio is 16.5 per cent for detached homes, 32 per cent for townhomes, and 30.6 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“What’s interesting to see in the current market environment is that, while the Bank of Canada rate hike this July was only a quarter of a per cent, mortgage rates are now at the highest levels we’ve seen in Canada in over ten years,” Lis said. “Yet despite borrowing costs being even higher than last July, sales activity surpassed the levels we saw last year, which I think says a lot about the strength of demand in our market and buyers’ ability to adapt to and qualify for higher borrowing costs.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,210,700. This represents a 0.5 per cent increase over July 2022 and a 0.6 per cent increase compared to June 2023.

Sales of detached homes in July 2023 reached 681, a 28.7 per cent increase from the 529 detached sales in July 2022. The benchmark price for a detached home is $2,012,900. This represents a 0.6 per cent increase from July 2022 and a 1.1 per cent increase compared to June 2023.

Sales of apartment homes reached 1,281 in July 2023, a 20.7 per cent increase compared to the 1,061 sales in July 2022. The benchmark price of an apartment home is $771,600. This represents a 2.6 per cent increase from July 2022 and a 0.6 per cent increase compared to June 2023.

Attached home sales in July 2023 totalled 466, a 53.3 per cent increase compared to the 304 sales in July 2022. The benchmark price of an attached home is $1,104,600. This represents a 1.2 per cent increase from July 2022 and a 0.5 per cent increase compared to June 2023.

Download the July 2023 stats package.

Posted on

July 6, 2023

by

Marie Taverna

Classic European inspired 5 bedroom, 4 bath executive home located in the prestigious “The Uplands” neighbourhood in Anmore.

Experience stunning mountain views in a private rural lot, just a short drive for the city.

Perfect for entertaining, with a dream kitchen complete with solid wood cabinets, SS appliances, granite countertops & expansive kitchen island.

Family room French doors open to massive outdoor deck, complete with 2 gas hookups.

Rest easy in the large primary bedroom complete with gas fireplace, walk in closet, shower & soaker tub.

Property boosts in ground sprinklers, aircon, custom blinds & beautiful wooden floors.

Walkout basement has suite potential with private balcony, 2 bedrooms, & rec room.

Don’t miss out on this perfect balance of natural & elegance.

Posted on

July 6, 2023

by

Marie Taverna

SURREY, BC – The Fraser Valley real estate market saw strong sales activity in June with levels on par with the 10-year average for the month, amid on-going challenges with supply. In June, the Fraser Valley Real Estate Board (FVREB) processed 1,935 sales on its Multiple Listing Service® (MLS®), an increase of 51.1 per cent compared to June 2022 and a 13.1 per cent increase compared to May.

“As seen in recent months, prices continue to trend upward, with lack of supply and high demand for housing,“ said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “What we’re seeing is sales increasing, with buyers entering the market despite current financial implications of anticipated rate hikes.”

The Board received 3,424 new listings in June, an increase of 2.8 per cent compared to last year, and a decrease of 3.1 per cent compared to May 2023.

The month ended with a total active inventory of 5,944, a 6.9 per cent increase compared to May, and 8.2 per cent less than June of last year. “A number of factors are at play in the Fraser Valley market, from low supply to unprecedented interest rates – the highest in more than 20 years,” said Board CEO, Baldev Gill.

“For those seeking to enter the market, whether buying or selling, only a professional REALTOR® can provide the expert guidance and advice to fully evaluate each clients’ needs, and to protect their interests.” Across Fraser Valley in June, the average number of days to sell a single-family detached home was 21 and a townhome was 16 days. Apartments took, on average, 22 days to sell. MLS® HPI Benchmark Price Activity

• Single Family Detached: At $1,526,200, the Benchmark price for an FVREB single-family detached home increased 2.3 per cent compared to May 2023 and decreased 7.4 per cent compared to June 2022.

• Townhomes: At $845,400, the Benchmark price for an FVREB townhome increased 2.3 per cent compared to May 2023 and decreased 5.2 per cent compared to June 2022.

• Apartments: At $552,200, the Benchmark price for an FVREB apartment/condo increased 1.8 per cent compared to May 2023 and decreased 2.5 per cent compared to June 2022.

The Fraser Valley Real Estate Board is an association of 5,057 real estate professionals who live and work in the BC communities of Abbotsford, Langley, Mission, North Delta, Surrey, and White Rock.

Posted on

July 6, 2023

by

Marie Taverna

VANCOUVER, BC – July , 2023 – Continuing the trend that has emerged in the housing market this year, the benchmark price for all home types in Metro Vancouver1 increased in June as home buyer demand butted up against a limited inventory of homes for sale in the region.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales2 in the region totalled 2,988 in June 2023, a 21.1 per cent increase from the 2,467 sales recorded in June 2022. This was 8.6 per cent below the 10-year seasonal average (3,269).

“The market continues to outperform expectations across all segments, but the apartment segment showed the most relative strength in June,” Andrew Lis, REBGV’s director of economics and data analytics said. “The benchmark price of apartment homes is almost cresting the peak reached in 2022, while sales of apartments are now above the region’s ten-year seasonal average. This uniquely positions the apartment segment relative to the attached and detached segments where sales remained below the ten-year seasonal averages.”

There were 5,348 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in June 2023. This represents a 1.3 per cent increase compared to the 5,278 homes listed in June 2022.

This was 3.1 per cent below the 10-year seasonal average (5,518). The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,990, a 7.9 per cent decrease compared to June 2022 (10,842) This was 17.4 per cent below the 10-year seasonal average (12,091). Across all detached, attached and apartment property types, the sales-to-active listings ratio for June 2023 is 31.4 per cent.

By property type, the ratio is 20.9 per cent for detached homes, 38.5 per cent for townhomes, and 39.4 per cent for apartments. Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months. “Despite elevated borrowing costs, there continues to be too little resale inventory available relative to the pool of buyers in Metro Vancouver.

This is the fundamental reason we continue to see prices increase month over month across all segments,” Lis said. “With the benchmark price for apartments now standing at $767,000, we repeat our call to the provincial government to adjust the $525,000 threshold exempting first-time home buyers from the Property Transfer Tax to better reflect the price of entry-level homes in our region. This is a simple policy adjustment that could help more first-time buyers afford a home right now.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,203,000. This represents a 2.4 per cent decrease over June 2022 and a 1.3 per cent increase compared to May 2023.

Sales of detached homes in June 2023 reached 848, a 28.3 per cent increase from the 661 detached sales recorded in June 2022. The benchmark price for a detached home is $1,991,300. This represents a 3.2 per cent decrease from June 2022 and a 1.9 per cent increase compared to May 2023.

Sales of apartment homes reached 1,573 in June 2023, an 18.6 per cent increase compared to the 1,326 sales in June 2022. The benchmark price of an apartment home is $767,000. This represents a 0.5 per cent increase from June 2022 and a 0.8 per cent increase compared to May 2023. Attached home sales in June 2023 totalled 547, a 17.6 per cent increase compared to the 465 sales in June 2022.

The benchmark price of an attached home is $1,098,900. This represents a one per cent decrease from June 2022 and a 1.5 per cent increase compared to May 2023. -30- 1.

Editor’s Note: Areas covered by the Real Estate Board of Greater Vancouver include: Bowen Island, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler. 2. REBGV is now including multifamily and land sales and listings in this monthly report.

Previously, we only included detached, attached, and apartment sales, and these additional categories, which typically account for roughly one to two per cent of total MLS® activity per month, are being included for completeness in our reporting.

The Real Estate Board of Greater Vancouver is an association representing more than 15,000 REALTORS® and their companies. The Board provides a variety of member services, including the Multiple Listing Service®. For more information on real estate, statistics, and buying or selling a home, contact a local REALTOR® or visit www.rebgv.org.

Posted on

June 22, 2023

by

Marie Taverna

Welcome to 2110 Anita Drive in the ever-popular Maryhill family friendly neighbourhood. This home has been updated through the years. Stunning kitchen with white painted wood cabinets, stone counters, SS appliances & black accents. Large laundry/pantry off dining area/family room. 3-year-old roof & gutters .Lovely real hardwood flooring. 3 bedrooms up+2 baths. Lots of windows for light. Beautiful soundproofed 1 bedroom suite down with updated kitchen & 3-piece bath. Separate entrance with a patio area. Large rec room with a 3-piece bath. Workout area, teen/student hangout, home office, etc.

Fabulous kid & dog friendly fully fenced backyard. New gazebo on the raised patio. 2 sheds & workshop for extra storage. Imagine entertaining in this lovely backyard oasis.

Posted on

June 22, 2023

by

Marie Taverna

As home prices and interest rates continue to rise, whilst inventory remains extremely tight, Canada’s first-time buyers are feeling increasingly worried about missing out on their desired home because they don’t have enough of a down payment.

According to a recent survey released by Sagen™, conducted by Environics Research with a series of questions for Royal LePage, 67% of first-time buyers (those that purchased a home within the last two years) said that before buying, they worried they might miss out on the property they really wanted because of an insufficient down payment. This reflects a five point increase compared to the same survey question in 2021 (62%), and a ten point increase over the 2019 result (57%).

When the same question was asked to first-time intenders – those who plan to buy their first home in the next two years – 63% reported feeling worried that they will miss out due to an insufficient down payment, a three point increase from the same survey question in 2021 (60%).

“Canadians continue to face challenges in entering the real estate market, be it high interest rates, strict mortgage qualification standards, or difficulty saving enough money in a reasonable time period for a down payment,” said Phil Soper, president and CEO, Royal LePage. “That first transaction is the most difficult, and in today’s environment, first-time buyers are faced with large price tags, high carrying costs and the added challenge of qualifying for lending at higher rates due to the stress test.

“Still, they continue to prioritize home ownership, and view it as a milestone worth achieving. With household savings still sitting above historical norms, due to accumulation during pandemic lockdowns, many Canadians will have a leg-up on their down payment when they are ready to enter the market,” added Soper.

Here are a few highlights from the Royal LePage 2023 Canadian First-time Homebuyer Survey:

- In Greater Calgary, the percentage of first-time homebuyers who were worried about their down payment has increased substantially, from 42% in 2021 to 69% in 2023

- 74% of first-time homebuyers in the Greater Toronto Area, 71% in Greater Vancouver and 67% in the Greater Montreal Area reported feeling worried that they would not have a large enough down payment to purchase a home they really wanted

- More than a third of first-time buyers (35%) received financial assistance in a lump sum payment toward their purchase, while a quarter of buyers (25%) received support on their monthly mortgage payments

Are you thinking about buying your first home, and looking for tips on how to get into the market? Tom Storey, sales representative with Royal LePage Signature Realty, shares his advice for buyer hopefuls preparing for home ownership.

Posted on

June 2, 2023

by

Marie Taverna

Competition among buyers in Metro Vancouver’s housing market heats up as summer arrives

While the year started slower than usual, Metro Vancouver’s housing market is showing signs of heating up as summer arrives, with prices increasing for the sixth consecutive month.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,411 in May 2023, which is a 15.7 per cent increase from the 2,947 sales recorded in May 2022, and a 1.4 per cent decline from the 10-year seasonal average (3,458).

“Back in January, few people would have predicted prices to be up as much as they are – ourselves included,” Andrew Lis, REBGV’s director of economics and data analytics said. “Our forecast projected prices to be up modestly in 2023 by about two per cent at year-end. Instead, Metro Vancouver home prices are already up about six per cent or more across all home types at the midway point of the year.”

There were 5,661 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in May 2023. This represents an 11.5 per cent decrease compared to the 6,397 homes listed in May 2022, and was 4.3 per cent below the 10-year seasonal average (5,917).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,293, a 10.5 per cent decrease compared to May 2022 (10,382), and 20.6 per cent below the 10-year seasonal average (11,705).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for May 2023 is 38.4 per cent. By property type, the ratio is 28.5 per cent for detached homes, 45 per cent for townhomes, and 45.5 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“You don’t have to squint to see the reason prices continue to increase. The fundamental issue remains that there are more buyers relative to the number of willing sellers in the market. This is keeping the amount of resale homes available in short supply,” Lis said. “And in a surprising twist, MLS® sales in May snapped back closer to historical averages than we’ve seen in the recent past, despite mortgage rates being where they are now, and new listing activity having been slower than usual this spring. If mortgage rates weren’t holding back market activity so much right now, I think our market would look a lot like the heydays of 2021/22, or even 2016/17.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,188,000. This represents a 5.6 per cent decrease over May 2022 and a 1.3 per cent increase compared to April 2023.

Sales of detached homes in May 2023 reached 1,043, a 30.7 per cent increase from the 798 detached sales recorded in May 2022. The benchmark price for a detached home is $1,953,600. This represents a 6.7 per cent decrease from May 2022 and a 1.8 per cent increase compared to April 2023.

Sales of apartment homes reached 1,730 in May 2023, a 7.9 per cent increase compared to the 1,604 sales in May 2022. The benchmark price of an apartment home is $760,800. This represents a two per cent decrease from May 2022 and a 1.1 per cent increase compared to April 2023.

Attached home sales in May 2023 totalled 608, a 16.7 per cent increase compared to the 521 sales in May 2022. The benchmark price of an attached home is $1,083,000. This represents a 4.7 per cent decrease from May 2022 and a 0.2 per cent increase compared to April 2023.

Download the May 2023 stats package.

Posted on

May 3, 2023

by

Marie Taverna

Presented by iA Auto and home insurance

Spring is synonymous with renewal, and now that the season is finally here, it’s the perfect time to try new things. Why not rearrange your living space and enhance your sense of wellbeing? One popular decor style is inspired by Feng Shui, a Chinese philosophy that has taken the west by storm and focuses on the free flow of energy, or Chi, from one room to the next.

With a few pointers from this Chinese art of living, you can create a harmonious atmosphere in your own home.

Declutter

The first step in creating a restful space is clearing away clutter. Put away all the things around your home that you don’t use or are just in the way. According to Feng Shui philosophy, when positive energy is unable to flow freely, the result can be blockages, frustration and stress. So sort through, throw away or donate the things you no longer use.

Choose suitable colours

Colour has a big impact on mood, which affects the quality of the energy flowing through a space. Cool, pastel colours, such as grey, blue and green, are known as Yin colours. They invite relaxation and are the colours of choice for your bedroom, bathroom and living room. Yang colours, like yellow, orange and red, are warm and vibrant. They energize a room and are commonly used in the kitchen, rec room and front hall.

Your home’s orientation and the amount of light in each room will also affect colour choices. A Feng Shui consultant can help you choose the best colours for your interior.

Rearrange your furniture

Try to arrange your furniture to facilitate conversation, relaxation and hospitality. If you have large pieces, like a substantial sofa or wardrobe, try to place them so they don’t block the flow of energy in your living space and are not too visually overpowering.

Include natural materials

The five elements—wood, water, earth, fire and metal—can have a positive impact on your wellbeing. Use natural decor such as plants, stones, candles and fountains to create a harmonious atmosphere and bring positive energy to your space. Plants, for example, are a great way to add vitality to a room, and they improve air quality too. According to some schools of thought, stones and crystals bring stability and serenity to a space, while candles create a warm, welcoming ambiance. Fountains can contribute a tranquil and rejuvenating energy and provide a soothing soundscape.

Avoid sharp angles

Opt for soft and curved shapes in your decor, such as round or oval tables, plush cushions and soft carpets, to enhance positive energy. If you have furniture or objects with sharp angles, you can soften their appearance by covering them with fabric or adding rounded cushions or accessories.

Create a meditation space

In Feng Shui philosophy, meditation and relaxation are essential practices for calming the mind and enhancing wellbeing. The best way to accomplish this is to create a space in your home used only for meditation and relaxation. The space could be an entire room or just a quiet corner in your living room or bedroom. The key is to choose a calm, peaceful area where you can relax without distractions.

You can add decorative elements to this space to enhance relaxation and meditation, such as comfortable cushions, soft rugs, scented candles, incense and plants. You can also add items specifically designed for meditation, like a meditation cushion or bench. What’s important is to create a space that promotes relaxation and is a reflection of you.

Whether you’ve just moved to your dream apartment or you’re simply rearranging your living space, the key is to feel zen and serene in your home. For even more peace of mind, don’t forget about home insurance. If you need to make a claim, your home will be covered and your sense of serenity will be complete. Apply for an insurance policy online with just a few clicks and spend more time enjoying your Feng Shui space.

Try the Feng Shui method now and rediscover your inner peace!

Posted on

May 1, 2023

by

Marie Taverna

25 Years of Making Home a Safe Place for Everyone

Royal LePage professionals understand that a house is only a home if the people who live there feel safe.

25 years ago, Royal LePagers unanimously agreed that helping women and children find safety from domestic abuse should be where they channeled their big hearts and charitable efforts. Since its founding on August 26, 1998, the Royal LePage Shelter Foundation has grown to become the largest public foundation in Canada dedicated exclusively to this important cause.

In order to fund this life-saving and life-changing work, many Royal LePagers have made generous donations from their commissions each time they've helped a client buy or sell. They have also hosted and attended local fundraising events of all shapes and sizes, hiked hundreds of kilometers as part of the ‘Challenge for Shelter’ series, purchased thousands of ‘Shelter Blooms’ tulip bulbs, and donated and bid on countless Shelter Auction items - including our very famous Faux Fur Coat!

As fundraising revenues and personal donations have grown over the past two and half decades, so too has our collective understanding of the complexities of domestic violence. Following closely the work of experts, educators, and front-line shelter workers, we now know that:

- Intimate partner violence doesn’t always show up as bruises or physical injuries. Psychological, emotional and financial abuse can be just as harmful.

- While violence and abuse can happen to any woman, some are at much greater risk and have less access to helpful services, including Indigenous women, Black and racialized women, 2SLGBTQIA people, young women, women with disabilities, and women living in rural or remote communities.

- There are complex reasons why people stay in abusive relationships, as well as significant barriers and risks of seeking help.

- Children cannot be shielded from violence in their homes – even that which takes place behind closed doors – and the impacts to their mental and physical health and development can be devastating.

- A safe and secure bed in a shelter is only the first of many important steps for a woman fleeing abuse. Job training, financial literacy, affordable transitional housing, legal services, and therapy are all essential, longer-term supports that help women thrive after experiencing domestic violence.

In the face of rising rates of violence over the COVID-19 pandemic and the increasing incidence of women killed each year by current or former partners, Royal LePage Shelter Foundation supporters look ahead with determination. We know that, together, we have made a difference in the lives of so many women and children. We know that with continued investment in today’s youth, the tide can be turned for many of their future dating and intimate relationships. We can envision a world where our Shelter Foundation is no longer needed because women and children are safe in their homes. And so, as we mark 25 years of progress, we look with purpose at the work that remains.

Posted on

May 1, 2023

by

Marie Taverna

Jerry Aulenbach (front right) and guests prepare to cook a delicious Thai meal at ‘Cooking for a Cause’ in Langley, BC

Jerry Aulenbach with Royal LePage Noralta Real Estate in Edmonton, AB knows how to get creative in support of the Royal LePage Shelter Foundation. Over a decade ago, he organized a series of tweet-ups in support of Shelter. Then, he climbed British Columbia’s famed Grouse Grind in a bacon costume in exchange for donations. Next, he criss-crossed the country for five straight winters to host skating events in all weather conditions (including -40°C in Moose Jaw) that raised more than $42,000 for domestic violence prevention. Then, there was the underground pizza party at the Royal LePage National Sales conference in Winnipeg which helped contribute to record-breaking fundraising for the Shelter Foundation.

Emerging from the COVID-19 pandemic, Aulenbach wanted to find a way to rebuild the connections many were craving while living by his personal motto to “never eat alone”. And so, ‘Cooking for a Cause’ was born. In total, Aulenbach hosted five hands-on, interactive cooking classes, all led by professional local chefs. Guests in New Minas learned to cook an elegant salmon en papillote, and in Victoria, the meal centered around seafood and cider. Attendees in Langley learned the ins-and-outs of Thai cuisine, those in Whitby perfected Southern fried chicken, and it was a Korean feast for participants in Toronto.

At each event, attendees separated into groups and worked on one portion of the meal which was then shared at a communal table of old and new friends, all keen to show their support for the Royal LePage Shelter Foundation. In total, more than $2,000 was raised, which will fund programs that help teach teens how to build healthy relationships and avoid violence in their lives.

“For me, a great food experience cannot happen without the right group of people and all of my Cooking for a Cause events delivered,” said Aulenbach. “It was very rewarding to learn new skills alongside good friends, enjoy delicious dishes, and know that our gathering was also helping support the critical work of the Royal LePage Shelter Foundation.”

Aulenbach looks forward to hosting more ‘Cooking for a Cause’ events in 2023. Cities are expected to include Red Deer, Calgary, Edmonton and Winnipeg.

Posted on

May 1, 2023

by

Marie Taverna

Moving into a new home should be an exciting time, but without proper planning and organization, the whole experience can quickly turn into an overwhelming ordeal.

To help ease the anxieties of moving day, here’s a handy to-do list to keep you organized and on-track:

1. Plan ahead

This may seem obvious, but many people find themselves rushing to hire movers and pack their belongings in the final frantic days leading up to their big move. To avoid the stress this can cause, and to ensure moving day flows smoothly, be sure to start packing at least one month in advance. Focus on one room or closet at a time, and use this as an opportunity to purge items you no longer need. Moving into a new place means starting fresh – donate, rehome or recycle those belongings that won’t serve a purpose in your new home. Remember, the first and last days of the month are popular moving days, so don’t put off booking your professional movers in advance.

2. Optimize your packing process

For safe travels and storage, pack your belongings in durable moving boxes, ideally new or ones that have little wear-and-tear. There’s also the option to rent reusable moving crates that can be returned once your move is complete. You can even hire professional packers to do it for you! To avoid sensitive items getting wet or damaged, use plastic, sealable bags and bins to protect clothing, books and important documents. And, be sure to bubble wrap glassware and fragile items to keep them from shattering in transit.

Bonus: Here are expert tips for packing your kitchen!

3. Label and organize your boxes

Label each moving box with the room it belongs in (ie. kitchen, bathroom, bedroom #1). Take it a step further by numbering each box and creating a tracking document to specify which boxes should go in each room. This not only makes it easier for your movers to know where to place your items, but it also helps you to keep track of all your boxes.

4. Make those small repairs before moving in

If time allows, paint the walls, deep clean the appliances, and complete any minor repairs before moving into your new place. Unsurprisingly, it is a lot better to have a fully-functioning home before you start to unpack and assemble furniture. If this is not an option for you, consider placing all your items in the garage or basement at first, or simply in the centre of a room, to allow you a few days to clean thoroughly and complete any small jobs necessary before settling into your new space.

5. Update your services and accounts

It can take time for some utilities to get up and running. Set a reminder to take your name off your current utility bills and set up accounts for services at your new place in advance of moving in. Remember to also change the mailing address on your subscriptions, delivery services, and most importantly government and banking documents.

6. Make a plan for your first night

Moving day can be a long and tiring process, so you’ll want to plan ahead for that first night. You may not have the time or energy to set up your bedroom right away, or perhaps you are having a new mattress delivered in the coming week. Book a hotel or arrange to stay with family or friends until you are ready to sleep comfortably in your new home.

Posted on

April 24, 2023

by

Marie Taverna

Let's face it: Unless you're a minimalist, moving is one of the biggest household tasks there is and it can be extremely overwhelming. But if you can get a head start and stay organized, you should make it through this mammoth process unscathed and ready to enjoy your new abode. Here are 21 tips to help you avoid moving day chaos.

1 GET ORGANIZED EARLY

Avoid leaving anything until the last minute. Unless you have to pack up and leave in a hurry, chances are you have between 30 and 60 days to make a plan and ensure that moving day runs smoothly. Create a countdown list and itemize everything you need to accomplish week by week.

READ ALSO :

Designer Lindsey Levy shifts the tone of a 52nd-floor condo from basic to beautiful

2 FIGURE OUT YOUR MOVE STRATEGY

How are you going to get from point A to point B on moving day? For shorter moves, you'll either need to assemble some very nice friends with trucks or consider renting a truck for the day. If you have a big family to move or you'll be moving a long distance, you'll want to price out moving companies.

3 KEEP YOUR MOVERS IN THE LOOP

Boxes are one thing, but when you get to the big, heavy stuff, it's important to let your movers know what to expect. "Communicate with your moving company and explain all the requirements and expectations prior to booking," advises Andrew Ludzeneks, founder and current president of iMove Canada Ltd. "Your mover has to be aware of all those minor details in order to estimate your total move time and cost, and have proper equipment available." That includes informing the company about any overweight items (i.e. a piano or fridge), access restrictions (small elevator, walk-up only, narrow driveway) and whether you’ll need help with disassembly or assembly of furniture.

4 PICK THE RIGHT TRANSPORTATION

If you're moving a short distance, you may be able to get away with making more than one trip. But if you don't have that luxury, you'll need to make sure you have the right size of truck to cart your belongings in one go. "Choosing the right size is particularly important when moving farther away, as making several trips could be a problem," says Andrew, who recommends using the following guidelines when determining the size of your truck:

• In general, the contents of bachelor and one-bedroom apartments will fit in a 16' cube truck available at your local rental company.

• Two to three fully furnished bedrooms will require a 24'-26' truck to ensure your move is completed in one load.

• The contents of most houses can be moved in the same 24' truck with one or two trips.

5 SEIZE THE OPPORTUNITY TO PURGE

Moving is a great chance to organize your belongings and get rid of items you no longer use. If the time of year permits, hold a yard sale. Or, take the time to sort and donate gently worn clothing to Goodwill, put furniture up for sale on a site like craigslist.org, recycle old magazines and catalogues and shred old documents.

6 PUT TOGETHER A PACKING KIT

If more than one person is packing, stay organized by establishing a system. Have blank inventory sheets prepared so one person can tackle each area or room. Arm each packer with a pen, black marker, and packing materials, like newspaper, a packing tape dispenser and boxes.

7 GREEN YOUR MOVE

Moving day can generate a great deal of waste like cardboard, bubble wrap and newspaper. For items you’ll be storing even once you’ve moved in, opt for the reusable plastic bins you can purchase at stores like Home Depot or Solutions. These can be labeled to go directly into closets until you’re ready to deal with the contents. You can avoid cardboard for the rest of your belongings, too, by renting plastic bins from a company like Blue Bins Unlimited. You might also consider using older linens to wrap breakables.

8 REUSE BOXES

You may still need a few cardboard boxes to round out your moving kit. A few weeks before you start packing, grab a few each time you visit the grocery store. Keep in mind that smaller boxes are easier to carry when facing stairs and narrow pathways, says Andrew.

9 TAKE INVENTORY

This is especially necessary if you’re hiring a moving company. Having a record of your household items is useful if something goes missing. Consider keeping a spreadsheet of the contents of each box. Then, assign each box a number and all you have to do is write that number on each side (maybe with the appropriate room listed, as well).

10 LABEL EVERYTHING!

Label all sides of the box (avoid the top). Whoever is carrying in your boxes might not make sure all labels are facing one way for your easy retrieval. Try labeling each side in marker so you can easily find what you need in a stack.

11 FIND OUT YOUR CONDO RULES

Moving into a condo isn’t as easy as pulling up to the front door and loading your boxes onto an elevator. Be sure to check the moving policy before scheduling your moving day. For example, some condos don’t allow move-ins on Sunday. According to Andrew, you may need to book a service elevator and a time frame for moving in. “On most occasions, your condo will ask for a security deposit in order to book a service elevator. That can range from $100 to $500 depending on your condo rules.”

12 PACK IN THINGS YOU NEED TO PACK

You need to take your luggage with you. Why not use it as a box? The same goes for dresser drawers. You may need to remove them for transport, but if you don’t have too far to go, they can be helpful for light items. “For delicate apparel that you don't want to fold, using a portable wardrobe box is the way to go,” recommends Andrew.

13 PREPARE A MOVING DAY KIT

Keep one box aside of “essentials” that you’ll need on moving day: cleaning supplies, light bulbs, toilet paper, garbage bags, a change of clothes, your toiletry bag, etc.

14 BE READY FOR YOUR MOVERS, WHETHER HIRED OR FRIENDS

Whether you have family or professional movers showing up at your door, be ready for them when they arrive. With a moving company, unless you hire packers, be ready and packed before the crew arrives, advises Andrew. “Scrambling for boxes will delay your move and increase your cost.”

15 PROTECT YOUR VALUABLES

Find a safe place to store your valuables on moving day. Insure anything that’s valuable or breakable if you’re using a moving company. And if you’re moving a computer, do a quick backup of important files just in case something happens in transit.

16 DELAY DELIVERIES

If you’ve made some new purchases, such as a couch or dining room suite, schedule the delivery after moving day. That will help you focus your attention on moving day itself and will avoid any congestion between delivery people and the movers.

17 DON’T MISTAKE BELONGINGS FOR TRASH

Try to avoid packing things in garbage bags. Well-meaning friends or family could accidentally throw them out on moving day.

18 HOOK UP ESSENTIAL SERVICES

Make sure you understand how utility bills (gas, water, electricity) will be transferred over to you from a previous owner. Also, arrange to have your phone line, cable and Internet working if necessary.

19 FIND A PET SITTER FOR THE DAY

If you have a pet that could be traumatized by a move, arrange to have them stay somewhere during moving day. If you’re hiring movers for a long-distance move, be sure to arrange your pet’s safe transport to your new home.

20 MAKE NICE WITH YOUR NEW NEIGHBOURS

Start off on the right foot by informing your immediate neighbours that you’ll be moving in and what kind of moving vehicles you’re using. If you’re moving on a weekday, make sure your truck isn’t blocking anyone’s exit. If it’s wintertime, clear your driveway of snow and ice, says Andrew. “Make sure there’s plenty of room to park the moving truck. That’s essential on busy streets otherwise you could slow down your move … increasing your total cost.”

21 TREAT YOUR MOVERS

Whether hired movers or friends and family, be sure to have food and drinks readily available for everyone. “On a hot summer day, your crew will appreciate a cold drink,” says Andrew.

Posted on

April 21, 2023

by

Marie Taverna

Spring has officially sprung, and with the arrival of warmer weather, now is an opportune time to give your home a post-winter deep clean. A thorough spring cleaning goes beyond everyday surfaces and tackles the nooks and crannies of your living space. It’s a great time to start fresh by purging old and underused items in your garage, closets and cabinets. It’s also the perfect opportunity to perform a maintenance checkup on major household appliances, like your washing machine, stove and fridge.

Conducting a yearly maintenance checkup is not only beneficial in extending the lifespan of your appliances, but also ensures that they will be running optimally when you need them the most. Is there anything worse than your dryer breaking down before an important job interview, or the oven giving out just as your guests are set to arrive for a dinner party, or your air conditioner malfunctioning in the dead of summer?

Here’s a maintenance checklist to help ensure your large home appliances are in top shape this spring:

Fridge maintenance

- Coils: To clean your coils, locate where they are on your fridge – whether they’re at the bottom or at the back of the appliance – and remove the access panel. Gently remove any debris and dirt with a vacuum or brush before replacing the panel. Cleaning your fridge coils annually can actually help to reduce your electricity bill, as dirtier coils require more time and energy to chill food.

- Water filter: If your fridge has a water filter, clean or replace this every five to six months to avoid impurities and contaminants in the water.

- Door seals: If the door seals are leaking or don’t seem tight enough, replacing these will ensure your refrigerator is running in an energy efficient manner.

Oven and stove maintenance

- Stovetop: While it’s important to give your stovetop a regular clean, a deeper scrub down is vital for preventing overheating and potential fire hazards from baked-on food particles. For electric stovetops, wipe down the cooking surface with warm, soapy water before applying a layer of glass cooktop cleaner or baking soda paste and leaving to dry. Once fully hardened, remove the paste with a scrubber or non-abrasive tool to remove baked-on food and stains. If you have a coil stove top, carefully remove each coil by hand and wash down without fully submerging in water before reassembling. For gas cooktops, be sure to remove the grates and burner caps, and wash with hot water and soap. Carefully wipe down the surface of the stove without getting the igniters or electrical components wet.

- Range hood: Oven range hood filters must be cleaned or replaced to ensure proper functioning of the appliance. You can clean your filter by letting it soak in hot water and degreasing dish soap before scrubbing off the remaining debris. Allow the filters to dry completely before reinserting.

- Oven door seals: Similar to refrigerator door seals, these are required to ensure ovens can heat efficiently, and should be regularly cleaned with warm water and soap, and replaced if/when necessary.

- Oven drip pans and racks: Ensure oven drip pans and racks are routinely cleaned to avoid potential fire hazards. Soak greasy items in hot water with degreasing dish soap or cleaning vinegar to remove splatters, stains and food particles.

Dishwasher maintenance

- Rust removal: Remove any visible rust from your dishwasher by running an empty cycle with a calcium, lime and rust remover solution. A water and baking soda paste or a combination of water and vinegar can also be effective against rust.

- Spray/pump area: Clean around this area in the base of your dishwasher to promote seamless drainage.

- Filter: Hard water and leftover food can build up in your dishwasher. Cleaning the filter will extend the life of your appliance and ensure this build-up is not continually being released onto your dishes during the cleaning cycle. To clean, simply pull the cylindrical filter from the base of your dishwasher and gently wash it with a brush under warm running water.

Washing machine maintenance

- Hose lines: Prevent flooding in your home by ensuring no cracks or breakage are present in your washer’s hose lines. Perform a thorough check once per year, and replace them every five years.

- Washer drum: Prevent build up in the drum of your washing machine by regularly running a cleaning cycle with a dedicated cleaner or water and bleach every few months. Using a damp rag, thoroughly wipe the rubber liner and inside of the door.

Dryer maintenance

- Dryer vent: In addition to clearing out your dryer’s lint trap after each load, the dryer vent should be cleaned at least once per year to clear out lint build up and to prevent fire hazards. Disconnect the dryer before pulling it away from the wall and removing the dryer duct. Use your vacuum cleaner inside and around the vent to catch leftover lint. Remember to clean the exterior vent too by removing the cover and removing any debris.

- Dryer drum: Using a damp rag, clean the inside of your dryer drum, the rubber liner and the door. If necessary, soak and wash the lint trap, but ensure it is completely dry before replacing it.

Air Conditioner maintenance (outdoor unit)

- Condenser unit: Spring is the best time to run maintenance on your HVAC A/C unit. The weather is warm enough to run a cooling test cycle, yet not cool enough to withstand a few days with no air conditioning if your unit requires major repairs. Begin by turning off the power and removing the winter cover from your outdoor unit. Remove the cage and pull out any leaves and debris that may have accumulated on the bottom.

- Fins and fan: Using a paint brush or other long bristled brush, carefully brush away any trapped dirt and debris that may be caught in the air conditioning unit’s fins and condenser fan. If necessary, vacuum the fins to pick up fine dust. It is safe to use a garden hose to wash the inside and outside of your unit, but avoid using a pressure washer as this can damage the fins. Reassemble the unit before turning the power back on.

- Filters and vents: Replace filters and clean out vents on a regular basis (every one to two months) to ensure clean air is circulating through your home.

Be sure to run through this appliance maintenance checklist every spring to keep your appliances operating safely and optimally, and save you money in the long run.

Posted on

April 17, 2023

by

Marie Taverna

Royal LePage is updating its price forecast for 2023 following a stronger-than-expected start to the year.

In a report released Thursday, Royal LePage is forecasting home prices in Canada will increase 4.5 per cent year-over-year in the fourth quarter of 2023, a steep increase from the company’s December prediction that the national aggregate home price would end the year one per cent below Q4 2022.

On a quarter-over-quarter basis, Royal LePage expects prices to continue rising modestly but steadily over the next nine months.

“Coming out of a correction, it is common to underestimate the speed at which the market will turn itself around. As market activity is rebounding quicker than anticipated, we are looking ahead with a sense of cautious optimism,” noted Phil Soper, CEO, Royal LePage.

“While we do not expect huge price gains this year, some sense of normalcy is returning to the market.”

Source: Royal LePage

Canadian market begins to recover after downturn

The Royal LePage House Price Survey showed that home prices in Canada decreased by 9.2 per cent year-over-year to $778,300 in Q1 2023.

However, there has been a 2.8 per cent quarter-over-quarter increase following the Bank of Canada’s decision to pause interest rate hikes, which prompted many buyers to return to the market.

“We have turned the corner, and the housing economy is growing again; none too soon for many buyers, who have been waiting patiently for prices to bottom out,” says Soper.

The national median price of a single-family detached home fell 10.7 per cent year-over-year to $808,700, while the median price of a condominium fell 6.7 per cent year-over-year to $571,700. Quarter-over-quarter, median prices rose for these two property segments by 3.4 per cent and 1.8 per cent, respectively.

“Sanity is slowly returning to the housing market,” added Soper. “While some buyer hopefuls will remain sidelined by a reduced capacity to borrow in this higher rate environment, our market data shows that many of those who chose to pause their search to see where prices and interest rates would land have resumed their home buying plans.”

While sales have been trending upward since the start of the year, the number of listings remains too low to satisfy demand.

Source: Royal LePage

Soper explains that the challenge now is the severe supply shortage: “We are grappling with a growing problem here that once was the burden of our largest cities but is increasingly being felt in secondary markets as well.”

He adds, “Yes, governments are adopting policies intended to address the problem, yet the pace of progress is far from encouraging. And challenges facing developers—such as the increased cost of materials and labour, and a shortage of skilled tradespeople— persist.”

Public policy

The report notes the Office of the Superintendent of Financial Institutions’ (OSFI) proposed changes to Canada’s mortgage stress test that would impose more restrictive access to mortgage financing in an effort to mitigate risk for major banks against potential consumer default.

However, Soper warns against tightening restrictions in an environment where rates are high and likely to fall. He believes such a move could do more harm than good, forcing families into the unregulated B-lender market.

“Despite a year of rapidly-rising interest rates, we see that the number of Canadian homeowners who have failed to meet obligations to their financial institution remains exceptionally low,” Soper says. “Our banks have managed their mortgage portfolios well, and it helps that unemployment is very low.”

B.C.’s Home Buyer Rescission Period

Royal LePage says British Columbia’s newly-implemented Home Buyer Recission Period (a cooling-off period that allows buyers to rescind an offer within three business days of fan APS being signed) has not “proven to be useful.”

“Few B.C. buyers are exercising their right to use the cooling-off period the way it was intended—to allow them an ‘out’ after a rash decision to purchase a property.

“Unfortunately, we are seeing people blatantly abusing the program by making offers on multiple homes as they shop around, locking up scant housing inventory as if clothing in a retail store. The legislation is harmful, not helpful, and should be amended or scrapped.”

Interest rates

The Bank of Canada’s made the decision Wednesday to maintain its overnight lending rate at 4.5 per cent and has indicated it will continue to main the rate if inflation continues to come down.

“This was the signal that so many Canadians were waiting for. The Bank of Canada’s rate hold was the green light that stability is returning to the market, and it has had a swift and significant impact on buyer demand,” said Soper.

According to a recent survey by Royal LePage, found that one in four Canadians was in the market for a new home over the last year, and rising interest rates caused 63 per cent of them to postpone their plans, but 26 per cent of those planned to resume their search this spring and another 36 per cent said they would return to the market in the near future once the central bank paused rate hikes for several consecutive months.

Read the full report from Royal LePage, including regional breakdowns, here.

Posted on

April 13, 2023

by

Marie Taverna

The Royal LePage Home Price Update and Market Forecast was distributed to the media early this morning. The release, distributed each quarter, includes price data and insights from experts in 62 real estate markets across the country, as well as national and regional forecasts.

|

|

|

Key highlights from the release include:

-

National aggregate home price forecast to increase 4.5% year-over-year in Q4 2023

-

Single-digit price gains in first quarter driven by early return of sidelined buyer demand and continued shortage of inventory

-

National aggregate home price up 2.8% quarter-over-quarter in Q1 2023; down 9.2% over same period in 2022

-

Greater regions of Toronto, Montreal and Vancouver post quarterly aggregate price gains of 4.8%, 1.3% and 1.3%, respectively in the first quarter

-

Royal LePage urges OSFI to heed the economic dangers that would accompany new, aggressive mortgage restrictions

A big thank you to all of our spokespeople across the country who provided regional perspectives.

Use the buttons below to read the full national release, find regional insights and view the comprehensive data charts.

|

|

|

Posted on

April 13, 2023

by

Marie Taverna

| Vancouver, BC – April 13, 2023. The British Columbia Real Estate Association (BCREA) reports that a total of 7,118 residential unit sales were recorded in Multiple Listing Service® (MLS®) systems in March 2023, a decrease of 38.3 per cent from March 2022. The average MLS® residential price in BC was 961,451 down 11.6 per cent compared to the average price of close to $1.1 million in March 2022, recorded near the market's peak. The total sales dollar volume was $6.8 billion, representing a 45.5 per cent decrease from the same time last year. |

|

“The BC housing market is currently characterized by slow sales but also still very low levels of listings,” said BCREA Chief Economist Brendon Ogmundson. “Consequently, even though home sales remain about 20 per cent below normal levels for this time of year, the average home price in BC has now risen two months in a row, reaching its highest level since May 2022 as markets tighten due to a lack of supply.”

Active listings in the province are up 25 per cent compared to this time last year but have fallen for the second straight month in the wake of a modest recovery in home sales and continued weak new listings activity. |

|

|

Subscribe with RSS Reader

Subscribe with RSS Reader