Affordable housing was the top priority in BC Budget 2024 and the government plans to make significant capital commitments to get middle-income earners into market homes and provide more supports and protections for renters.

Here are the highlights for property buyers, renters, and small business.

Property Transfer Tax (PTT)

The first-time homebuyers’ exemption

The newly built home exemption threshold

New purpose-built rental buildings

PTT exemptions dates

- Increase threshold for first time home buyers’ exemption – begins April 1, 2024.

- Increase threshold for newly built home exemption – begins April 1, 2024.

- Enhanced exemption for new purpose-built rental buildings – begins January 1, 2025 and ends December 31, 2030.

The government estimates these new PTT exemption thresholds will save homebuyers about $8,000 and British Columbians over $100 million annually, and up to 14,500 homebuyers – twice as many as before – will now be eligible for the PTT exemption.

PTT revenue growth is expected to average 8.6 per cent annually over the next two years.

Note: For more than two decades, Greater Vancouver REALTORS® have been advocating for changes to the PTT, meeting with politicians and providing submissions each year. Government has finally listened.

Flipping tax

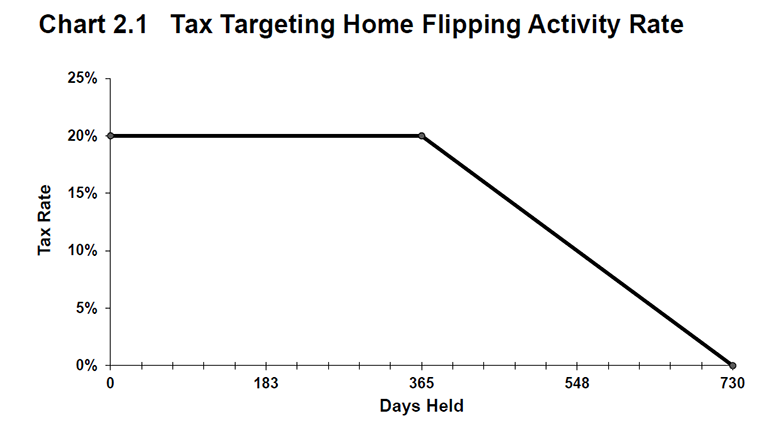

The government is bringing in a new flipping tax, effective January 1, 2025, on the profit made from selling a residential property, including a presale assignment, within two years of buying it.

The rate is 20 per cent within the first year of purchase, declining to zero between 366 and 730 days. The tax will not apply to land or portions of land used for non-residential purposes.

There are exemptions for

- those adding to the supply of housing or engaging in real estate development and construction

- life circumstances including separation or divorce, death, disability or illness, relocation for work, involuntary job loss, a change in household membership, personal safety, or insolvency

In addition to these exemptions, individuals selling their primary residence within two years of purchase can exclude a maximum of $20,000 when calculating their taxable income.

The government estimates the tax would generate $44 million in revenue in the 2025/2026 fiscal year, which is slated for affordable housing.

BC Builds and supporting renters

Secondary suites

Renter tax credit

Zoning and permitting

Allowing small-scale, multi-unit affordable housing including townhomes, duplexes, and triplexes through zoning changes and proactive partnerships.

Streamlining permitting to reduce costs and speed up approvals to get homes built faster.

Short-term rentals

Electricity tax credit

A new, one year electricity affordability credit for all households, regardless of income starting in April 2024. Households will save on average $100 a year on their electricity bills.

Commercial and industrial customers will receive savings of about 4.6 per cent based or about $400 on their 2023/24 electricity bills.

Climate change and climate action

More than $1 billion in new spending measures to help protect British Columbians from the effects of climate change and build a greener economy.

The Climate Action Tax Credit increases to $1,005 per year for families up to four persons, up from $890 last year. Individuals will receive $504 compared to $447 last year. Start date is in July 2024.

Small business

There is $100 million in relief for the employer health tax, including the continuation of the venture capital tax credit, and the expansion of the interactive digital media tax credit.

Deficit and debt

The government estimates this years’ deficit at $5.914 billion rising to $7.773 billion by 2026.

The total debt will rise from $103 billion to $123 billion in 2024-25.

More information

Read the BC Government news release on BC Budget 2024.

Read Budget BC 2024 Highlights regarding housing.

Read the BC 2024 Budget speech.

Visit the BC Budget 2024 website.

Read BC Budget 2024 (opens a 170-page pdf).

Subscribe with RSS Reader

Subscribe with RSS Reader

Comments:

Post Your Comment: