More than half of Canadian borrowers anticipate their monthly mortgage payment to increase upon renewal in 2025

More than a million Canadian mortgages will come up for renewal this year. Though interest rates have been on the decline for the last several months, many borrowers are bracing for an increase to their monthly payment – an adjustment that could be quite steep for some households.

According to a recent Royal LePage survey, conducted by Hill & Knowlton,1 more than half (57%) of Canadians who are renewing the mortgage on their primary residence in 2025 expect their monthly mortgage payment to increase upon renewal (35% expect it to increase slightly and 22% expect it to increase significantly). Meanwhile, 25% say their monthly mortgage payment will remain about the same – within $100 of their current payment amount – and another 15% expect their monthly payment to decrease upon renewal.

“When it comes to post-pandemic mortgage renewals, many Canadians have avoided the worst-case scenario of having to sell their homes due to the inability to cover the cost of their mortgage, thanks to solid employment trends and declining interest rates,” said Phil Soper, president and CEO, Royal LePage. “Nevertheless, some will face a substantial rise in their mortgage costs, putting added pressure on their household finances. Many in this situation are exploring options to lower their monthly fees, such as extending their amortization period; a tactic which has proven popular.”

Of those who expect their monthly mortgage payment to rise upon renewal, 81% say the increase will put financial strain on their household; 47% expect a slight strain, while 34% expect a significant strain.

Though many Canadians will see their monthly mortgage payment rise this year, most see no reason to make preemptive major lifestyle changes to cope with increased housing expenses. A majority (62%) of respondents say they will not change their living arrangements to avoid potentially higher monthly mortgage costs. Respondents in Quebec were the most likely to say they will not adjust their living arrangements (78%), while those in Alberta were the least likely to say so (53%). Nationally, however, 11% say they are considering relocating to a more affordable region; 10% say they are considering downsizing; and 10% say they are considering renting out a portion of their home to subsidize expenses. Respondents were able to select more than one answer.

Variable-rate mortgages rise in popularity

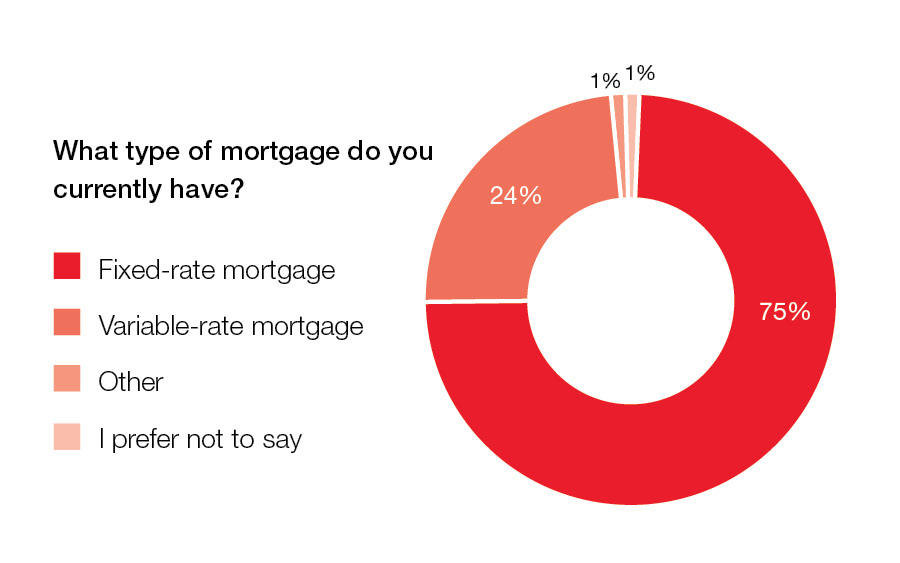

With interest rates on a downward trajectory, variable-rate mortgages are gaining in popularity. According to the survey, 66% of Canadians with a mortgage renewing this year say they plan to obtain a fixed-rate loan upon renewal (down from the 75% who currently hold fixed-rate mortgages), and 29% say they will choose a variable-rate loan (up from the 24% who currently hold variable-rate mortgages).

While most Canadians with pending renewals in 2025 plan to stick with the same type of mortgage product they currently have, a sizable shift toward variable-rate loans has emerged. Of those who currently have a fixed-rate mortgage renewing this year – the most popular mortgage product overall in Canada – 20% say they will switch to a variable-rate loan. Seventy-six per cent say they intend to renew with another fixed-rate loan. Meanwhile, 61% of current variable-rate mortgage holders intend to renew with another variable-rate loan, and 37% say they will switch to a fixed rate.

“Since last summer, the Bank of Canada has made several cuts to its overnight lending rate amounting to a decline of 200 basis points thus far, driving variable mortgage rates down in tandem. For homeowners looking to reduce their monthly payments or pay down their principal faster, variable-rate mortgages have become an increasingly attractive option in light of today’s declining rate environment and the likelihood of further cuts this year,” added Soper. “Ultimately, Canadians should choose the mortgage product that best suits their financial goals and risk tolerance.”

Read the full press release and review the data chart for more information and regional insights:

Subscribe with RSS Reader

Subscribe with RSS Reader

Comments:

Post Your Comment: